With the Halving happening in a couple of days, it’s an exciting week. However, while many Bitcoiners are organizing parties, miners are holding their breath. Will BTC price break down? Will inscriptions boost transaction fees and save the day? Will my mining fleet be efficient enough to stay profitable? In this week’s mining economics rundown, we will delve into the following topics:

Bitcoin Price

Network Hashrate

Difficulty

Transaction Fees

Hashprice

Post-Halving Breakeven Hashprice

Post-Halving Break-Even Fleet Efficiency

ASIC Prices

Fun Fact

News Headlines & Podcasts

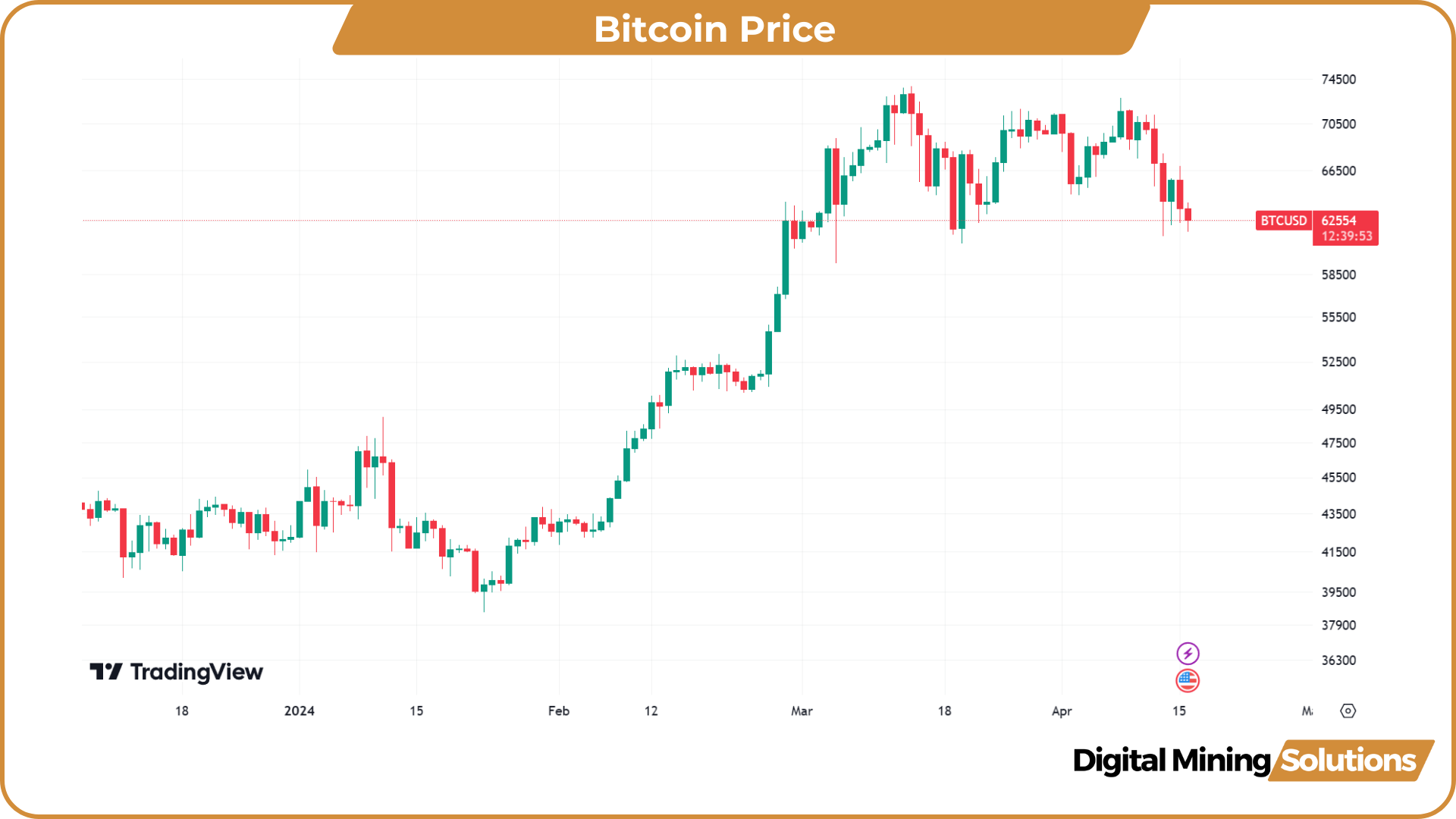

Bitcoin Price

On Saturday evening, Iran opened fire on Israel, launching a salvo of drones and rockets in response to the damage it suffered a week earlier from an Israeli airstrike. Bitcoin reacted immediately to the news, dropping almost 10% in a matter of hours. Fortunately, the damage on the Israeli side is limited, world leaders are calling for calm, and Israel seems to be refraining from immediate retaliation and further escalation. Bitcoin recovered from the drop, but it seems like the price wants to roll over again.

In addition to geopolitical tensions putting selling pressure on BTC price, demand was also low as the inflow of Bitcoin ETFs slowed down. Last week, ETFs noted the third lightest week of inflows since their launch in January.

There was also positive news: Applications for Bitcoin spot ETFs have been approved by the Hong Kong Securities and Futures Commission. The ETF market in Hong Kong is relatively small compared to the US. However, some analysts expect that these ETFs are not only interesting for Hong Kong but also for investors from mainland China. These investors are eager to find exposure to financial products that are decoupled from their local economy and stock market. However, since investing in Bitcoin is still prohibited in China, it remains to be seen if Chinese money reaches the Hong Kong ETFs.

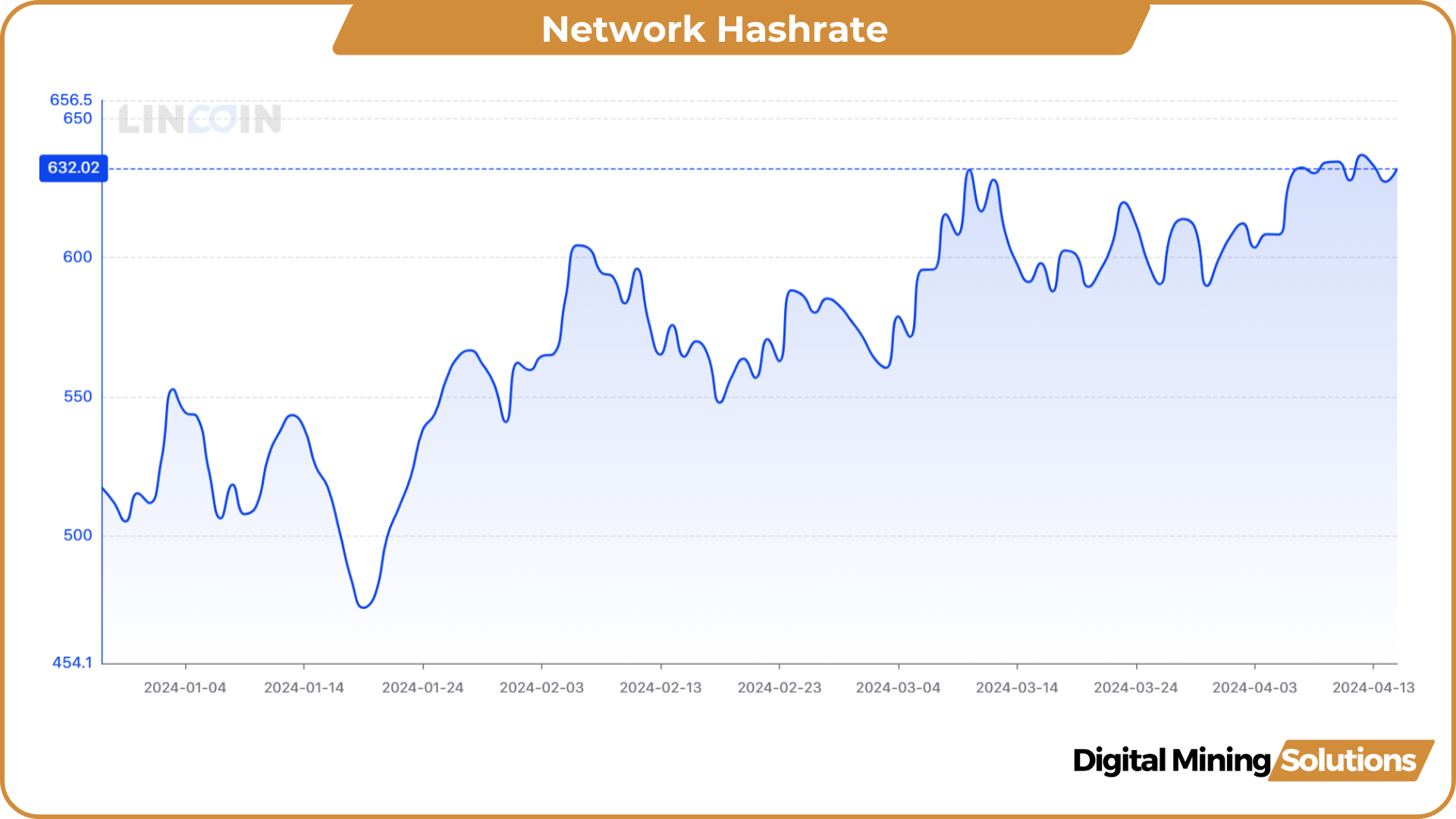

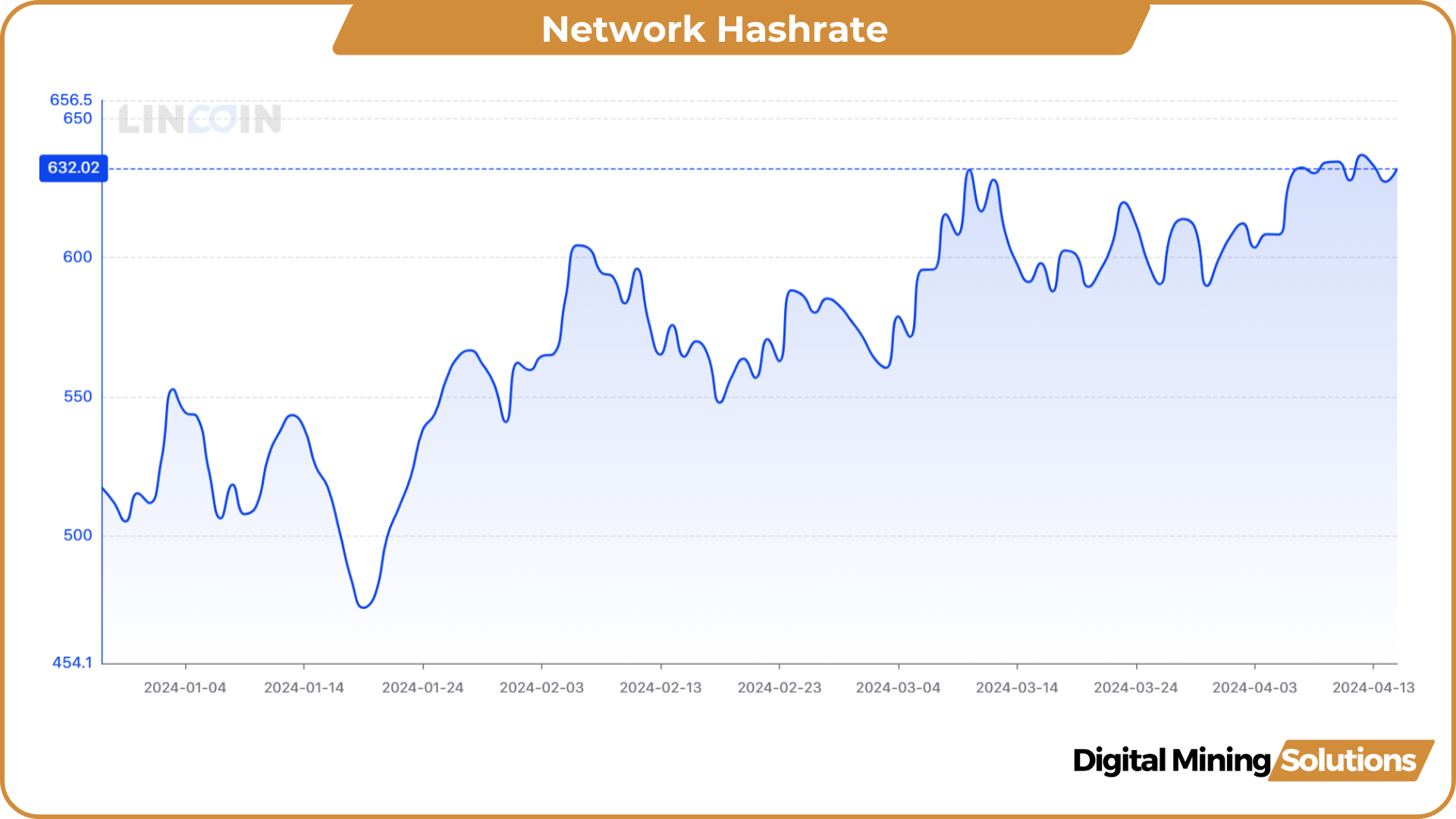

Network Hashrate

In April, the network hashrate began to rise again. On the 12th of April, the 7-day moving average reached a new all-time high of 636 EH/s, which is 5 EH/s more than the previous record set just a month prior. At the moment of publishing this article hashrate is at 632EH/s on the 7-DMA.

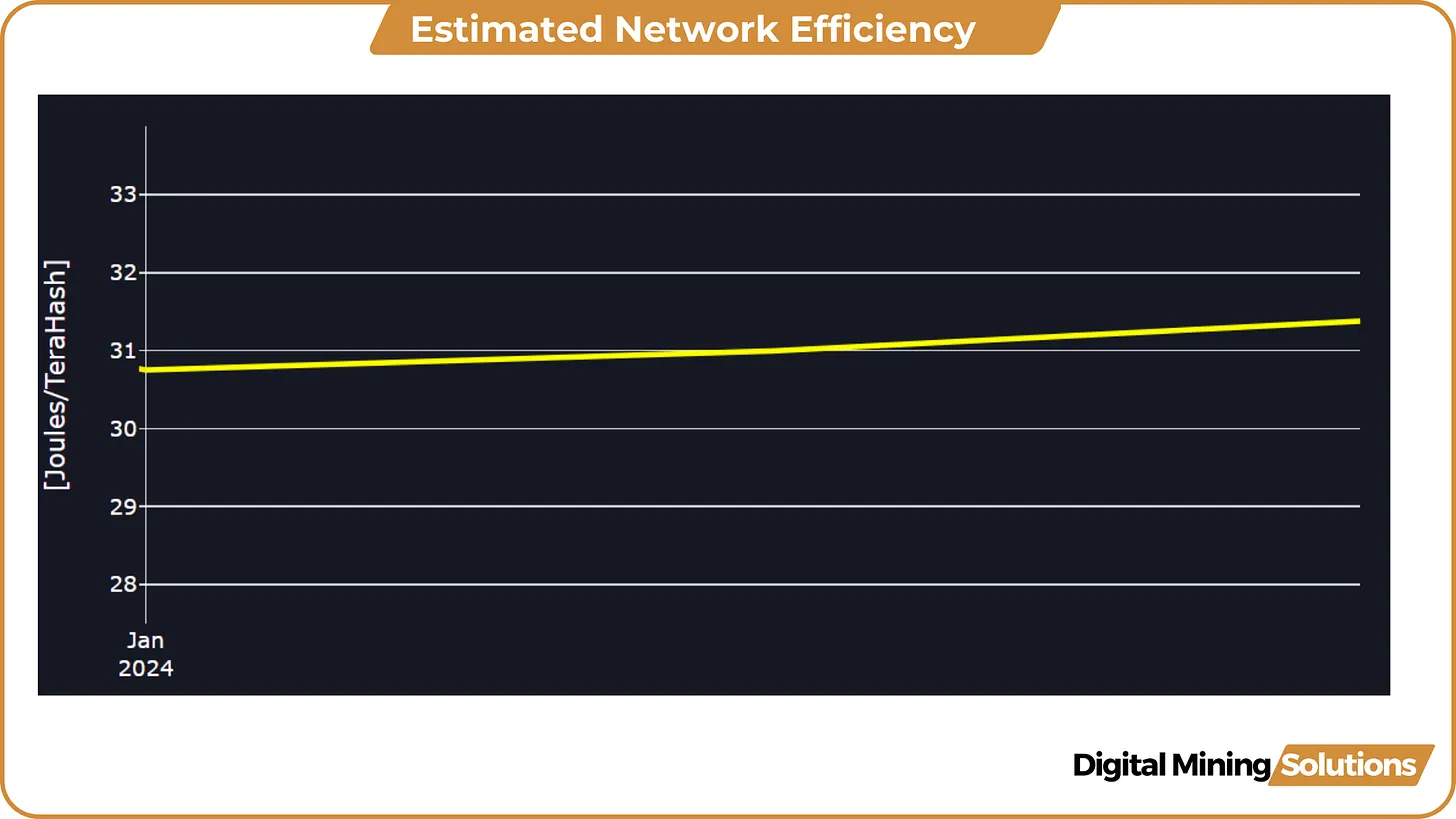

The deployment of S21s and other latest-generation mining equipment plays a significant role in driving the hashrate growth. Furthermore, improved market conditions have encouraged less efficient machines to come back online again. This conclusion is supported by data of Coinmetrics. The estimated average network efficiency went from 30.4 J/TH at the start of the year to 31.3 J/TH in March 2024. Despite big orders of highly efficient ASICs being deployed, this indicates that less efficient ASICs came back online.

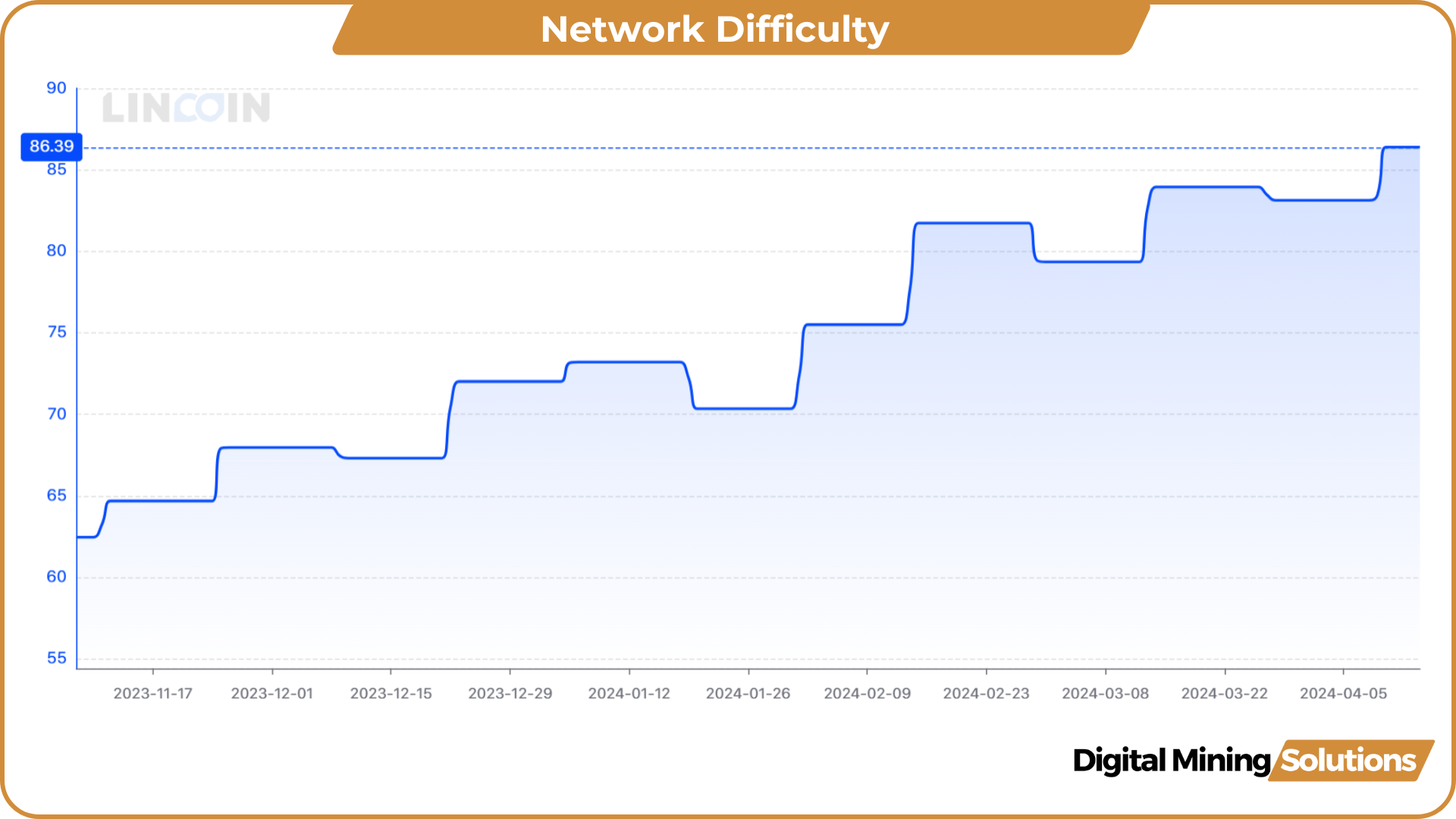

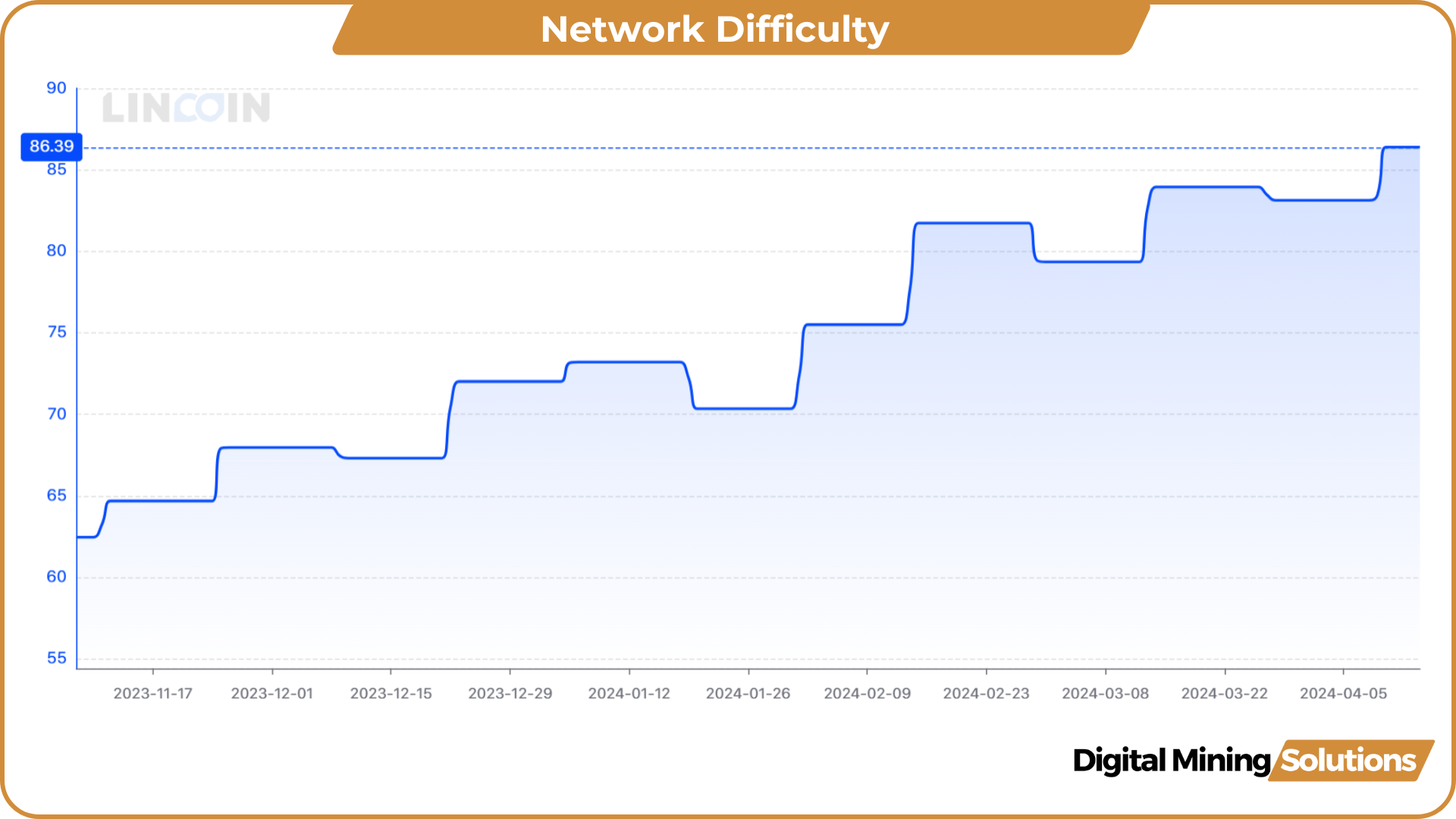

Difficulty

On April 10th, there was a difficulty increase of 3.92%, marking yet another record high of 86.39 T. We are currently in the last difficulty epoch before the halving.

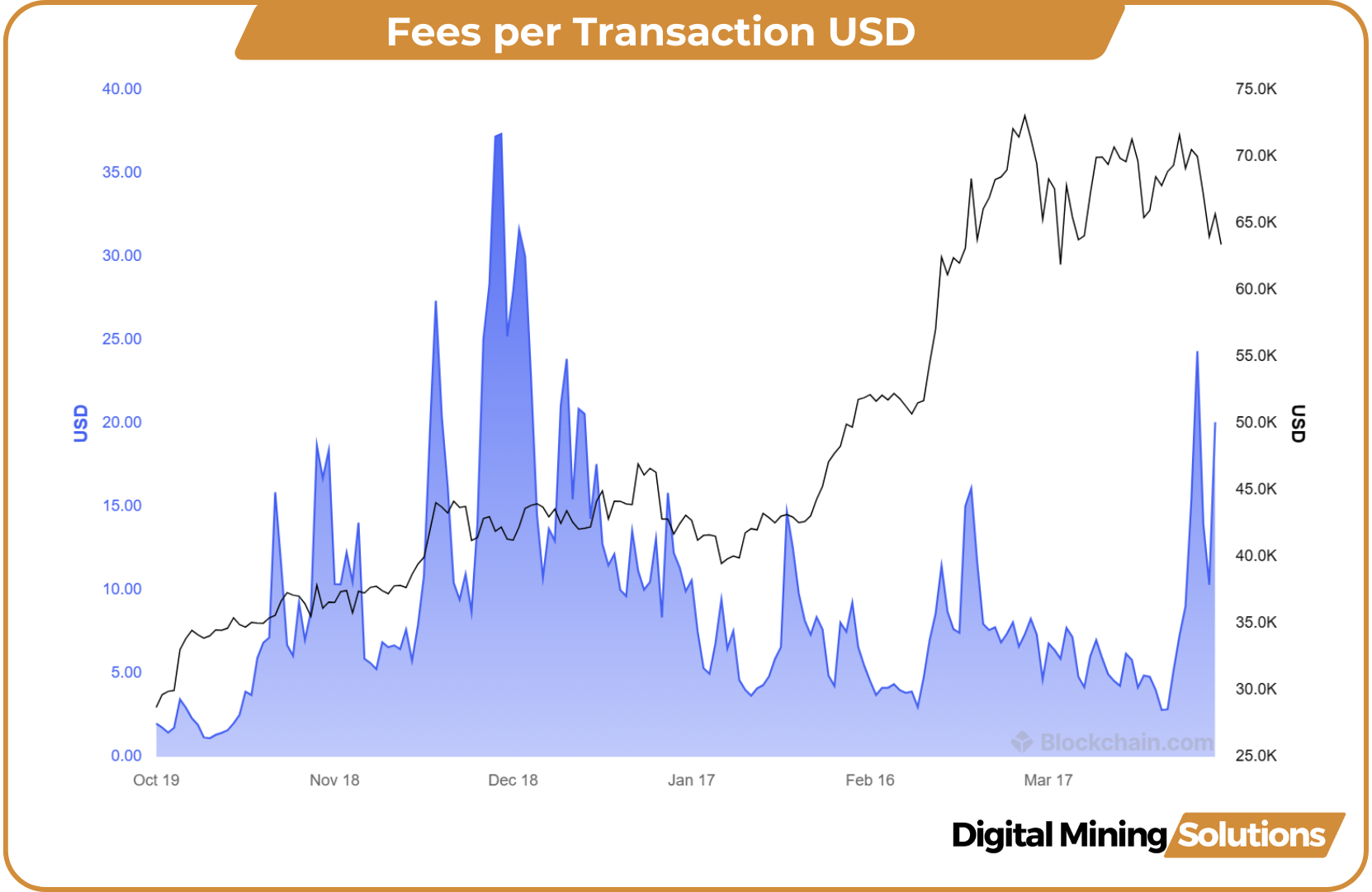

Transaction Fees

As we head into the halving, we see transaction fees starting to pick up. The fees per transaction went 10 X in a bit over a week, marking a yearly high of $24 on April 11th. The main driver for higher fees has been the competition for the unique block space heading into the halving. As ordinal fans outbid each other, driving fee spending upwards.

Fees will likely remain elevated for the next few weeks due to increased inscription activities. Especially given the launch of the new Runes fungible token protocol at the halving (block 840,000). This new token standard on Bitcoin provides users with a more efficient way of creating fungible tokens. Runes has not yet launched on the Bitcoin mainnet, but developers are already building projects based on it.

Additionally, if unprofitable miners shut off their machines en masse after the halving, the network hashrate will drop. This, in turn, will lead to a decline in difficulty. As a consequence, blocks will be mined slower than the usual 10 minutes on average. Usually, this causes higher fees as users seek urgent processing for their transactions; slower blocks only increase that urgency.

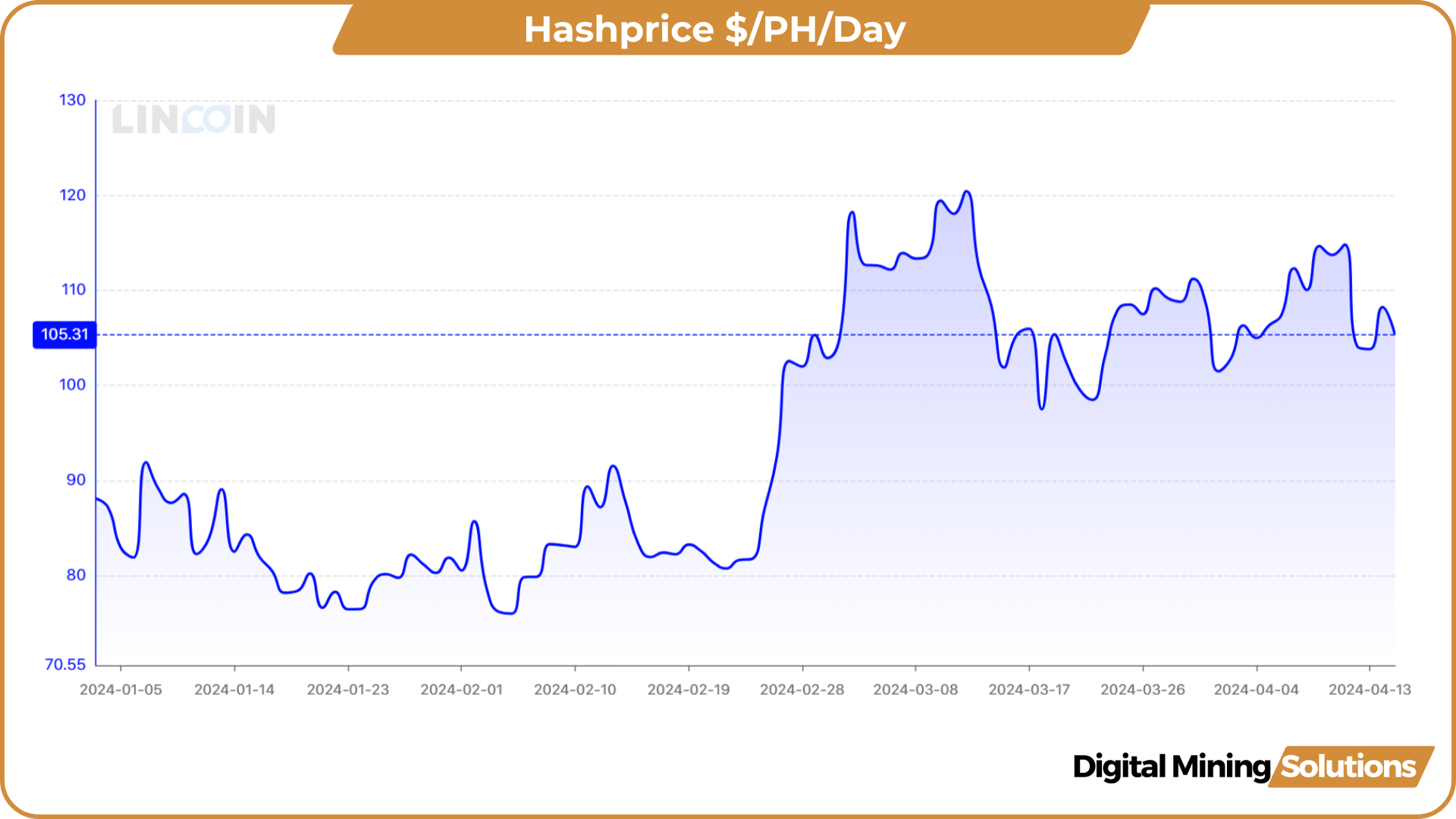

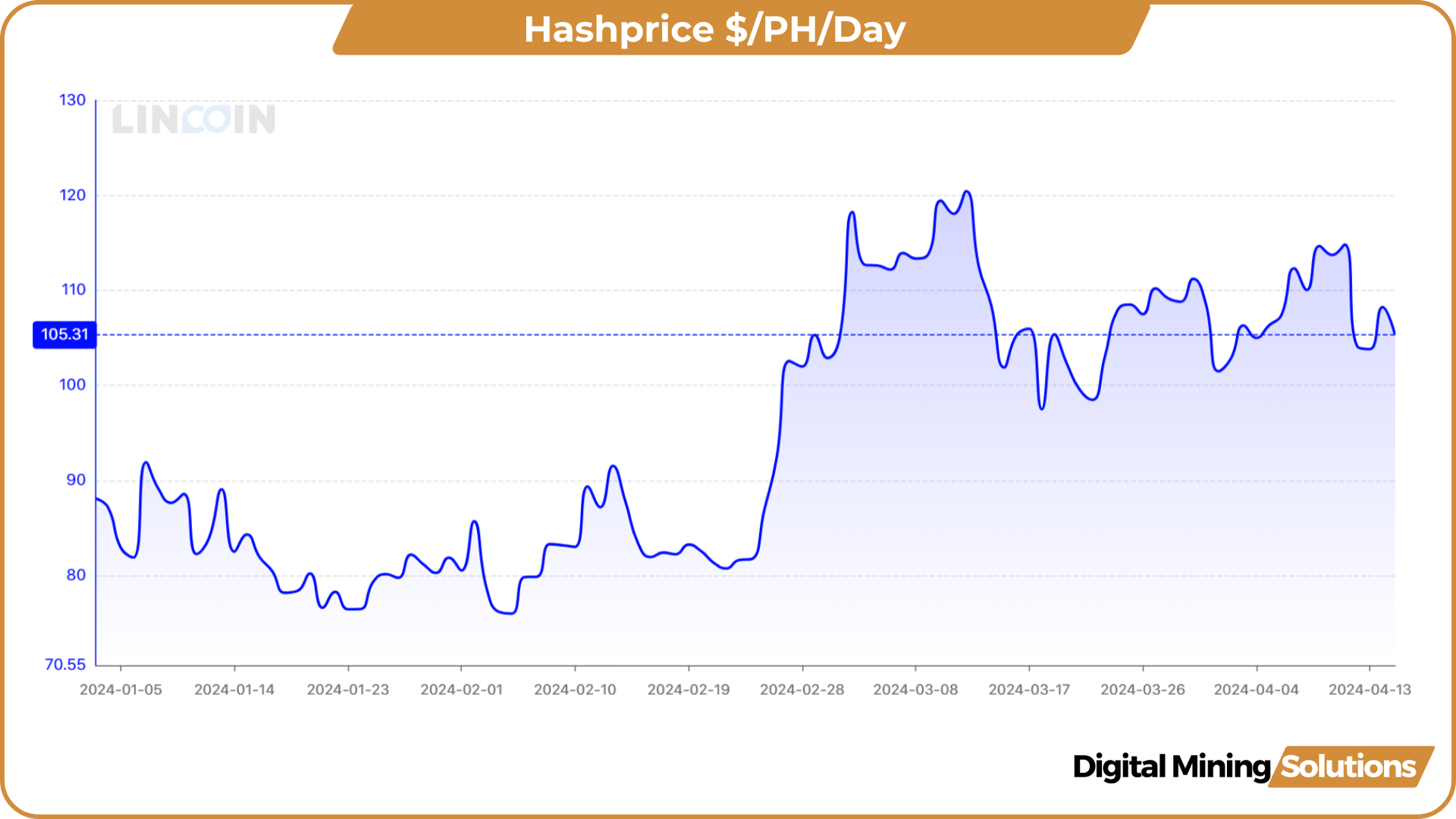

Hashprice

The increase in transaction fees has offset the minor drop in hashprice due to the difficulty increase. However, the weak BTC price action does put pressure on hashprice. For over 7 weeks, the hashprice has been able to stay above the $100/PH/Day level in a sustained way.

Post-Halving Breakeven Hashprice

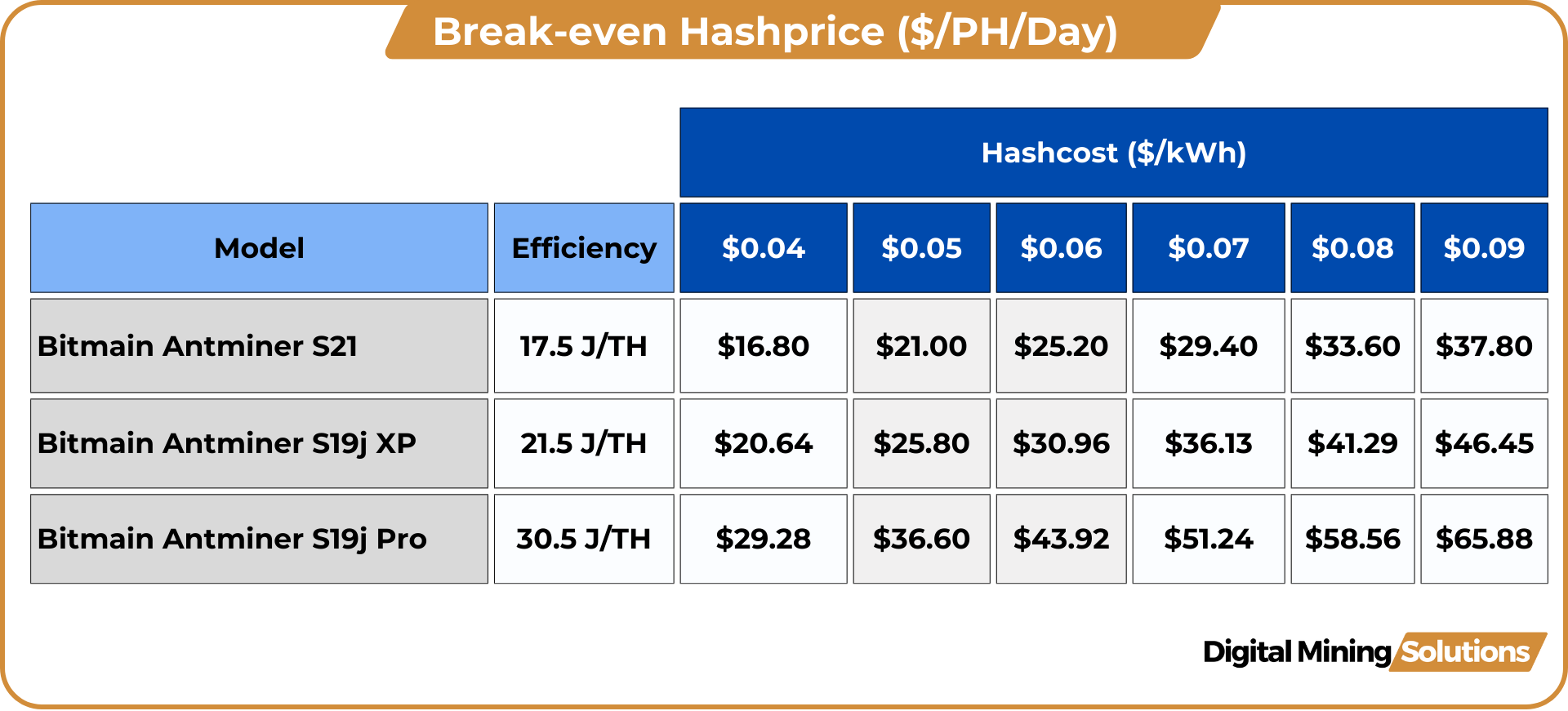

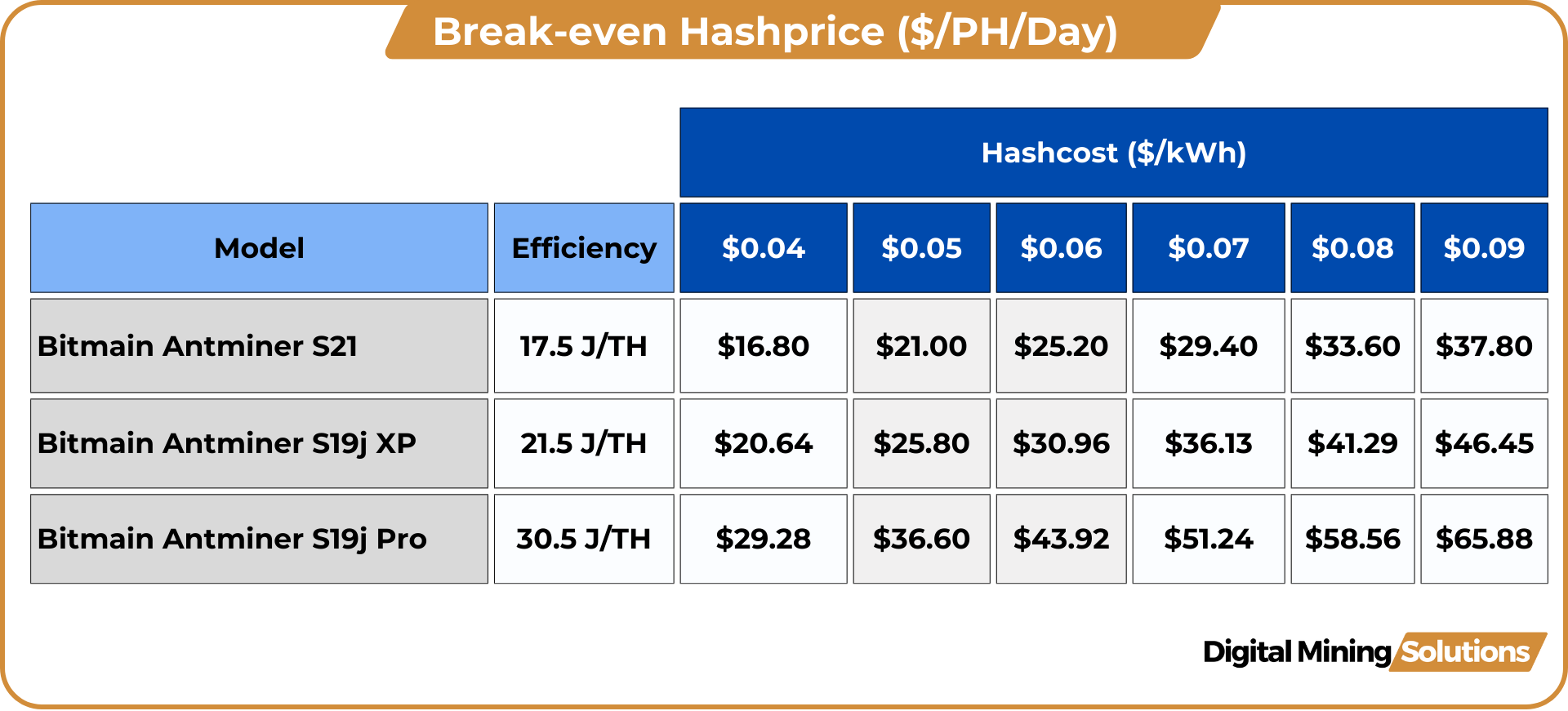

With the hashprice now at $105/PH/Day and transaction fees at around 15% of the block rewards, the hash price would drop to approximately $60/PH/Day if the halving were to occur now. The S19J Pro would be operating at a loss only when mining around a hashcost of $0.08 kWh or higher. This is significant because this most popular machine on the network comprises an estimated ~27%, according to CoinMetrics.

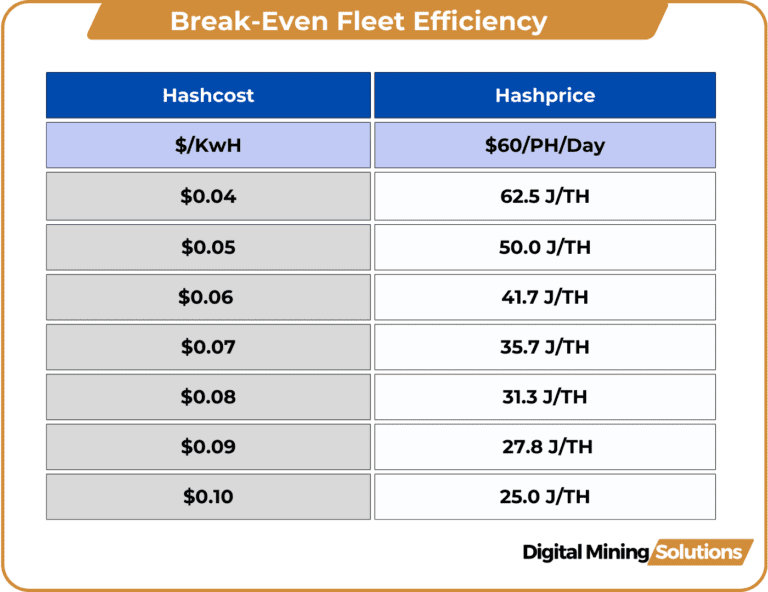

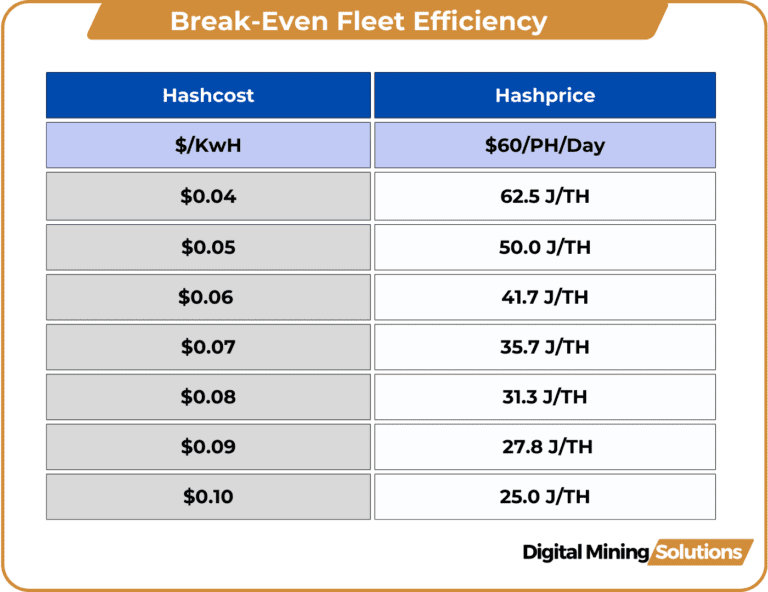

Break-Even Fleet Efficiency

With the hashprice currently at $105/PH/Day and transaction fees constituting 15% of the block reward, if the halving were to happen now, the hashprice would drop to approximately $60/PH/Day. Below an overview of the break-even efficiency of a miner fleet at different hashcost levels.

ASIC Prices

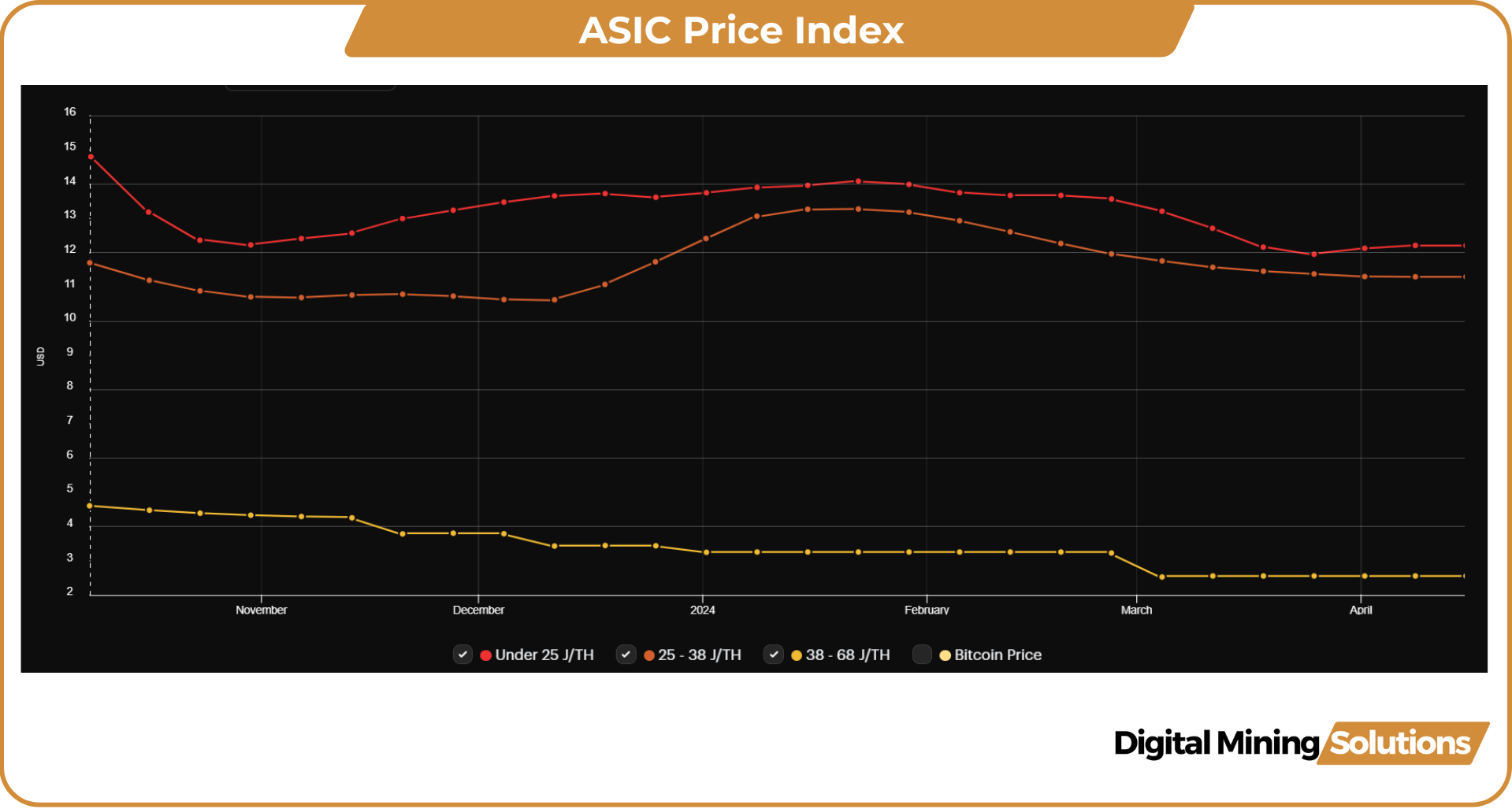

During the first weeks of April, ASIC prices seem to have recovered slightly from the decline witnessed in March. Over the last 6 months, ASIC prices have remained virtually unchanged, suggesting that mining equipment is bottoming out. Currently, machines with an efficiency under 25 J/TH are priced at $12.21/TH on average.

ASIC price action might seem boring at this moment, but there is a lot going on at the manufacturers’ end. First, Bitmain unveiled the S21 Pro with an efficiency of 15 J/T, marking a 14% improvement compared to the S21 at 17.5 J/T. Now, Auradine has announced its latest breakthrough, claiming that their cutting-edge chips achieve an efficiency of 15 J/T as well. The Auradine machines are anticipated to hit the market in the second quarter, beating Bitmain to the race.

Fun Facts

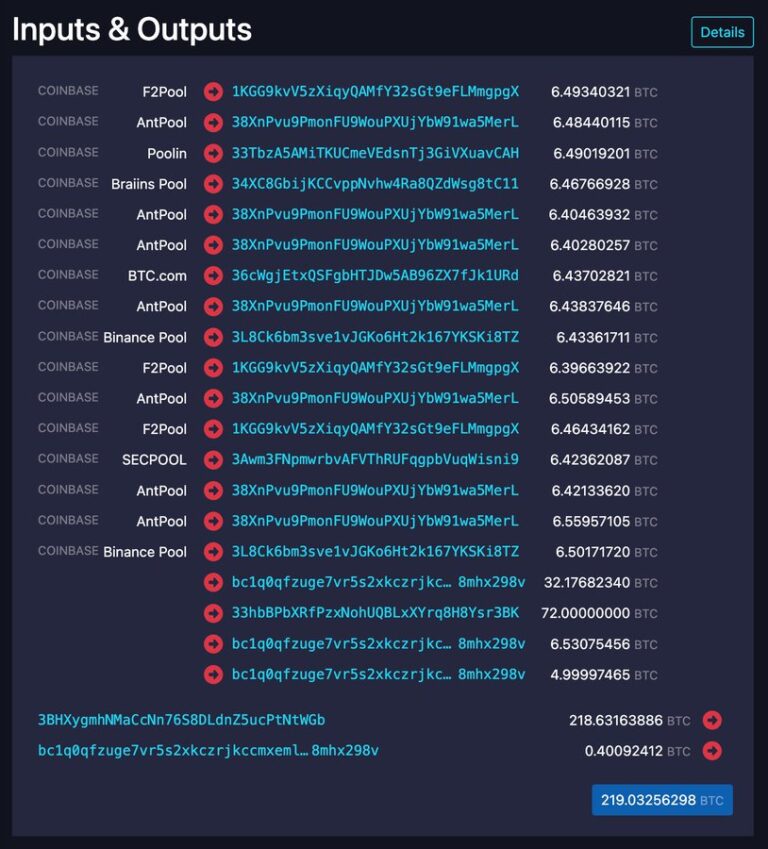

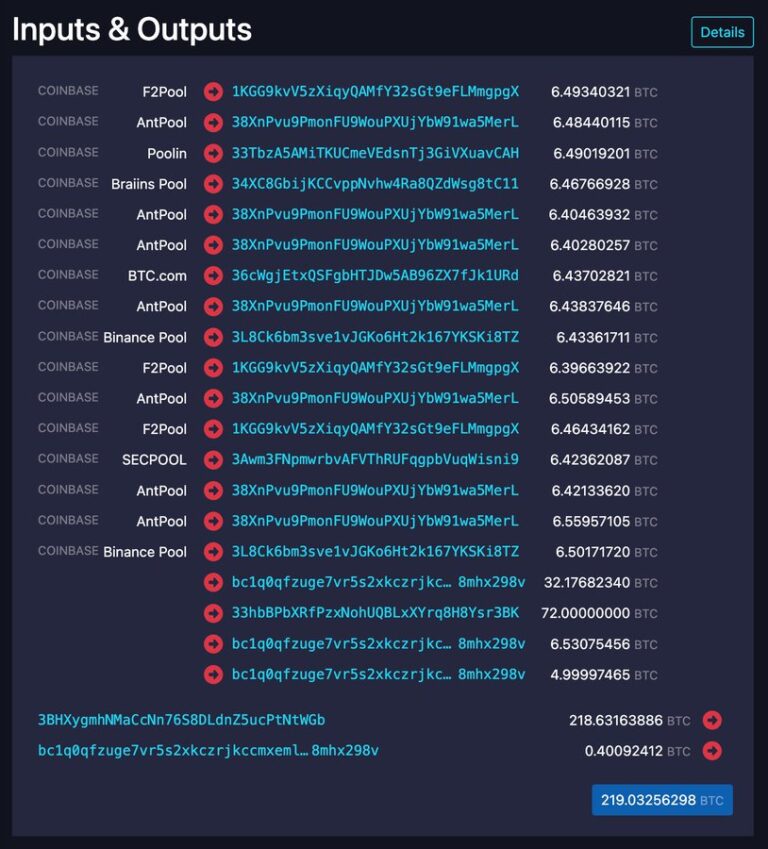

Mononaut analyzed the wallet addresses where mining pools are sending their rewards and came to the shocking conclusion that one single custodian controls the coinbase addresses of at least 9 pools, representing 47% of the total hashrate. This consolidation of mining reward outputs is evident from AntPool, F2Pool, Binance Pool, Braiins, btccom, SECPOOL, and Poolin. Consequently, this one entity holds the keys to at least 47 out of every 100 freshly mined bitcoins.

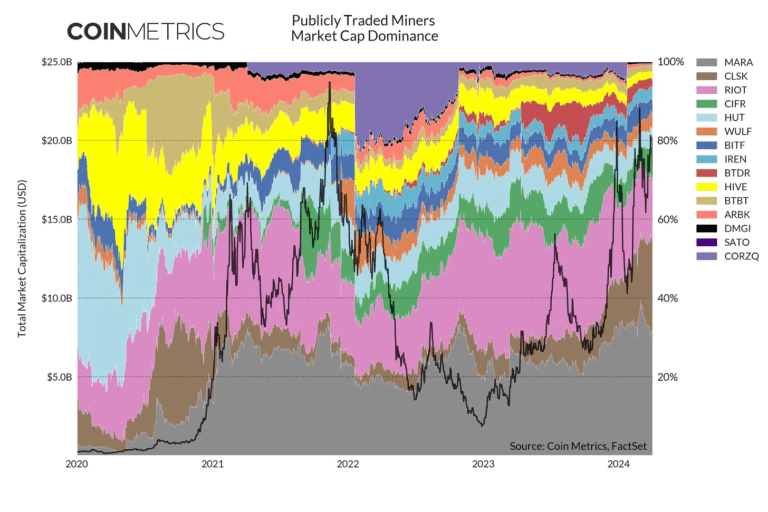

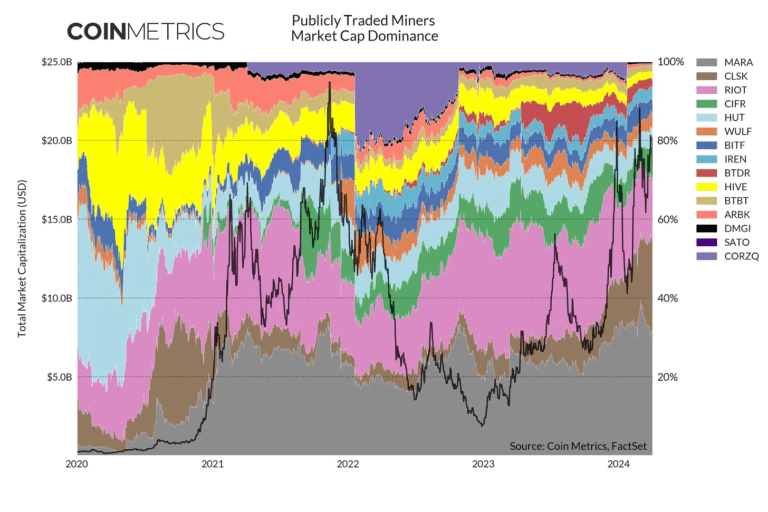

Parker Merritt of Coin Metrics analyzed the dominance of the market cap of publicly traded miners, revealing that the top 3 mining companies continue to consolidate market share. Marathon Digital Holdings ($MARA), Riot Blockchain ($RIOT), and CleanSpark ($CLSK) collectively command 70% of the sector’s capitalization. CleanSpark demonstrated impressive performance by increasing its dominance from 12% to 22% Year-to-Date. The company surpassed Riot and became the second most valuable publicly traded miner.