Bitcoin mining years can feel like dog years, with each quarter resembling a full calendar year of activity. The first quarter of this year was particularly eventful, marked by significant developments. ETF approval propelled BTC price to new all-time highs, while the deployment of the latest generation machines pushed network hashrate beyond the 600 EH/s mark. Despite declining transaction fees, miner revenue reached historic highs. Meanwhile, ASIC prices have been stabilizing as many miners hold off on new investments in anticipation of the halving. Foundry and Antpool maintained their dominance, although ViaBTC rose to the third spot, capturing market share from Antpool. In this Q1 2024 Bitcoin mining industry review, we delve into the following topics:

- Bitcoin Price

- Bitcoin Holdings

- Network Hashrate

- Difficulty

- Hashvalue & hashprice

- Transactions & tx fees

- Daily Mining Revenue

- ASIC prices

- Mining pools & hashrate distribution

- Biggest headlines

Bitcoin Price

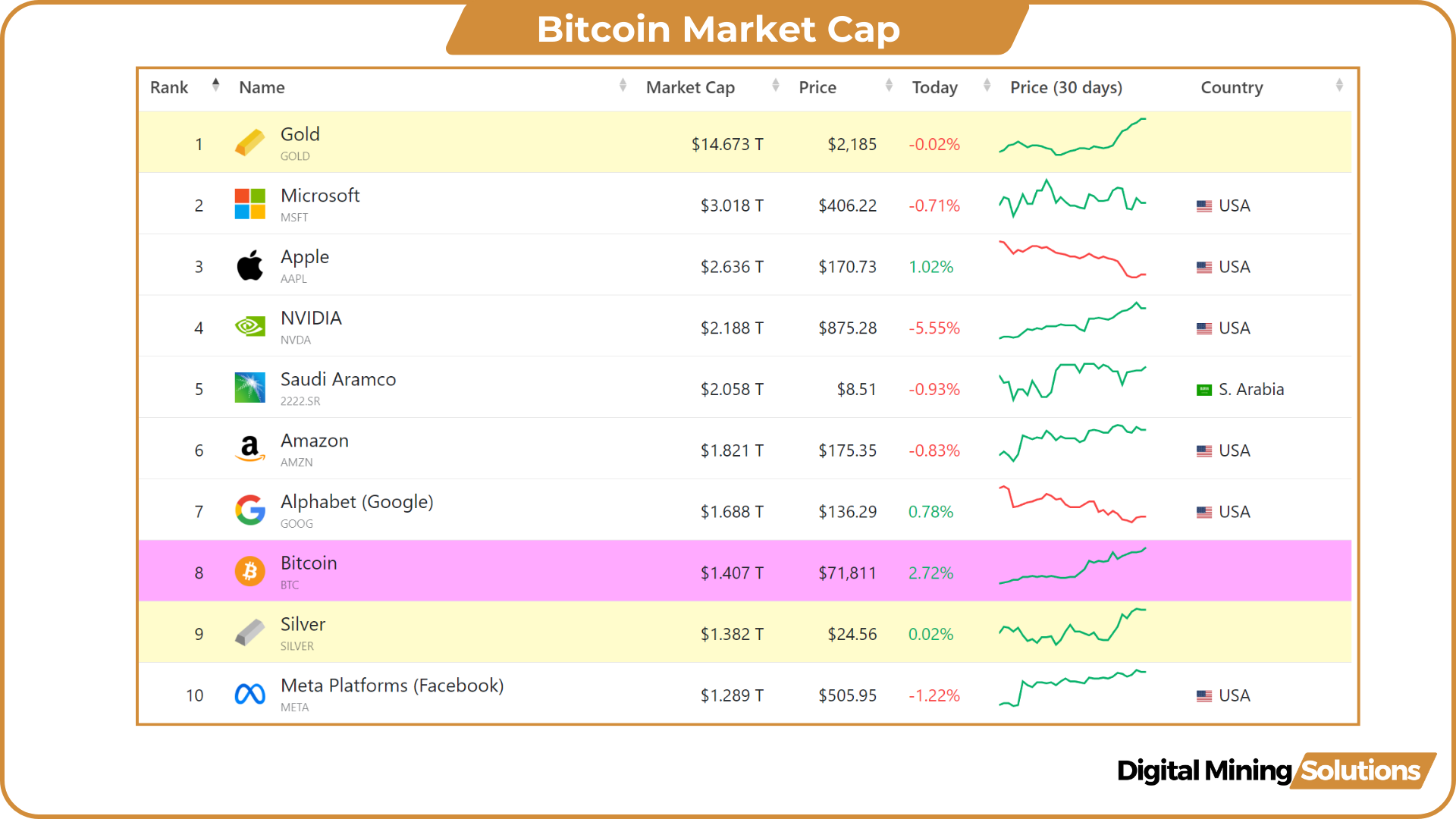

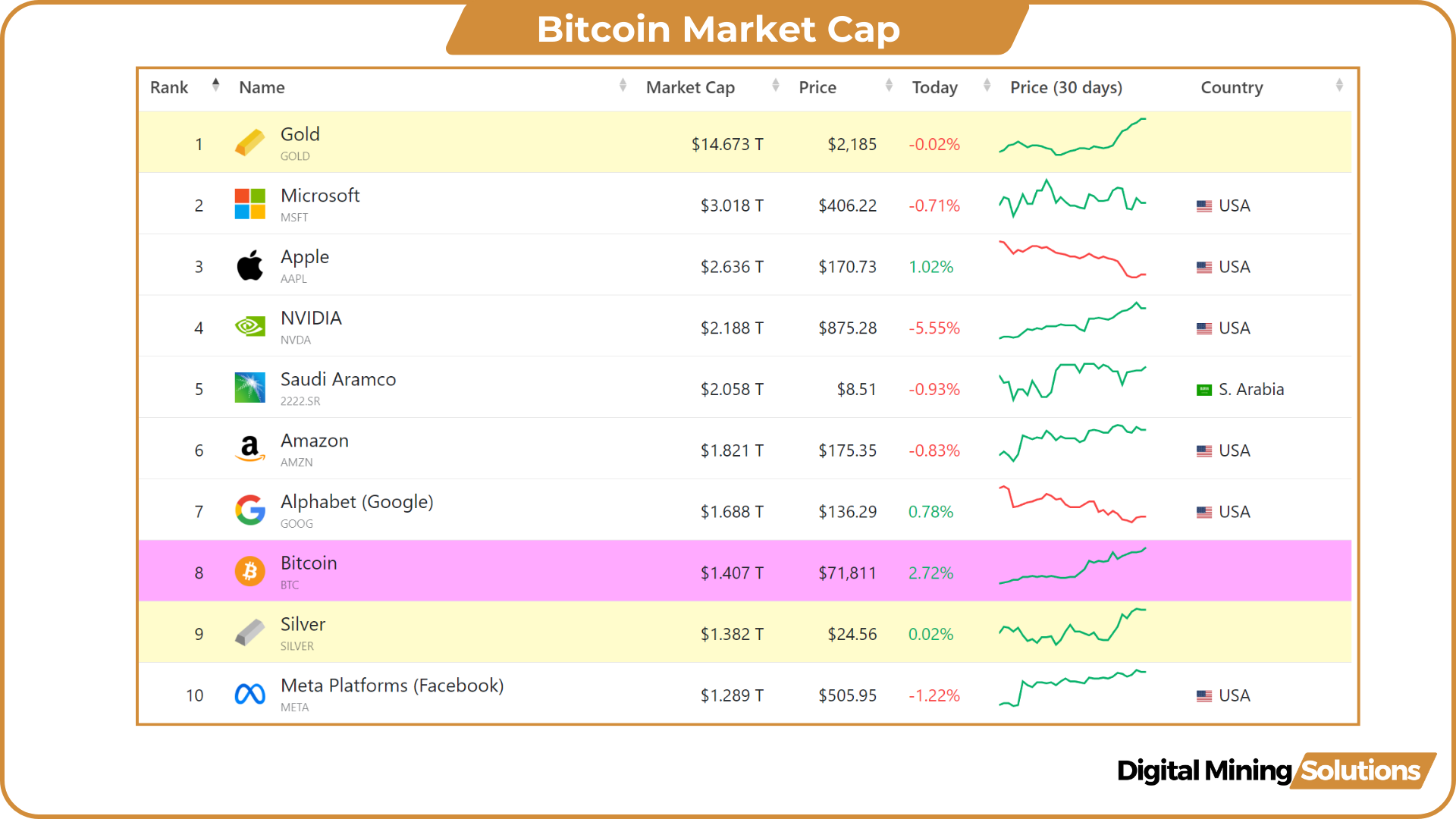

Bitcoin began the year at $42K and closed the first quarter at nearly $72K, marking a robust 70% increase. BTC surpassed the November 2021 all-time high for the first time on March 5th, reaching a as high as $73,800 on March 14th. The largest percentage drawdown this year occurred in January, with a 21% drop. The biggest decline in nominal terms happened shortly after reaching the record high, BTC fell from $73,800 to $60,800.

On a monthly basis, Bitcoin has witnessed a price increase for seven consecutive months, matching the 2012 record for the longest streak of consecutive green months.

In the first quarter of 2024, Bitcoin achieved a historic milestone by surpassing silver in market cap. However, with gold valued at $14.67 trillion, there is still a considerable distance to cover before the digital version overtakes the yellow metal.

Bitcoin Holdings

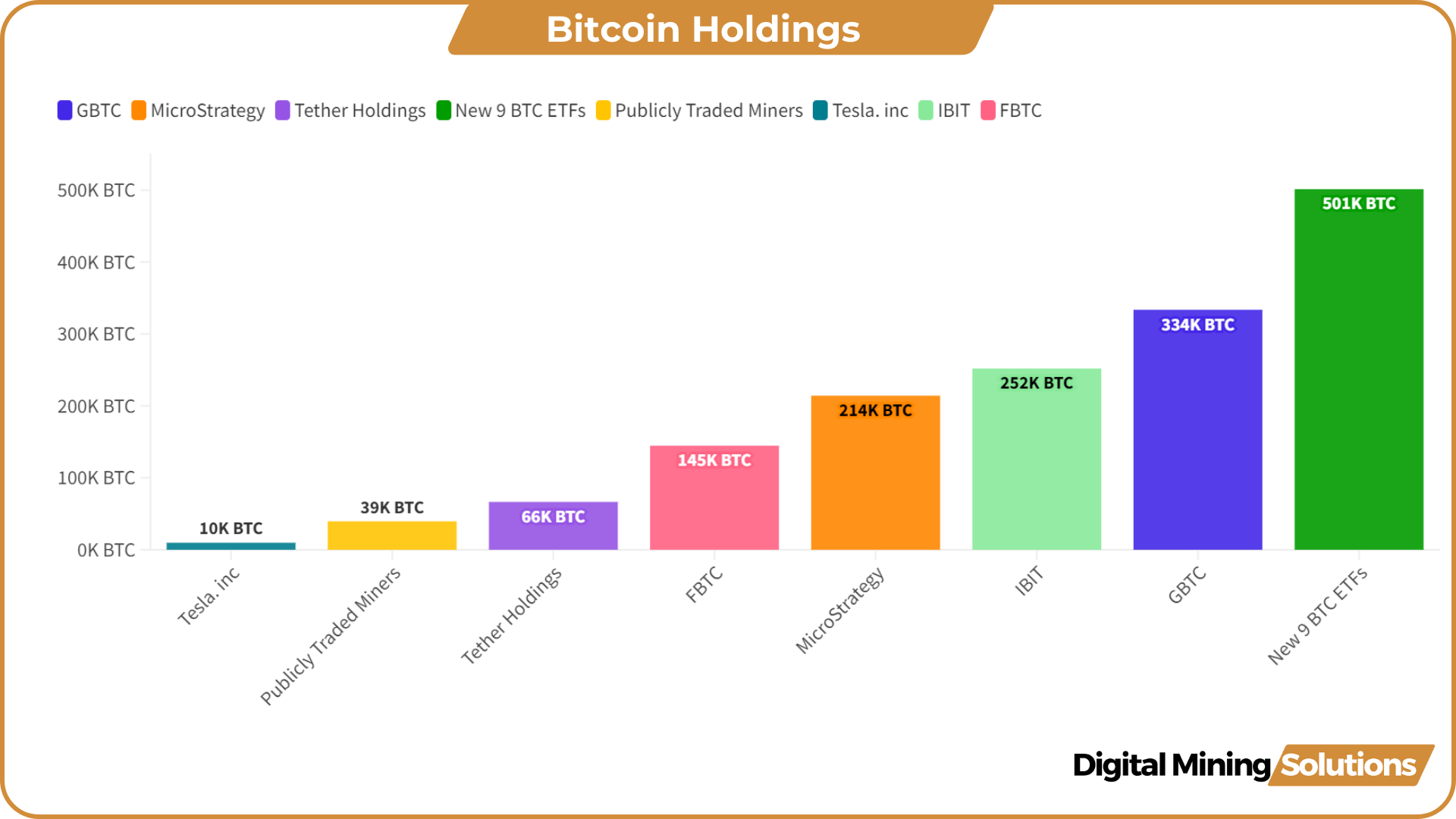

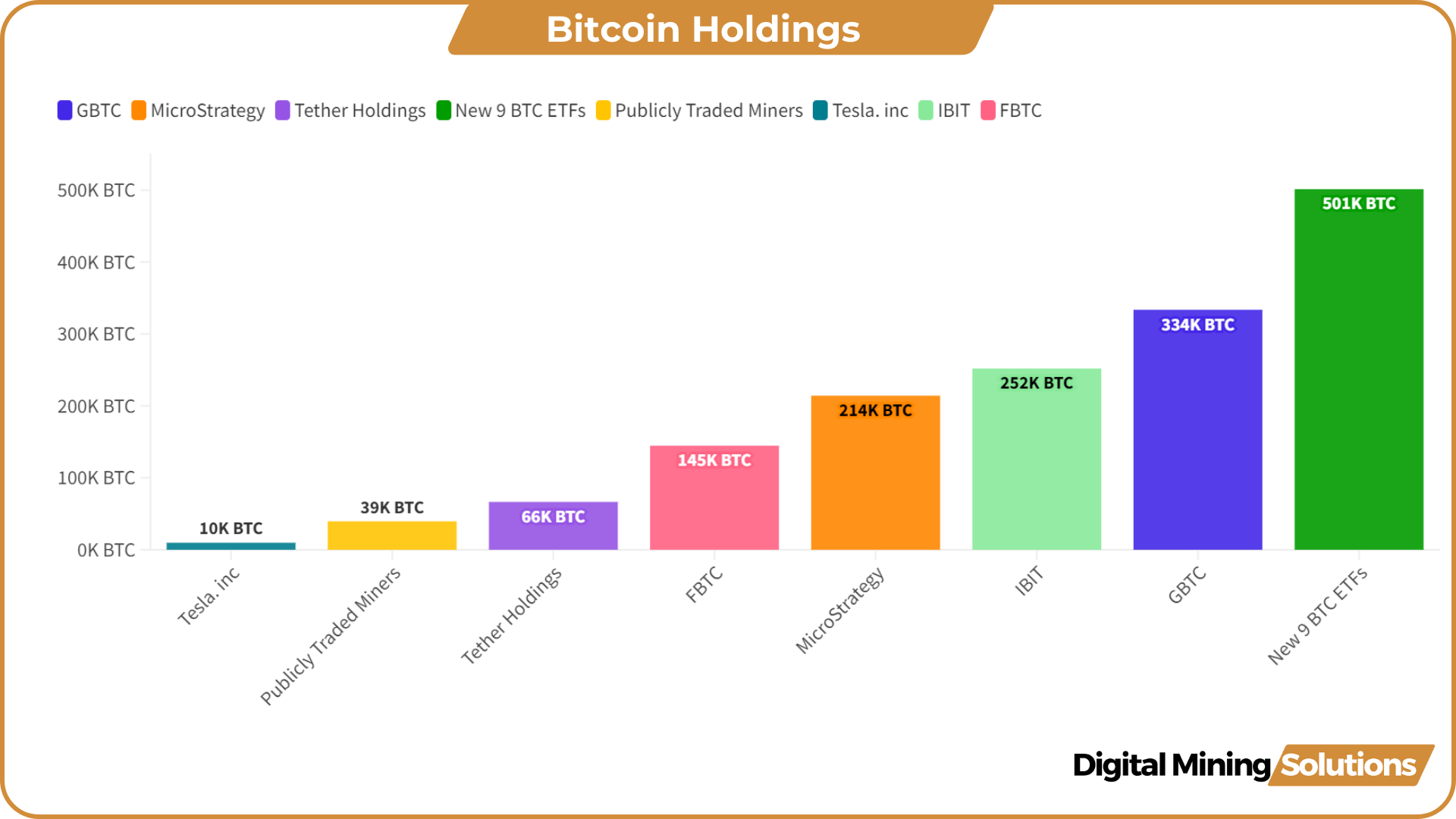

ETFs have been a significant driver of the price increase. Since the launch of the ETFs, total holdings have reached 835,058 BTC. The nine new ETFs have acquired 500K Bitcoin in less than three months, with net inflows averaging 3,720 BTC per day.

There has been a notable outflow from $GBTC as investors shifted to other ETFs with more attractive fees, resulting in the sale of 285,589 BTC. Despite this, $GBTC remains the largest holder of Bitcoin among the ETFs, with 334K BTC.

Blackrock showed the fastest growth in Q1, with $IBIT now holding more BTC than MicroStrategy. If this pace continues, it is likely to surpass Grayscale in Q2. Blackrock’s CEO Larry Fink described the Bitcoin ETF as the most successful ETF launch in history.

Adding to the momentum, BlackRock announced plans to purchase its own spot Bitcoin ETFs as well as other Bitcoin ETFs with its Global Allocation Fund, which holds assets close to $18 billion. Additionally, MicroStrategy acquired over 25,000 BTC in the first quarter, bringing its total Bitcoin holdings to 214,246 bitcoins, valued at approximately $15 billion, with an average purchase price of $33,706.00 per bitcoin.

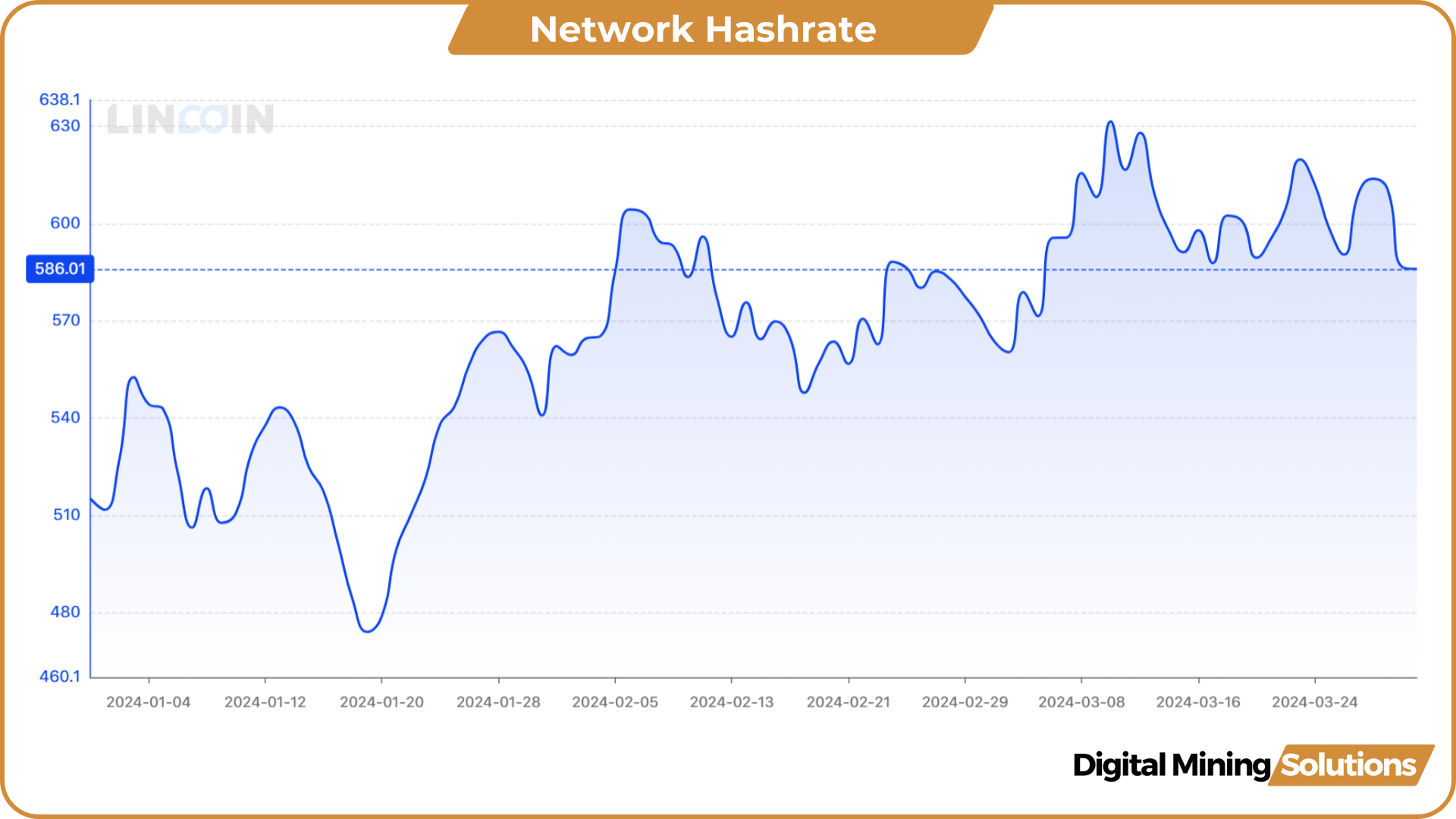

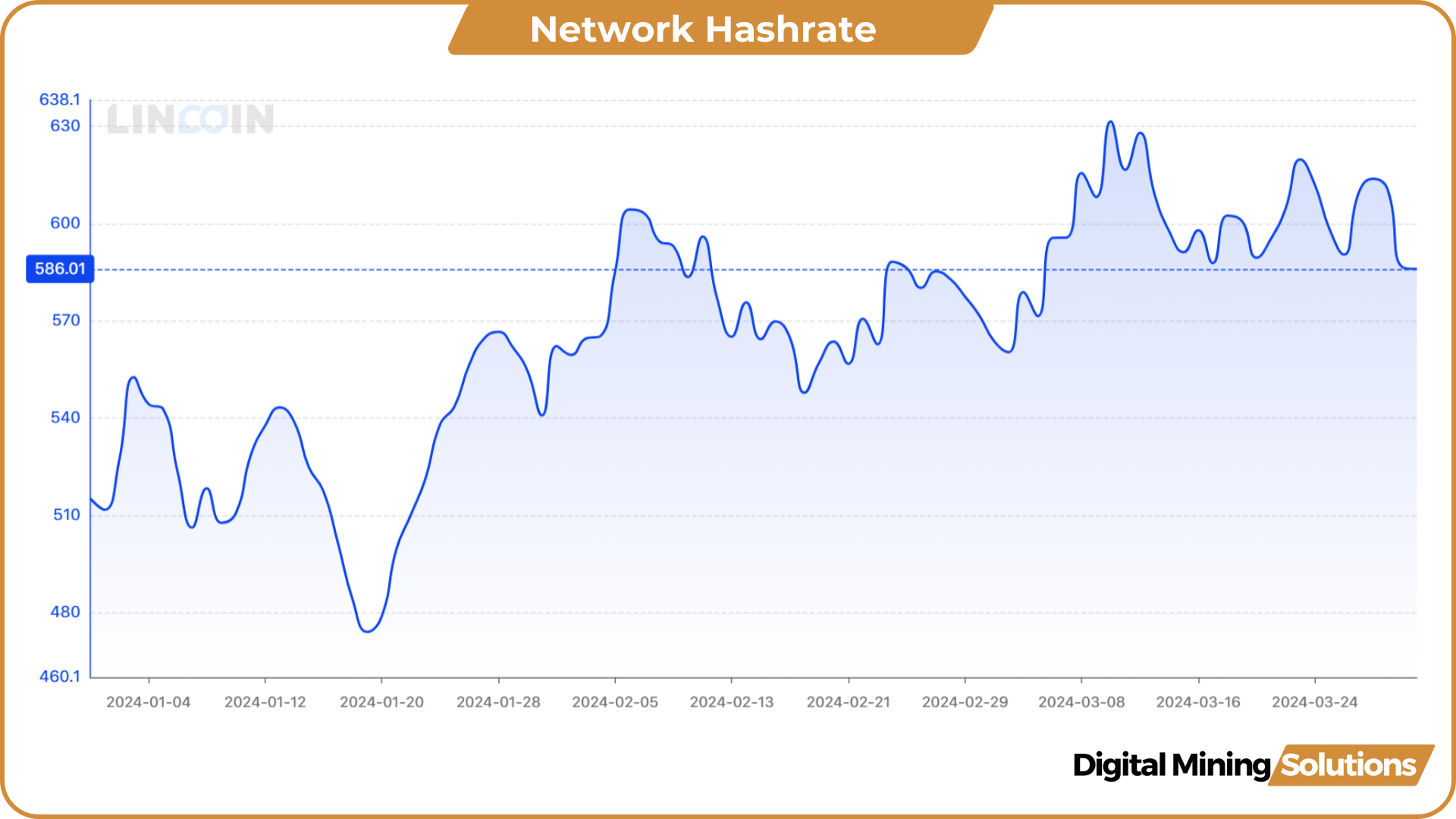

Network Hashrate

The network hashrate began the year at 511 EH/s and ended the first quarter at 586 EH/s, marking a total growth of 75 EH/s or 14.7%. This growth is equivalent to adding 375,000 Antminers S21 200 TH/s to the network. The deployment of S21s and other latest-generation mining equipment played a significant role in driving the hashrate growth during the first three months of the year.

Furthermore, improved market conditions have encouraged miners who were previously unprofitable at lower hashprice levels to come back online. On March 11th, the network hashrate reached a new all-time high of 631 EH/s on the 7-day moving average.

Biggest Headlines:

- Swan Bitcoin unveiled their mining unit in late January. The mining business aims to reach 8 EH/s mining power and, at the time of the announcement, already has 4.5 EH/s operational after starting the unit in the summer of 2023.

- Various miners went public in the first months of 2024. GRIID began trading on the Nasdaq under the ticker GRDI, and Gryphon Digital Mining debuted on the same exchange with the ticker symbol GRYP. BitFuFu, a bitcoin cloud mining and proprietary mining firm backed by hardware giant Bitmain, listed on the Nasdaq via a SPAC merger. Core Scientific completed the reorganization process and relisted its shares, also on the Nasdaq.

- Ethiopia signed a preliminary agreement to develop infrastructure for Bitcoin mining and artificial intelligence. The Ethiopian Investment Holdings (EIH) signed a memorandum of understanding for a $250 million project with a subsidiary of Hong Kong-based West Data Group.

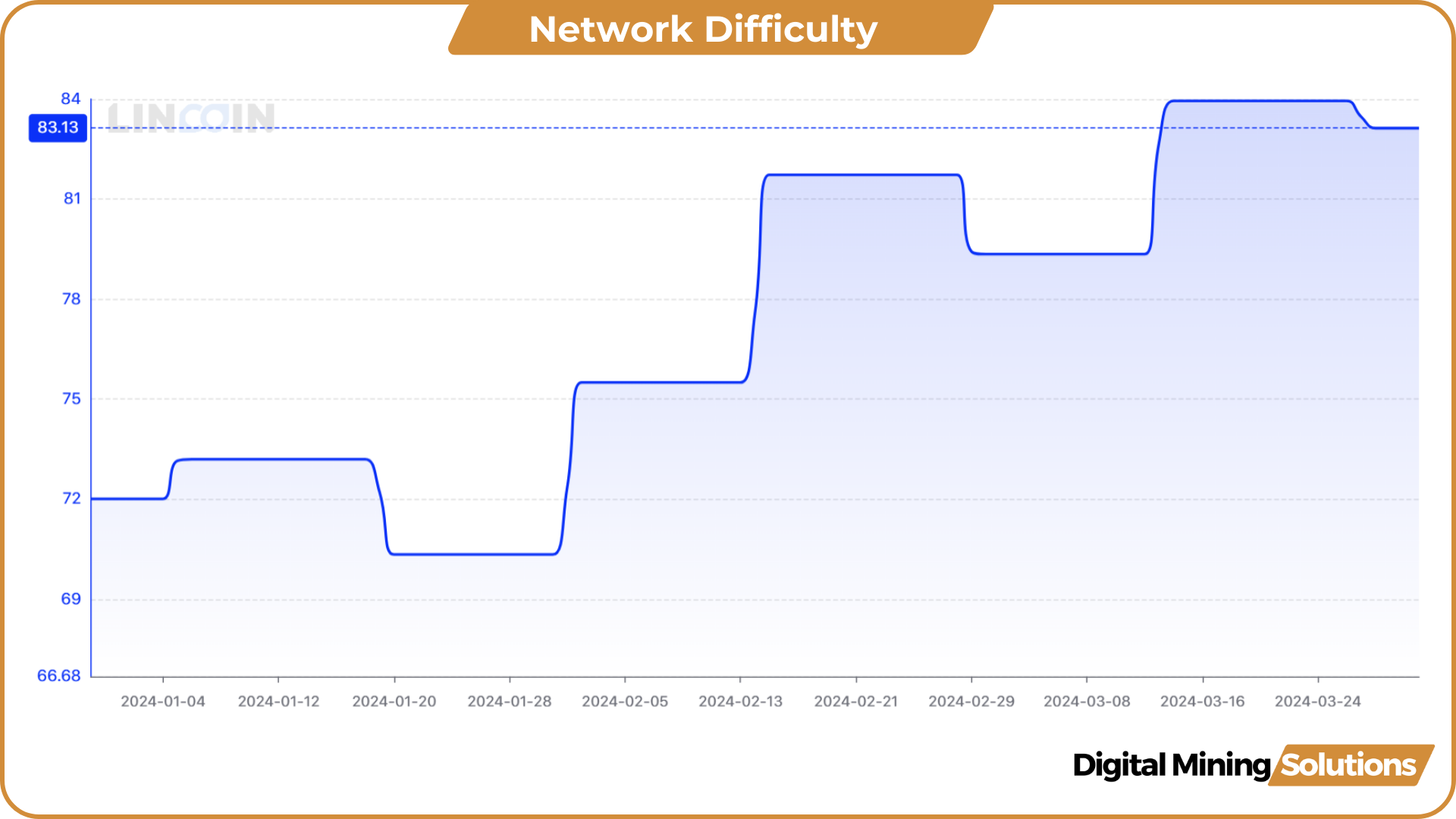

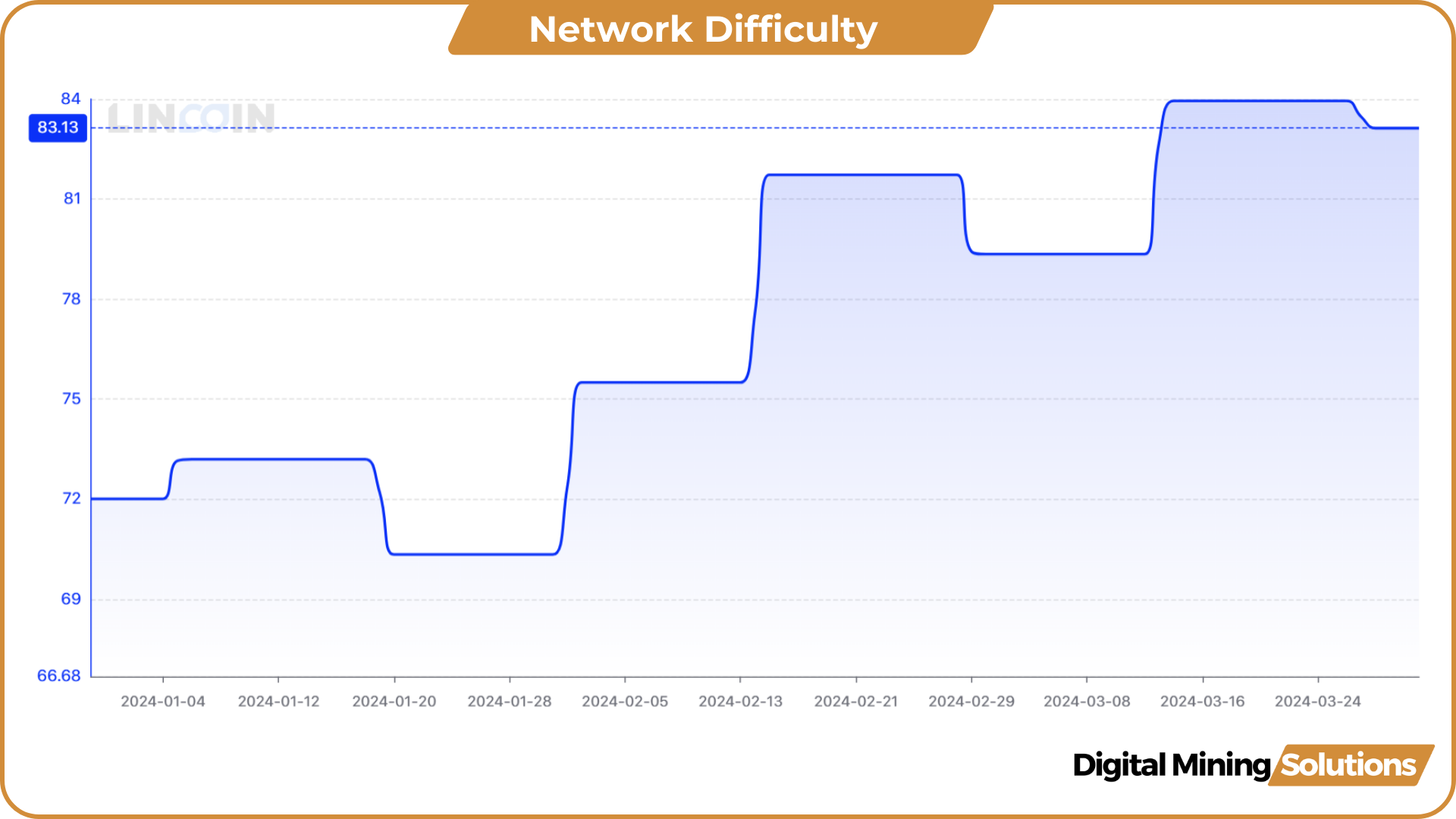

Network Difficulty

The network difficulty started the year at 72.01T and closed the first quarter at 83.13T, reflecting a 15.4% increase. On March 13th, the difficulty hit a record high of 83.95T.

During Q1, there were a total of four difficulty increases, with the highest being 8.24%, marking the biggest increase in almost a year. Additionally, there were three downward adjustments, with the largest being 3.9% on January 20th.

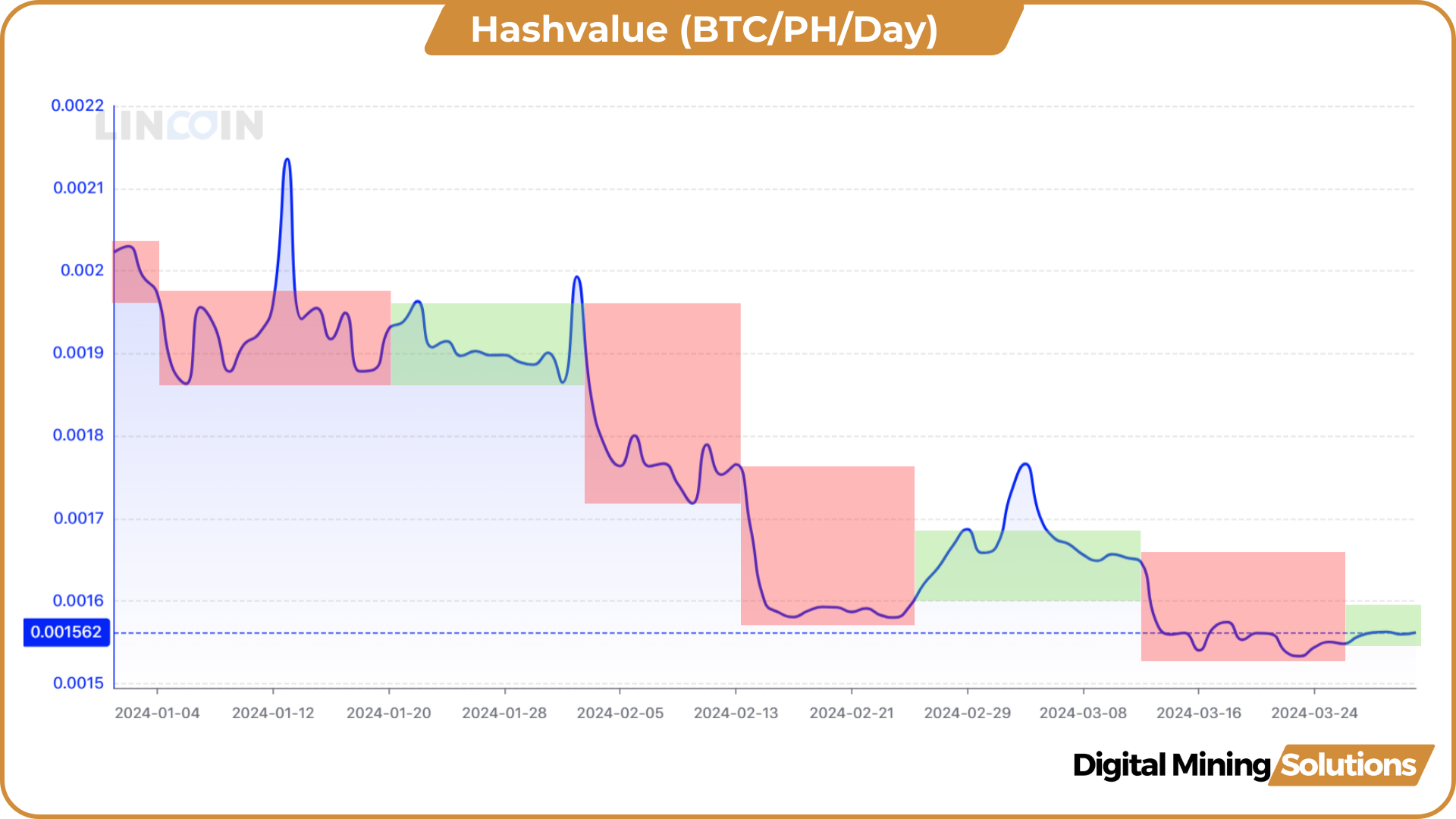

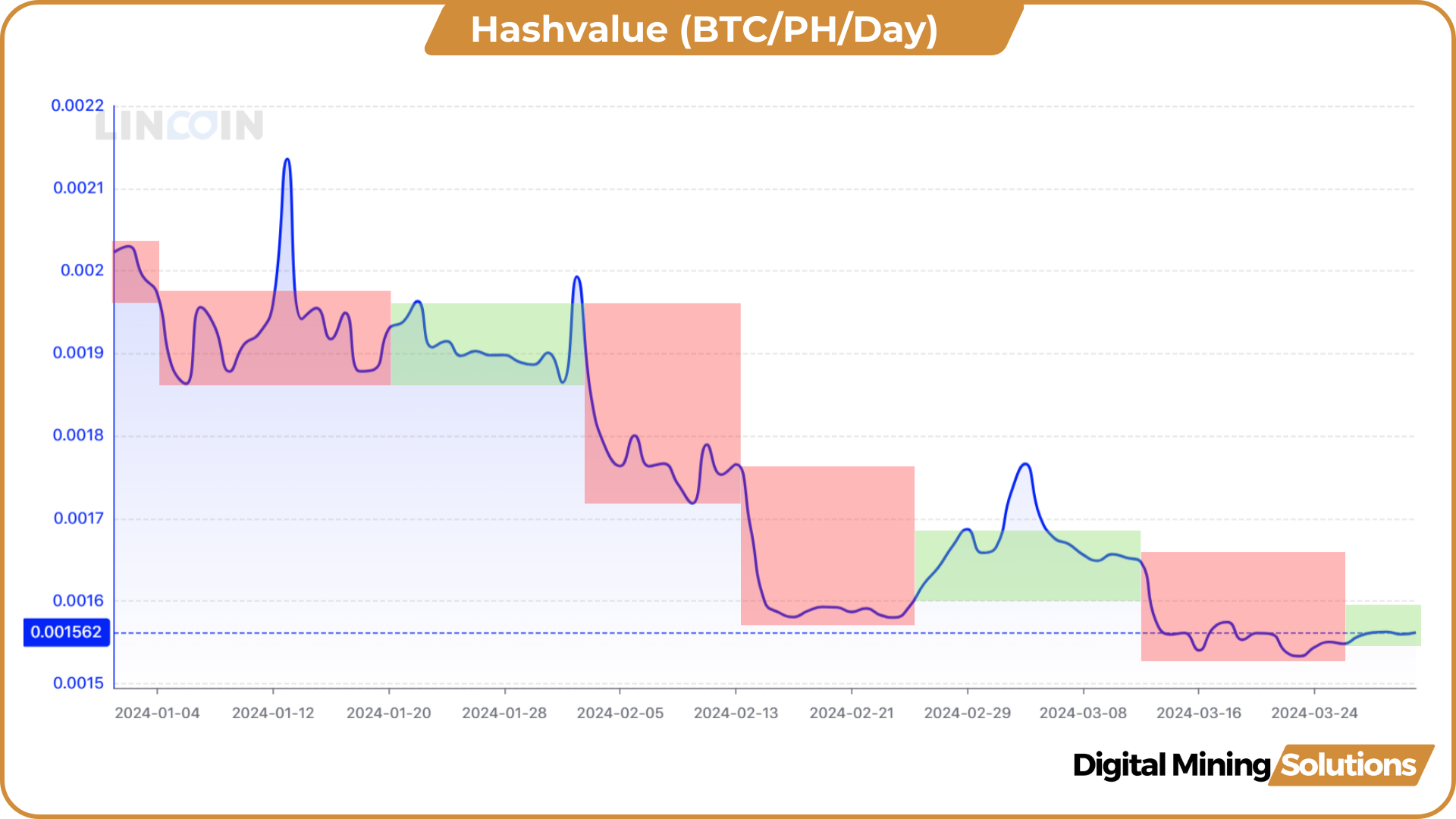

Hashvalue

Hashvalue indicates how much a miner can expect to earn in BTC per Petahash (PH/s) of computing power per day. It is determined by network difficulty, block subsidy, and transaction fees. Hashvalue began the year at 0.00202254 BTC/PH/Day and ended the first quarter at 0.00156202 BTC/PH/Day, marking a 22.8% decline.

In early 2024, transaction fees started to decrease, and the chart reveals that the primary influence on hashvalue has been the difficulty adjustments. There were only three instances where transaction fees caused a slight spike in BTC earned.

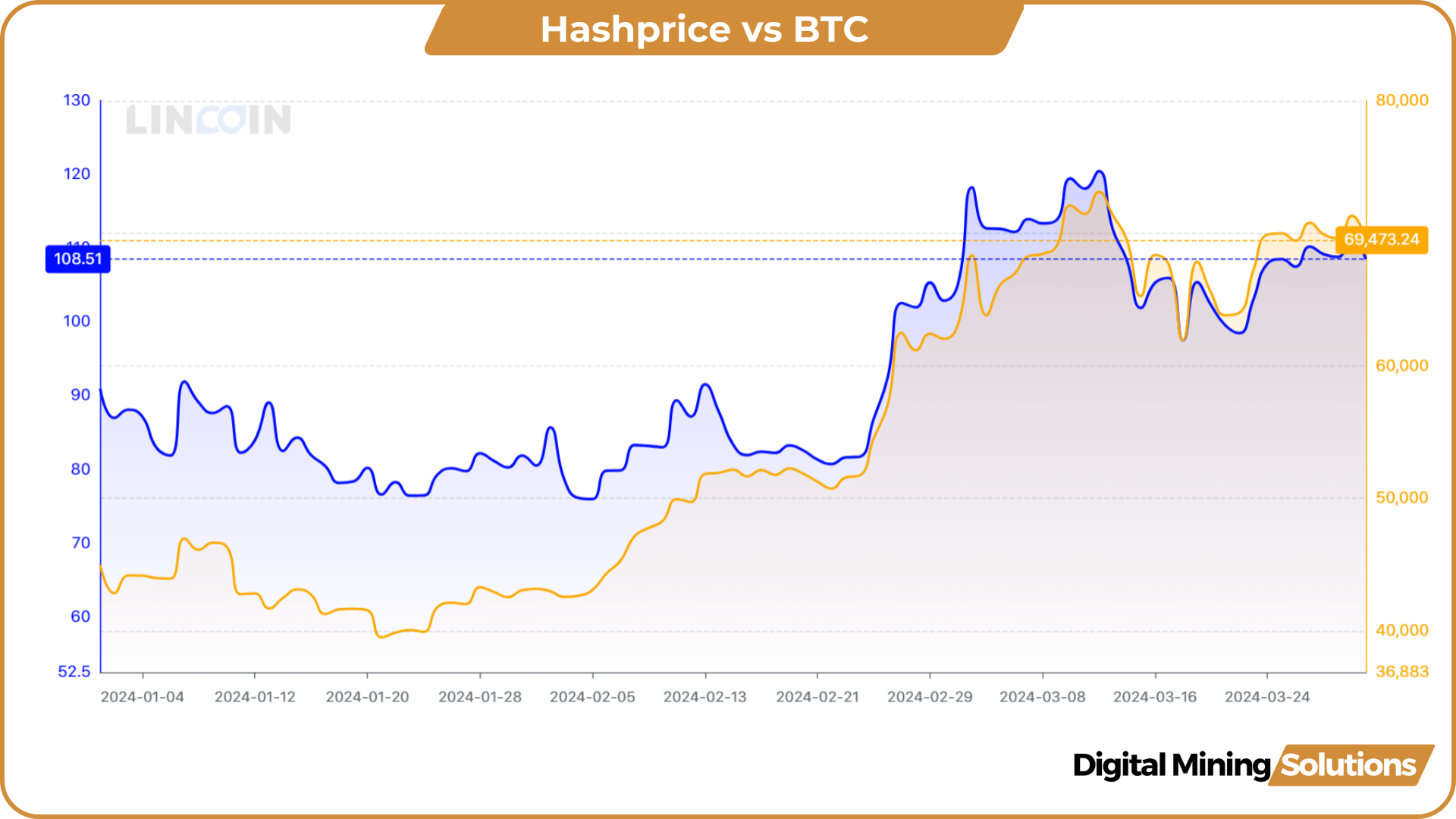

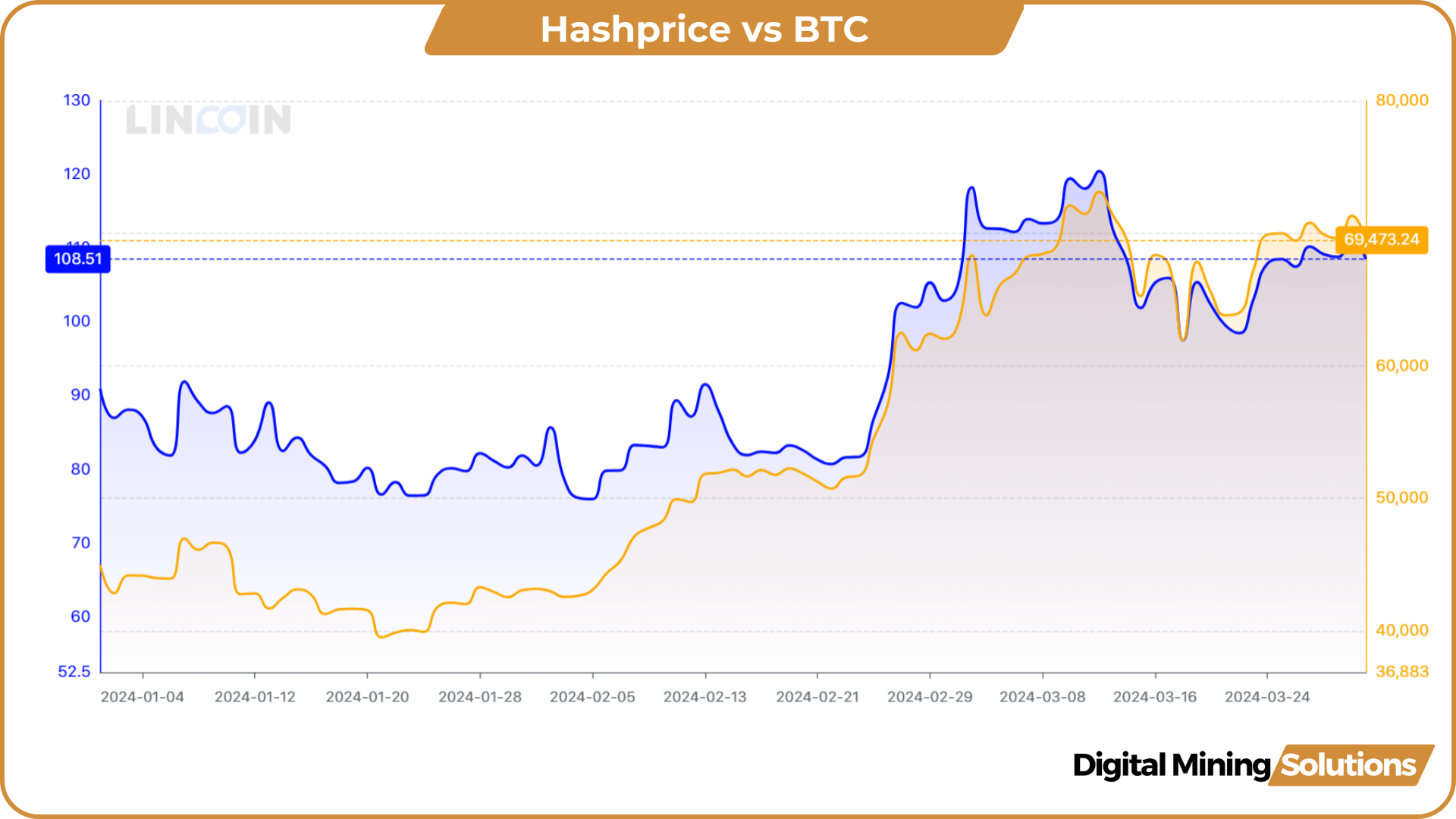

Hashprice

Hashprice indicates how much a miner can expect to earn in USD ($) per Petahash (PH/s) of computing power per day. It is determined by the same inputs as hashvalue (network difficulty, block subsidy, and transaction fees), along with Bitcoin’s price. With transaction fees at low levels, hashprice has been primarily influenced by the Bitcoin price. Unsurprisingly, hashprice reached a yearly high of $120/PH/Day on the same day BTC marked its all-time high.

As of March, hashprice has been consistently above the $100/PH/day level. The year started at $89/PH/day, and the quarter closed at $108/PH/day, indicating a 21.3% increase. If the halving were to occur today, hashprice would be around the record low of $55/PH/day marked in November 2022.

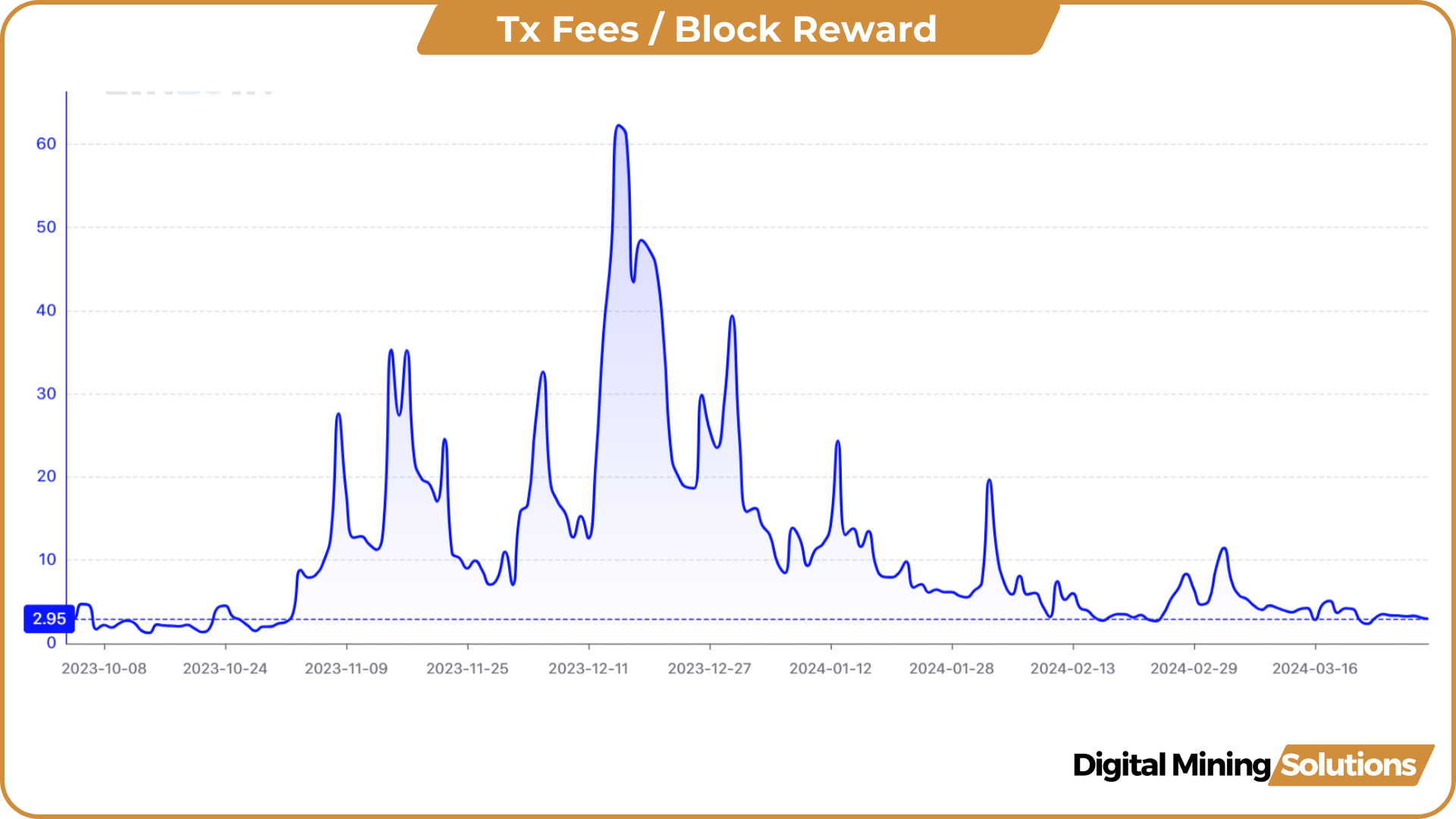

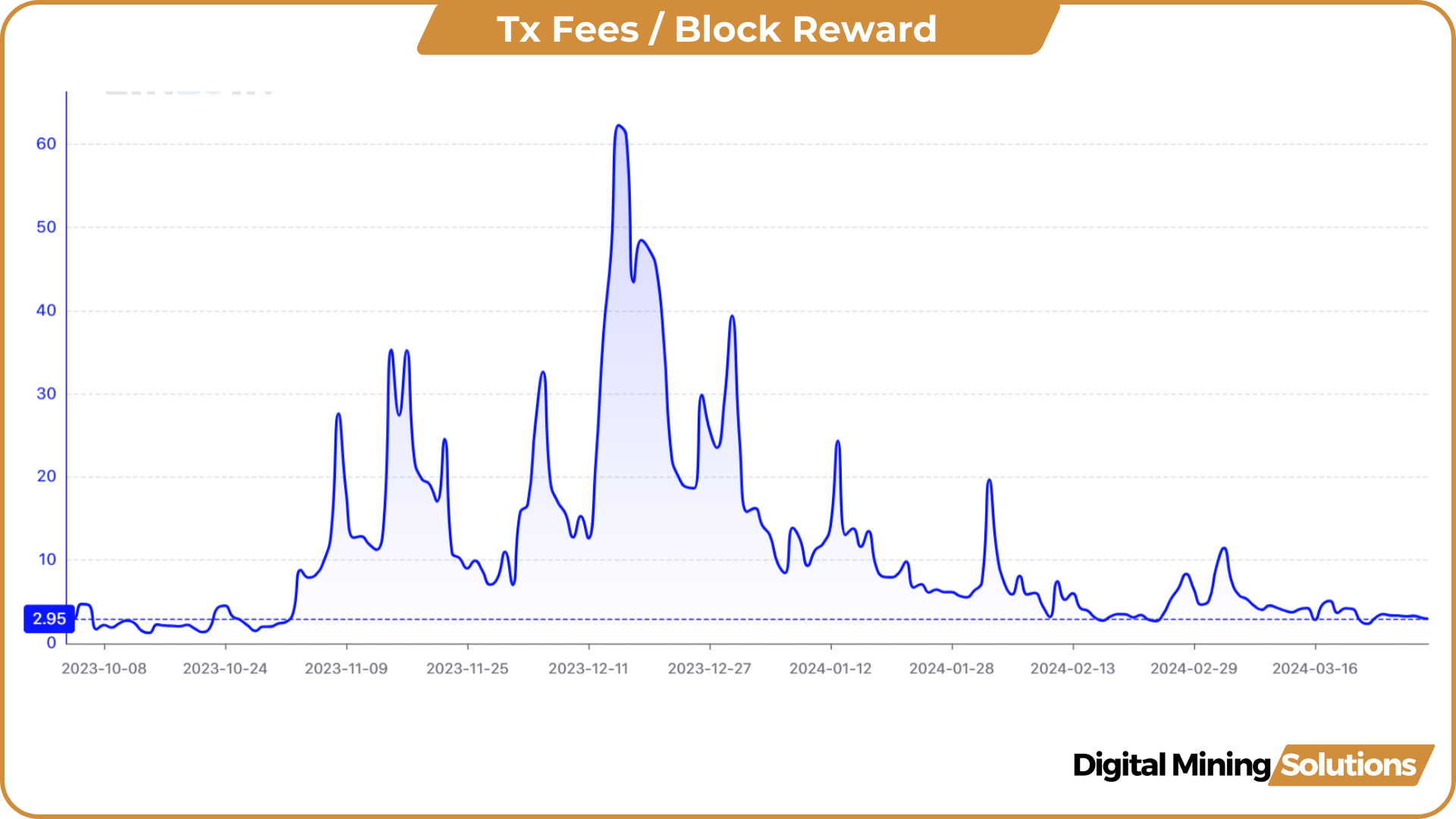

Transaction & tx fees

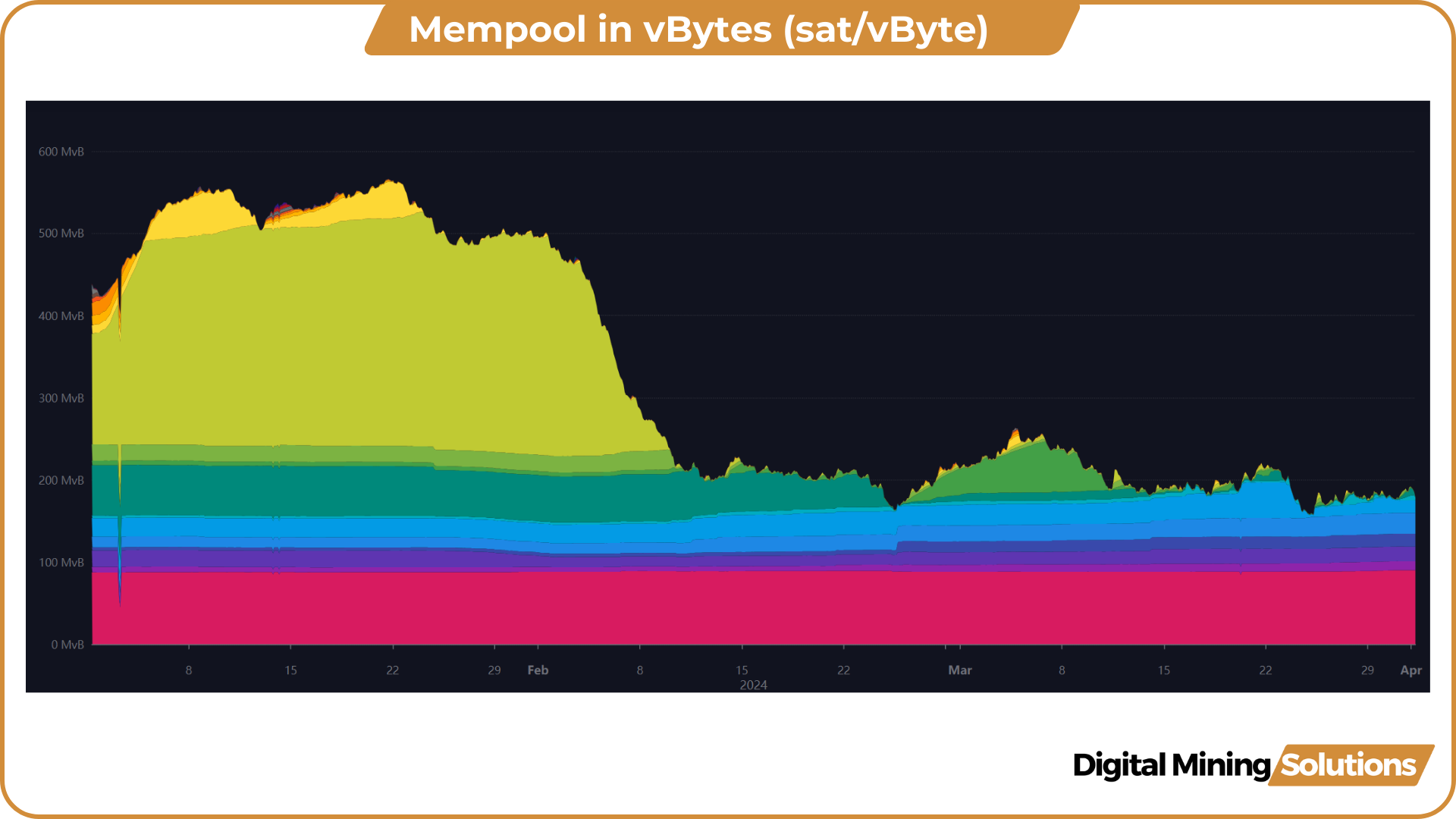

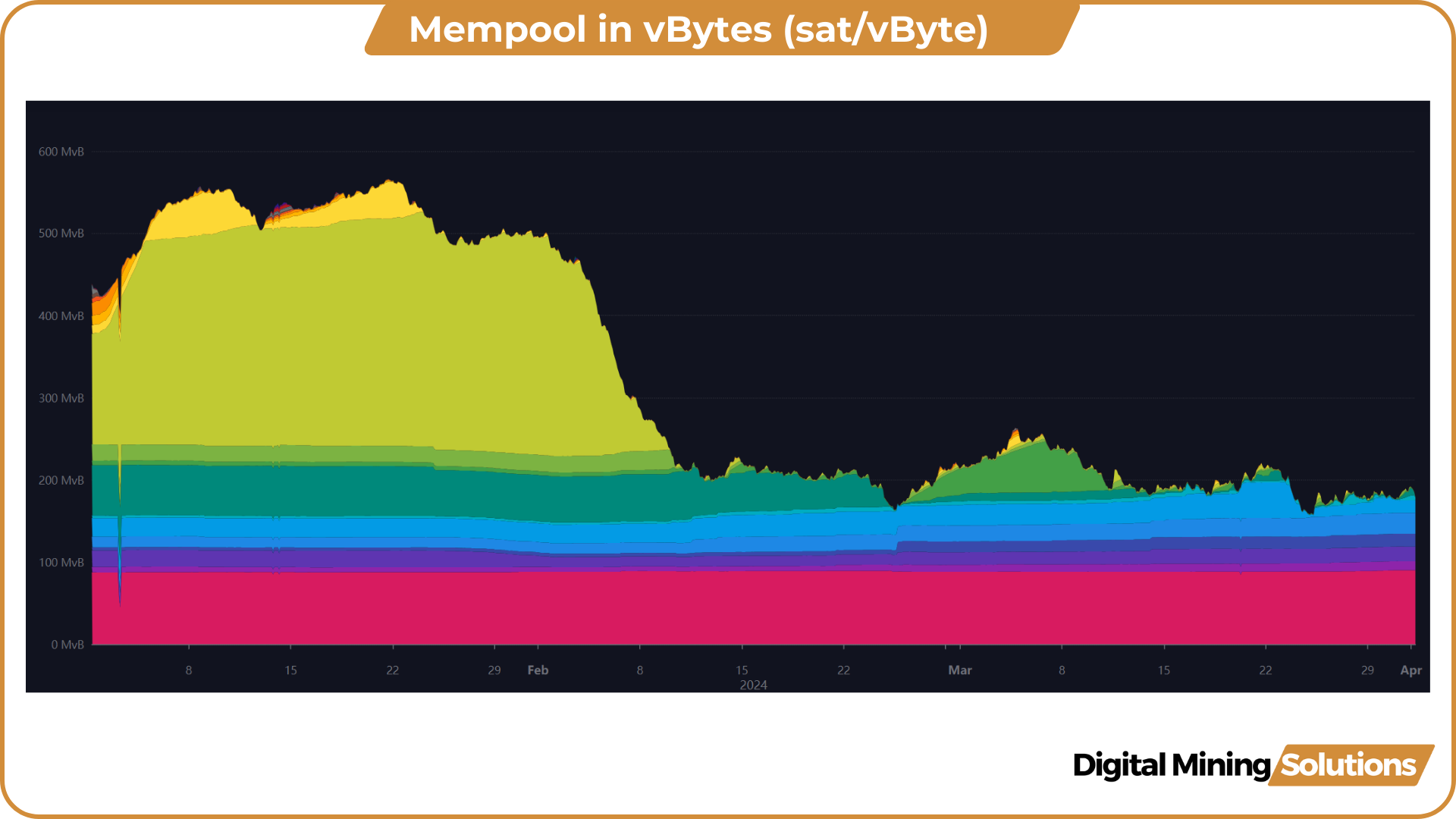

The mempool, which holds pending transactions, experienced a smooth clearance in February, resulting in a decrease in the fee rate. While this is beneficial for individuals seeking to send quick transactions, it presents a less favorable scenario for miners who have grown accustomed to high transaction fees over the past few months. However, the mempool hasn’t cleared any further in the past month, and with the halving less than 3 weeks away, fees are expected to rise again.

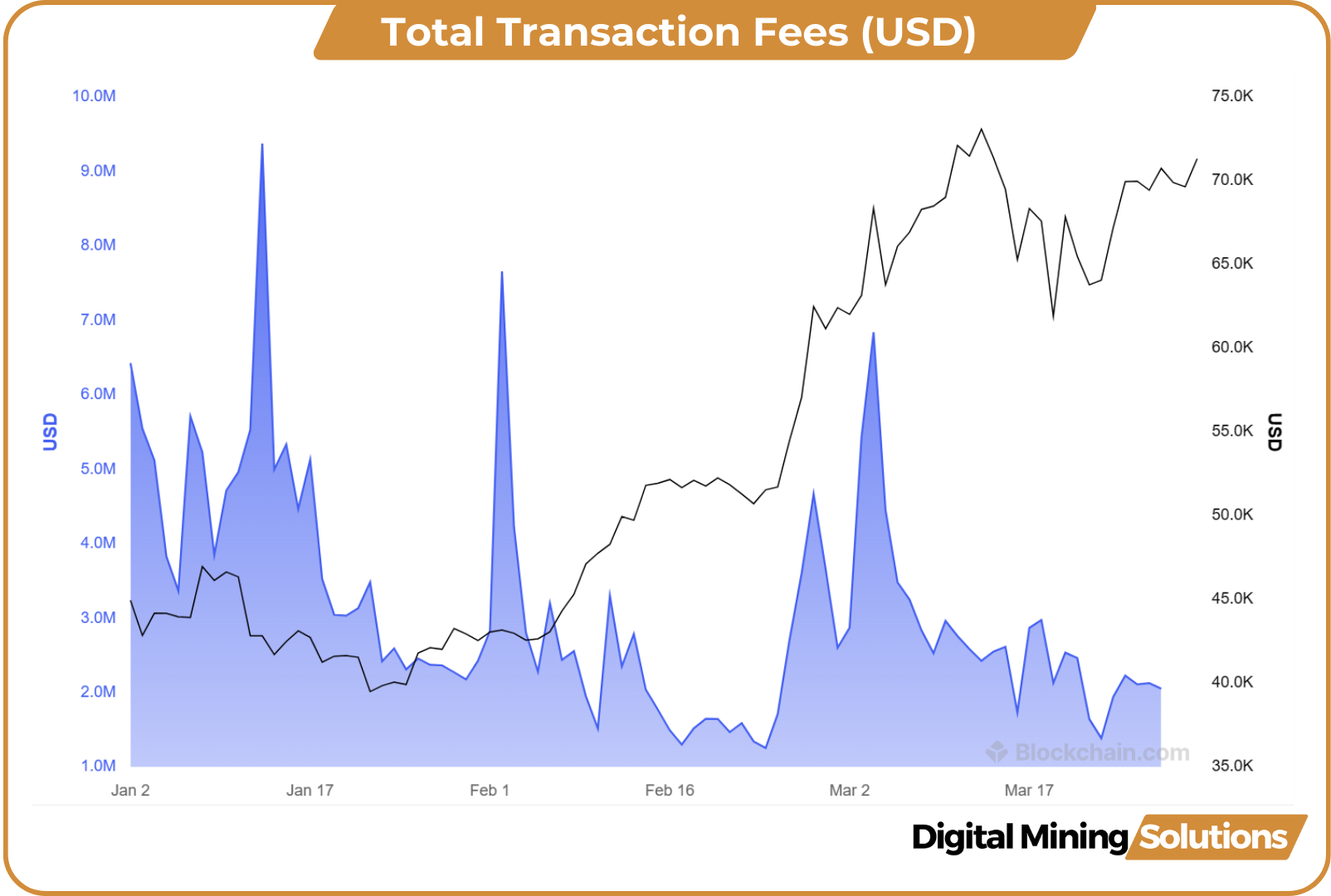

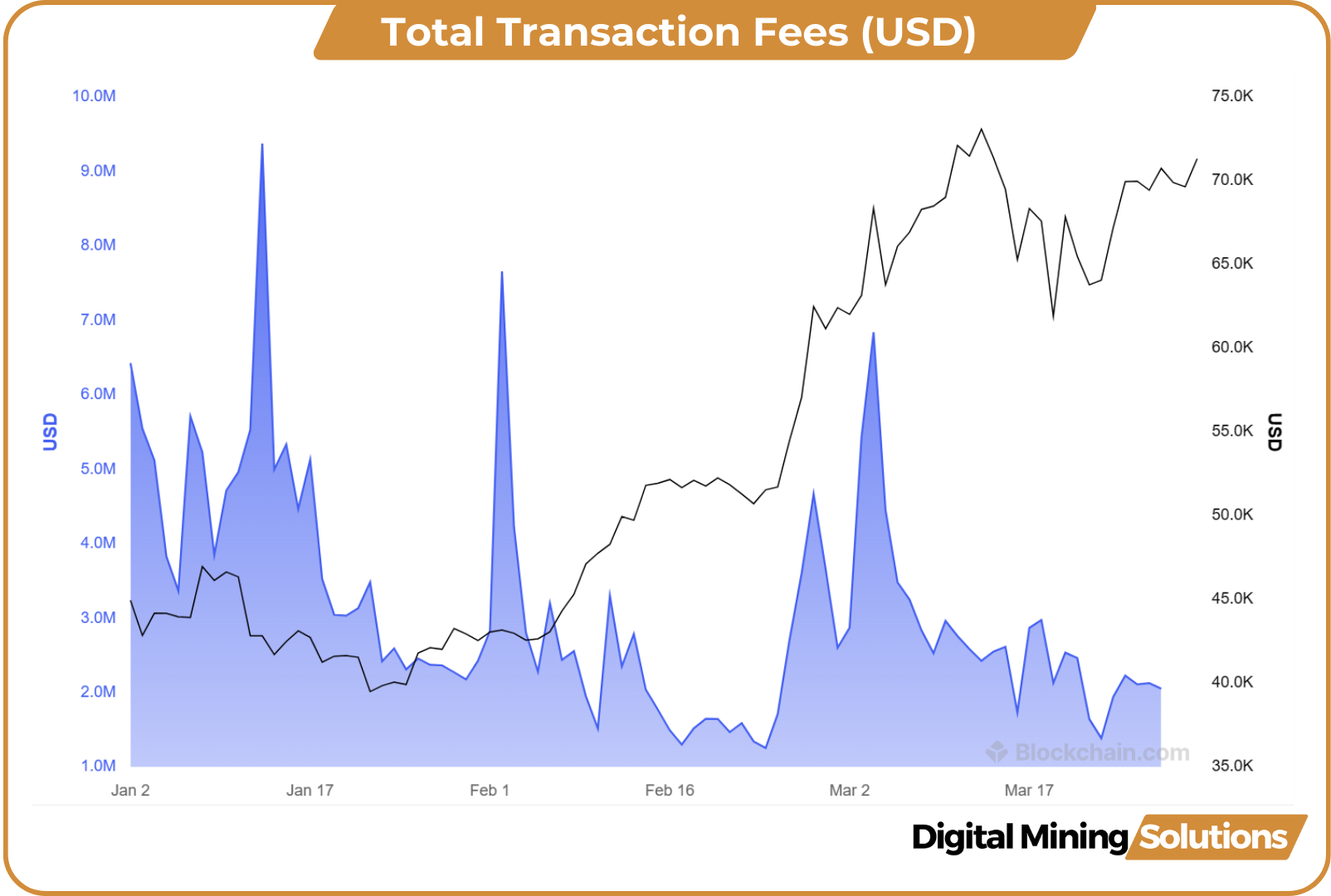

Although November and December of 2023 saw record transaction fees, the total transaction fees in USD have been declining over the first three months of the year. While there were some occasional spikes, even these temporary surges cannot compare to the peaks observed last year. For instance, on January 13th, there was a yearly high of $9.3 million, whereas the highest daily transaction fees recorded in December 2023 reached $23.7 million.

The decrease in transaction has caused the transaction fees as a percentage of the total block reward to reach levels last observed in October 2023. In 2024, the competition for block space has slowed down, as fewer transactions are being added compared to the end of last year. It’s likely that transaction fees will surge around the halving as there will be competition for block space to secure a place for transactions in the blocks before and immediately following the event.

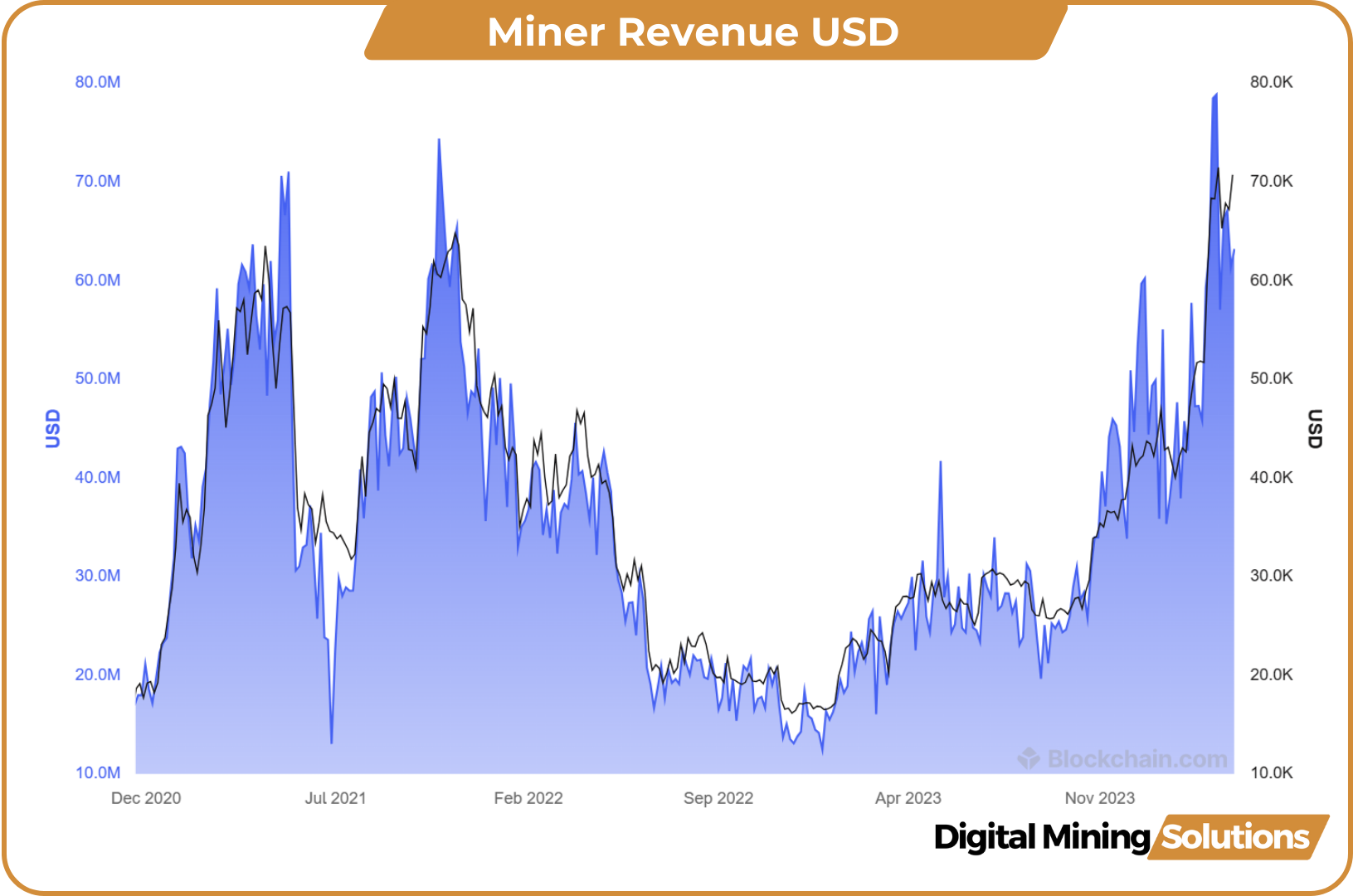

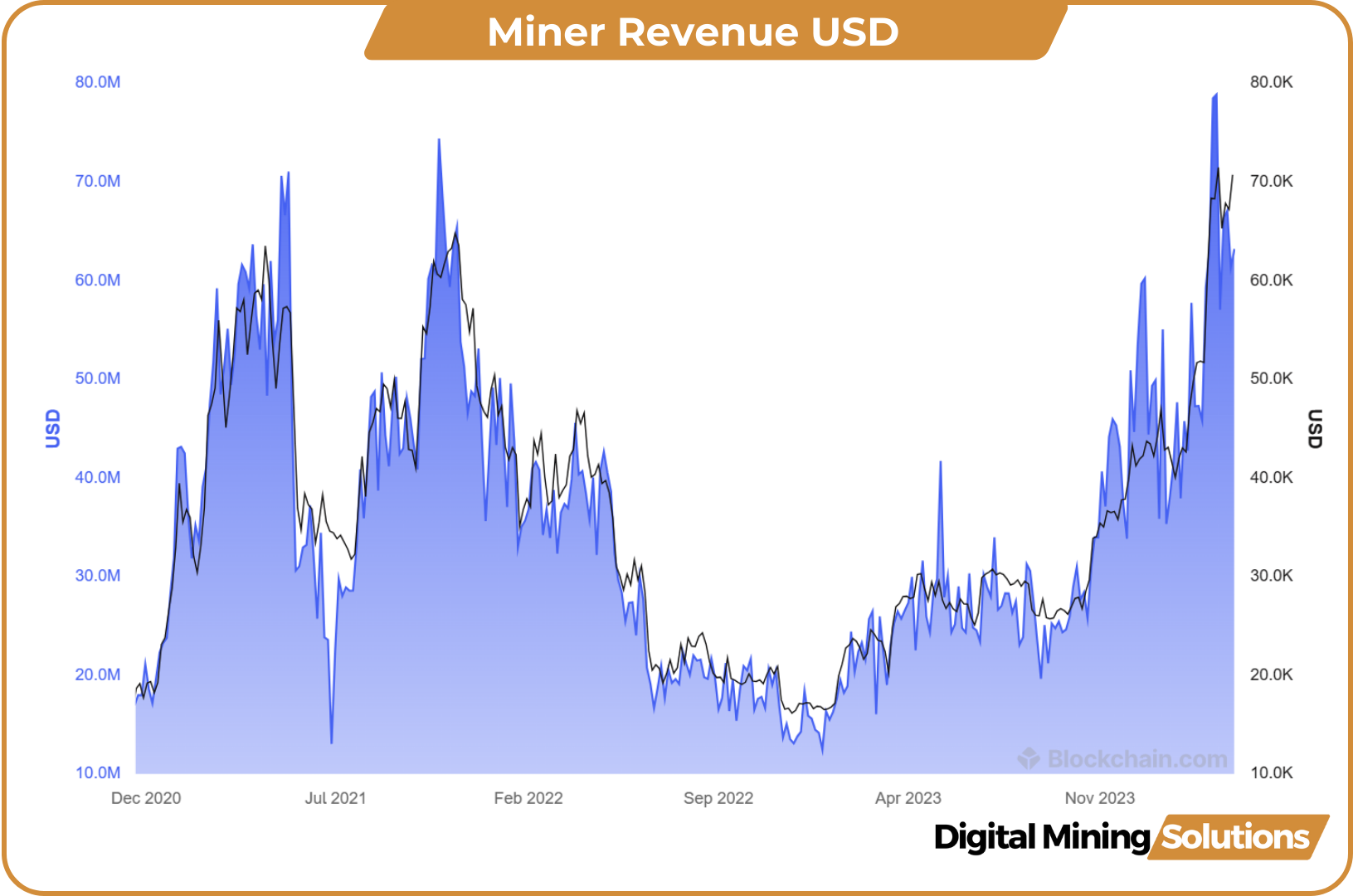

Daily Miner Revenue

Daily miner revenue represents the total value in USD of block rewards and transaction fees paid to miners. The year began at a high level of $50 million and closed the quarter at $63 million. On March 10th, a record high of almost $80 million was reached, surpassing the all-time high of $75 million seen at the peak of the 2021 bull market.

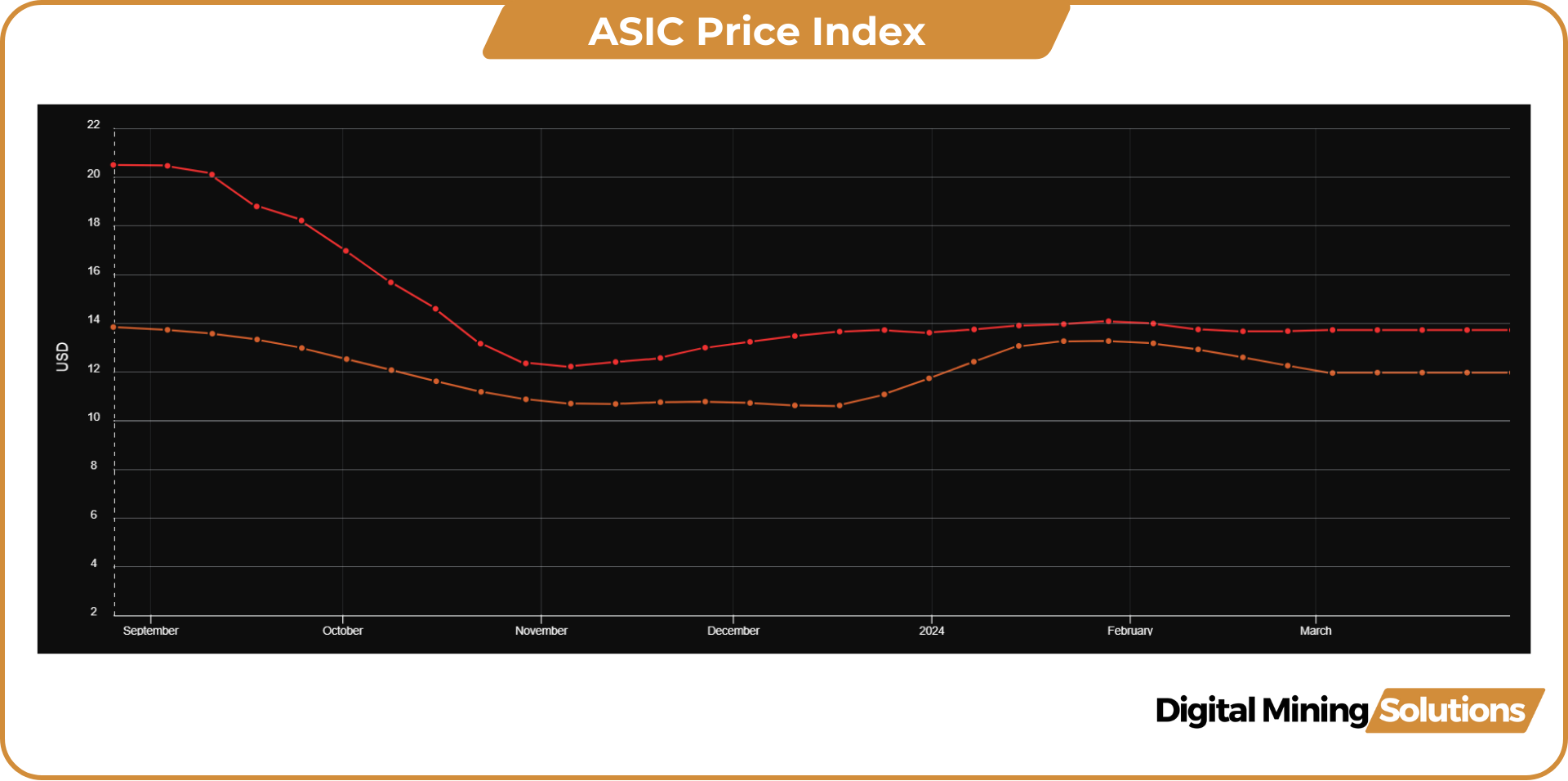

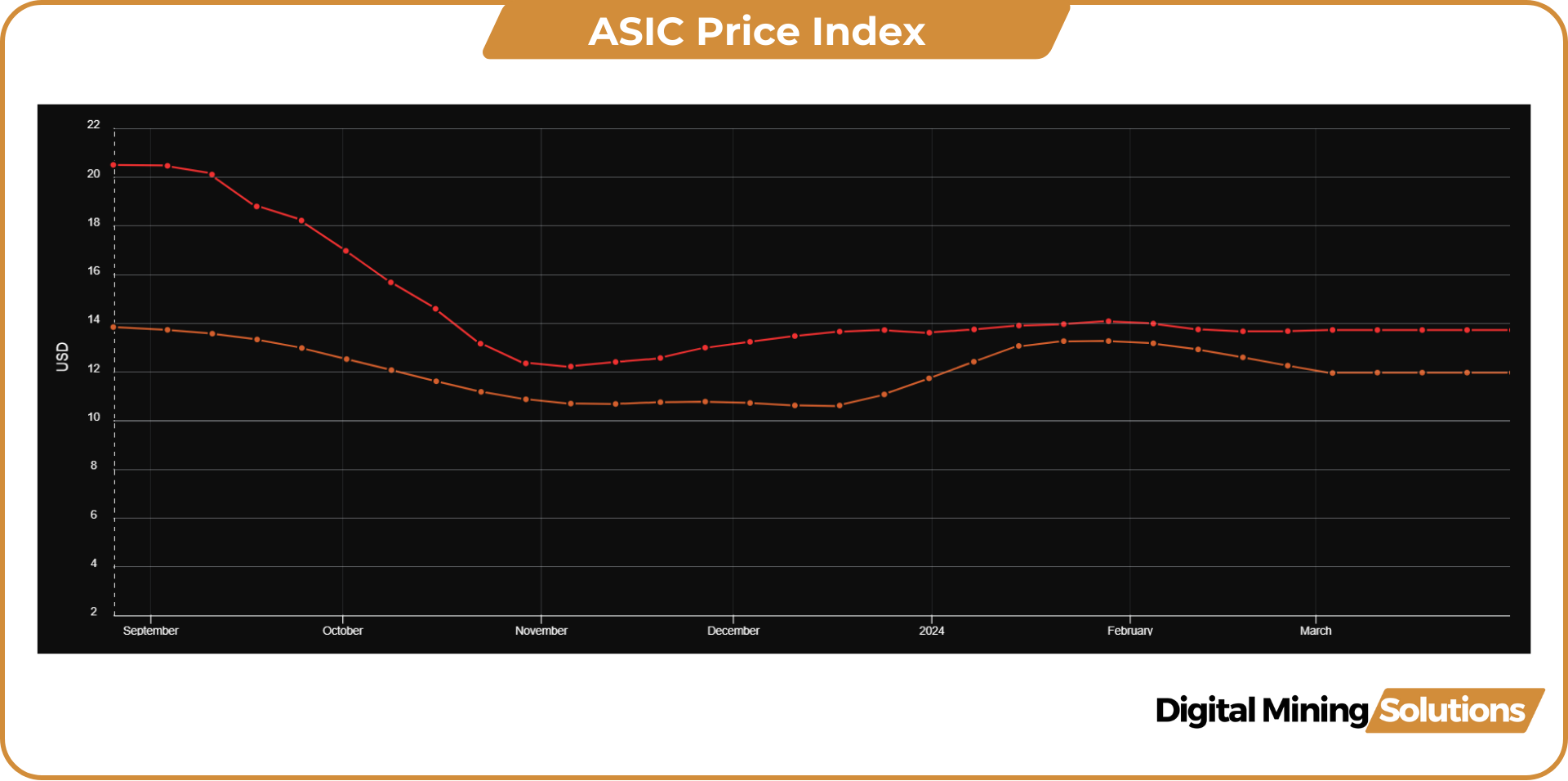

ASIC Prices

Despite the growth in network hashrate and the surge in BTC price driven by ETFs, ASIC hardware prices remained suppressed in Q1. Both the ASIC prices for miners in the range of 25 – 38 J/TH and those under 25 J/TH stayed above the record lows observed at the end of 2023, but not significantly so. Currently, miners seem to be adopting a “wait and see” approach as the halving event approaches. A survey conducted by ASIC Jungle among its customers confirms this sentiment, with 65% of respondents indicating they are postponing the purchase of new miners until after the halving.

Moreover, the premium for the next generation ASICs, compared to the previous generation, has also remained relatively small in the first quarter of the year. While the price difference was $20.92/TH at the beginning of 2023, this premium decreased to as low as $0.70/TH in January ‘24 and ended Q1 at $1.75/TH.

From 2020 to 2022, ASIC prices were highly correlated with BTC. However, starting in 2023, Bitcoin began to rise while ASIC prices continued to decline. This trend of decoupling between BTC and ASIC prices persisted in Q1 2024.

Biggest Headlines:

- On February 1st, it marked 11 years since the world’s first ASIC was plugged in, mining over 25 BTC per day! The “Avalon ASIC V1” entered the market, processing data at a speed of more than 65 gigahashes per second while consuming only 500 watts of electricity. This represented a roughly 50x increase in mining efficiency. While a typical desktop computer could mine only a few dollars of bitcoins per day, the Avalon ASIC V1, priced at $1500 (payable only with bitcoins), earned $200-$300 per day.

- Bitdeer introduced the SEAL01, a cutting-edge mining chip fabricated using 4-nanometer process technology. The SEAL01 chip boasts an impressive power efficiency ratio of 18.1 J/TH. Bitdeer is strategically incorporating this advanced chip into its upcoming mining rig, the SEALMINER A1. The company is gearing up for large-scale production of these mining rigs later this year.

- Bitmain unveiled the S21 Pro during the World Digital Mining Summit (WDMS) 2024 in Oman. The miner offers an output of 234TH/s and runs at 3531 Watts, translating to 15 J/T, a 14% efficiency increase compared to the S21 (17.5 J/T). Delivery is expected in Q3 2024.

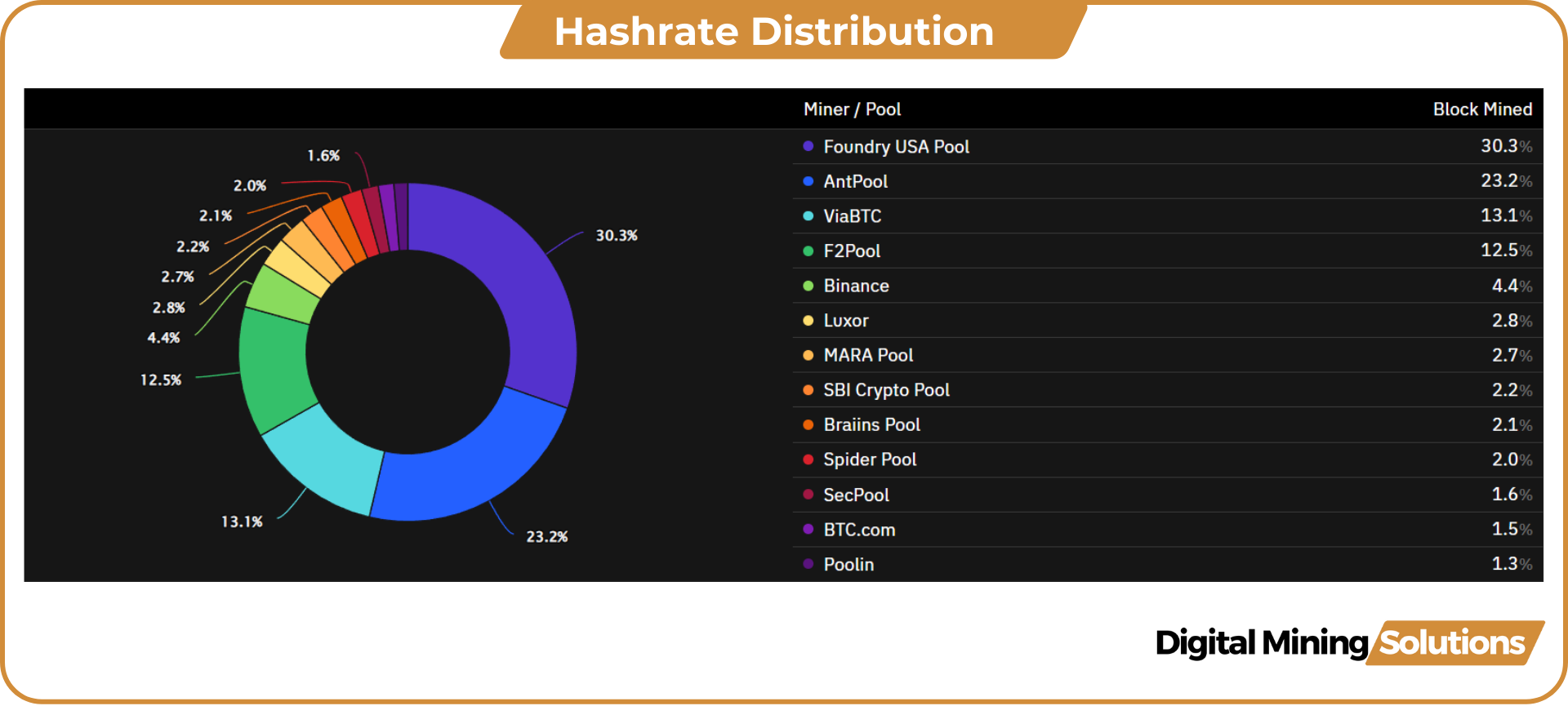

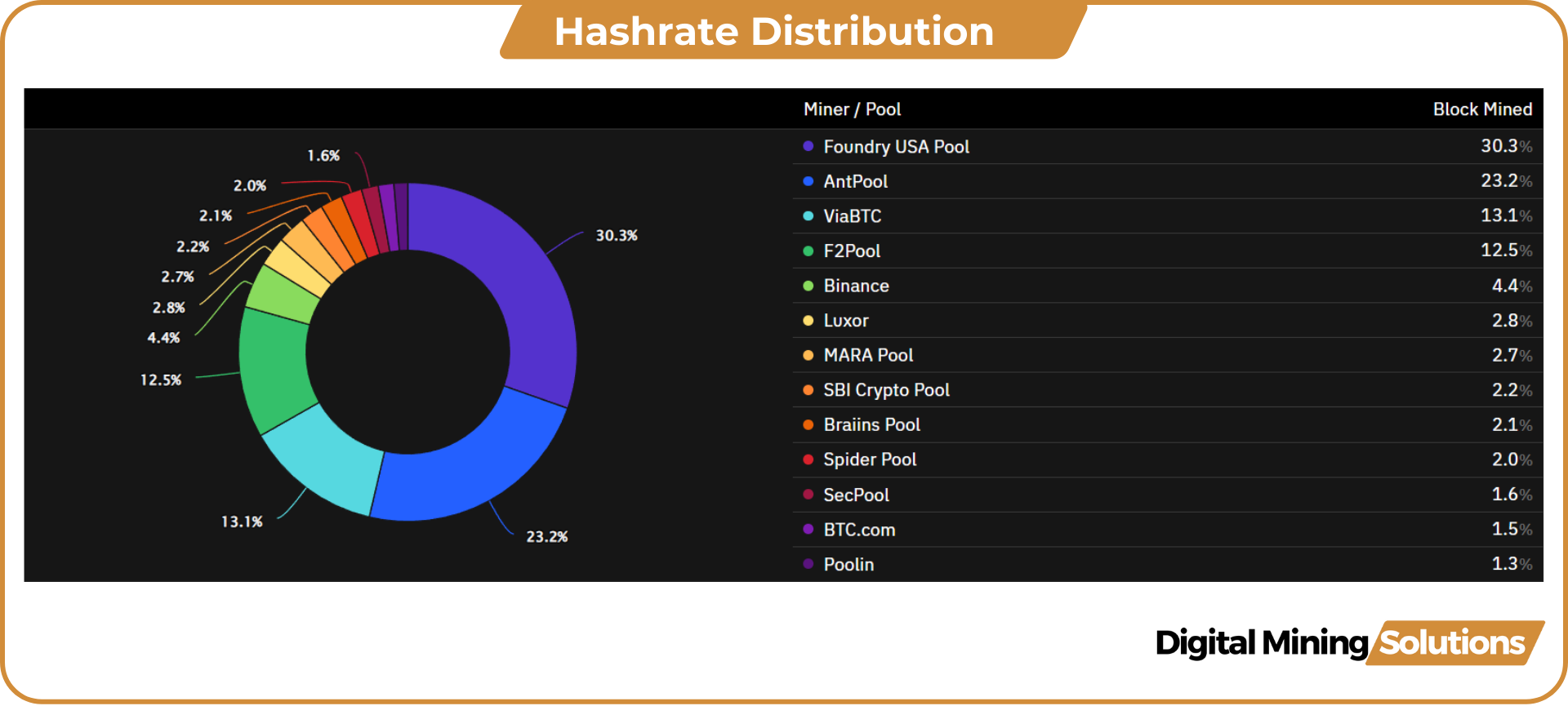

Mining Pools

During the first quarter of 2024, the top two pools, Foundry and Antpool, continued to dominate. The market share of Foundry USA remained practically the same. However, it’s interesting to note that Antpool started the year at 26.11% but has now decreased to 23.2% on the 5-week average. This figure drops even lower to 20.9% when looking at the 5-day average.

Foundry’s hashrate grew from 154.8 EH/s to 180.8 EH/s, adding 26 EH/s. In comparison, AntPool’s hashrate increased from 130.6 EH/s to 144 EH/s, adding approximately half of the hashrate compared to Foundry.

It appears that ViaBTC is the big winner of Q1. While starting the year in fourth position, ViaBTC has now claimed the third spot with a market share of 13.1%, surpassing F2Pool.

Biggest Headlines:

- Marathon Digital’s mining of the largest-ever Bitcoin block. This monumental achievement, accomplished through a collaboration between Marathon Digital’s Slipstream and OrdinalsBot, underscores the growing interest in innovative approaches to data inscription and distribution. The block, measuring an impressive 3,990.36 kilobytes, was mined on March 2nd.

- Braiins recently announced its groundbreaking move towards Lightning payouts, enabling miners to access their bitcoin rewards instantly with no minimums or fees. This decision to integrate the Lightning Network showcases Braiins’ deep understanding of the challenges faced by the mining community, particularly the hurdles encountered by small miners when withdrawing funds from pools.

- Marathon Digital shared details of block 836361, successfully mined on March 26th. The company marked the block with a prominent M, demonstrating its template building capabilities and technology stack. Each colored square in the block represents a transaction, with the visual effect achieved by incorporating different fees in each transaction. Notably, all transactions were for 0 BTC, and the fees paid for each square were: green = $0.08; orange = $11.21; maroon = $149.46. While the total fees paid amounted to $122,542, it’s worth noting that Marathon Digital paid these fees to itself.