Paraguay’s abundant and inexpensive hydroelectric power makes it an attractive location for Bitcoin mining, attracting significant industry growth in recent years and hosting major players like Bitfarms and Marathon Digital. However, the rise of illegal crypto mining operations, which have led to power theft and disruptions in the electricity supply, has prompted lawmakers to consider a bill proposing a temporary ban on crypto mining and related activities.

It’s essential to recognize that simply prohibiting formalized miners may not effectively halt illegal operations. Additionally, implementing a 180-day ban could lead to substantial revenue loss for the state. Let’s delve deeper into the mining landscape in Paraguay and explore the potential ramifications of such a temporary ban.

Paraguay, a Renewable Rich Country

Regulatory Bodies

680 MW of Crypto Mining

Not a Complete Picture

Pending Requests for 2 GW

Bitfarms & Marathon Digital

Illegal Mining Activities

Bill to Temporarily Ban Mining

A Hundred Million Dollar Mistake

What’s Next?

Paraguay, a Renewable Rich Country

Paraguay generates 100% of its electricity from renewable sources, with 99.9% coming from hydroelectric projects. The Itaipu Dam accounts for 7,000 MW (86%) of Paraguay’s generation, while Yacyretá, the second-largest hydroelectric facility, produces 900 MW (11%), and Acaray has an installed capacity of 210 MW (3%).

Ranked second globally after the Three Gorges Dam in central China, the Itaipu Dam’s hydroelectric power plant is the world’s most prolific electricity producer. With an installed generation capacity of 14 GW, it boasts 20 turbines generating 700 MW each. Situated on the Paraná River, the Itaipu hydroelectric dam is jointly owned (50/50) and operated by Paraguay and Brazil.

Regulatory Bodies

Permitting and regulation of energy projects are overseen by the Vice Ministry of Mines and Energy. ANDE (Administración Nacional de Electricidad) is the state-owned entity responsible for the generation, transmission, and distribution of electricity. ANDE primarily purchases power from two hydroelectric dams: Itaipú and Yacyretá.

Villarrica is home of a private energy company, CLYFSA. While other local electricity suppliers once existed, they were nationalized in 1948 to establish ANDE. In a legal dispute following ANDE’s widespread increase in energy prices across the country, CLYFSA emerged victorious. Consequently, CLYFSA still procures electricity from ANDE at an older, presumably more favorable rate. This arrangement enables CLYFSA to offer miners a competitive rate of $0.016 per kWh.

680 MW of Crypto Mining

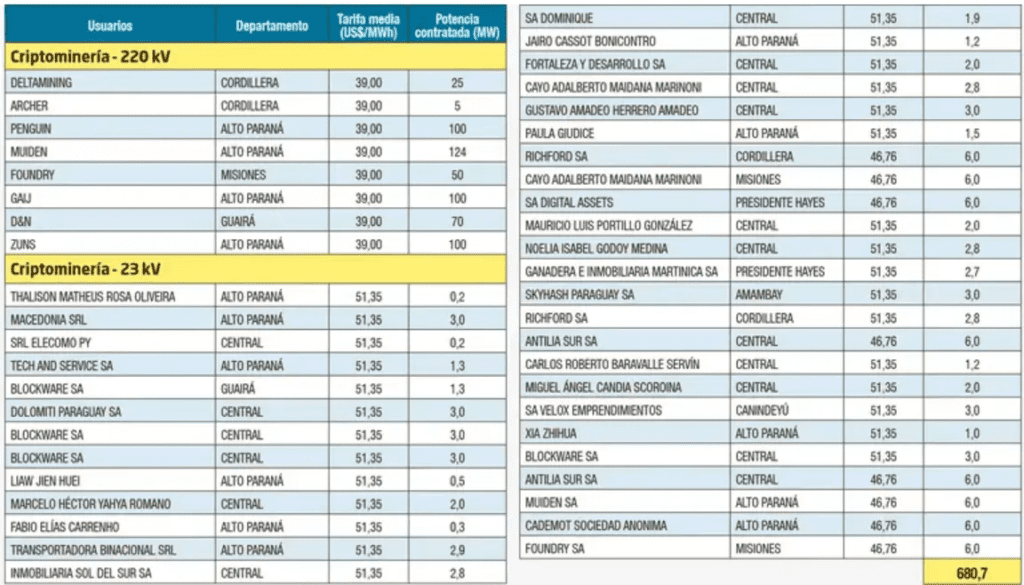

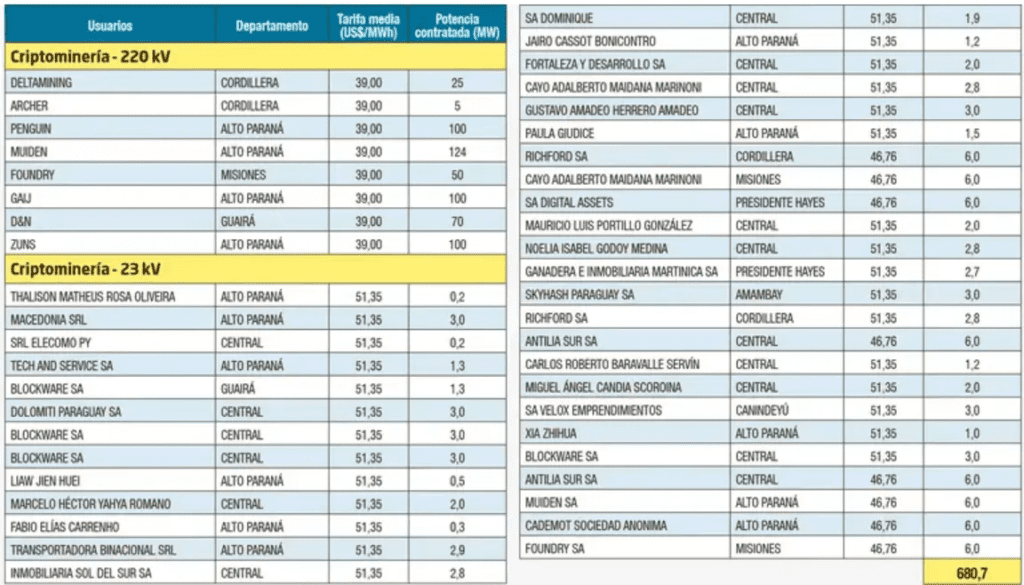

According to data from ANDE, there are 45 companies engaged in legal mining activities. Among these, 37 miners are connected to medium tension (23 kV), while 8 are connected to high tension (220 kV). Collectively, these miners represent a total capacity of 680.7 MW, nearly equivalent to the output of a single 700 MW turbine at the Itaipu Dam. The majority of these mining operations are situated in the Central (17) and Alto Paraná (15) departments, the latter located in close proximity to the Itaipu Dam.

Not a Complete Picture

The mining industry in Paraguay is actually larger than the data suggests. The figures provided do not include contracts miners have with CLYFSA, a significant player in the energy market. Apart from the known 10 MW contracted by Bitfarms, there are likely other miners with agreements with CLYFSA, although these contracts are not publicly documented. Additionally, the actual scale of mining in Paraguay exceeds ANDE’s reports due to unaccounted illegal mining activities.

Pending Requests for 2 GW

There are currently 20 pending requests from miners, totaling 2,000 MW. Paraguay sells energy locally to miners at $39-51 per MWh, significantly higher than the $10 per MWh rate offered to neighboring Brazil. The Paraguayan government is leveraging these pending requests for 2,000 MW to negotiate better prices for selling power to Brazil.

Bitfarms & Marathon Digital

Notable players like Bitfarms and Marathon Digital do not appear in the provided overview. Bitfarms operates a 70 MW facility in Paso Pe, registered under D&N in the department of Guairá. Bitfarms its new 100 MW facility in Yguazu, located in Alto Paraná, is registred under ZUNS. Marathon Digital’s 27 MW mining project is managed by the Penguin Group.

Illegal Mining Activities

Illegal mining activities present a significant challenge in Paraguay, particularly in Alto Paraná, where ANDE estimates annual losses of approximately $60 million due to crypto mining operations conducted without proper authorization. Since February alone, the region has experienced 50 instances of power supply interruptions linked to these illegal mining operations.

However, the issue extends beyond power theft. According to ING Nelson Cristaldo, there are allegations of complicity within ANDE itself. ANDE officials are accused of accepting bribes amounting to $3,000 USD for every MW used by illegal miners, effectively turning a blind eye to their activities. This pervasive corruption within ANDE must be addressed as a matter of urgency.

Bill to Temporarily Ban Mining

Illegal mining operations, which have been responsible for power theft and disruptions to the electricity supply, have prompted lawmakers to propose a bill aimed at temporarily banning crypto mining and related activities.

The draft law, introduced on April 4, seeks to prohibit “the installation of crypto mining farms” as well as “the creation, conservation, storage, and commercialization” of cryptocurrencies. The proposed ban would last for 180 days or until a comprehensive law is enacted, and power grid operator ANDE assures that it can adequately supply energy to miners without adversely affecting other users of Paraguay’s electrical system.

The fate of the temporary ban remains uncertain. Notably, some of the owners of these formal contracts are influential families with significant political connections, indicating potential resistance to the bill. However, it’s worth noting that not all government officials are opposed to miners. The Minister of Industry and Commerce has supported the proposal to sell excess energy to miners instead of exporting it to Brazil, suggesting a nuanced approach within the government regarding mining activities.

A Hundred Million Dollar Mistake

Prohibiting formalized miners may not effectively stop illegal operations. Furthermore, implementing a 180-day ban would result in a substantial loss of income for the state, as ANDE would be unable to charge formal miners for their usage of the 680 MW.

Under the existing contracts, 574 MW of formal mining operations are charged at $39 per MWh, while 48 MW are charged at $46.76 per MWh, and 58.7 MW are charged at $51.53 per MWh. If all miners were to operate at 100% uptime for 180 days, ANDE would potentially miss out on revenue totaling $119,470,857. Even with an 85% uptime, the government’s opportunity cost would still exceed a hundred million dollars.

Furthermore, the Ministry of Economy collects over $15 million annually in VAT payments for energy, and the state received $68 million in import taxes from 2020 to 2023 due to the entry of mining machines.

What’s Next?

Paraguay is one of the few countries worldwide with almost 100% hydroelectric generation capacity which makes it an attractive place in Latin America for Bitcoin miners. The country has the unique opportunity to stop giving away energy to Brazil for next to nothing. However, achieving this goal the government will need to collaborate with miners to combat corruption and power theft effectively.

The proposal poses a threat to the development of the Bitcoin mining ecosystem in Paraguay. However, the bill must pass through three additional levels within Congress before reaching the president’s desk. This isn’t the first time the legislature has attempted to pass a law to regulate crypto-related activities in the country. In 2022, the Paraguayan Congress rejected a similar proposal. The Congress abandoned the proposed law after failing to secure enough votes to override the veto it received from President Mario Abdo Benítez earlier that year.