MicroStrategy’s Michael Saylor predicts that Bitcoin could potentially reach $5 million, while Cathie Wood’s Ark Invest suggests it could exceed $1 million by 2030. Fundstrat’s Tom Lee has unveiled a $150,000 Bitcoin price target for 2024. These bullish forecasts from prominent figures all point to one common factor: the Halving.

But how exactly does the halving work, and has this event always triggered price appreciation? Moreover, when the block subsidy is cut in half, how does it impact the miners? In this article, we will delve into these topics, exploring the mechanics of the halving and examining how price, hashrate, and miner revenues have been affected in previous cycles. Will we witness another significant mining capitulation, or will this time be different? Let’s find out…

-

- What is the Halving?

- Next Halving Estimated End of April

- How does the Halving Impact Bitcoin Price?

- Will Miners Capitulate Again in 2024?

- The Impact on Mining Revenue

- 5 Reasons Why This Time It’s Different

What is the Halving?

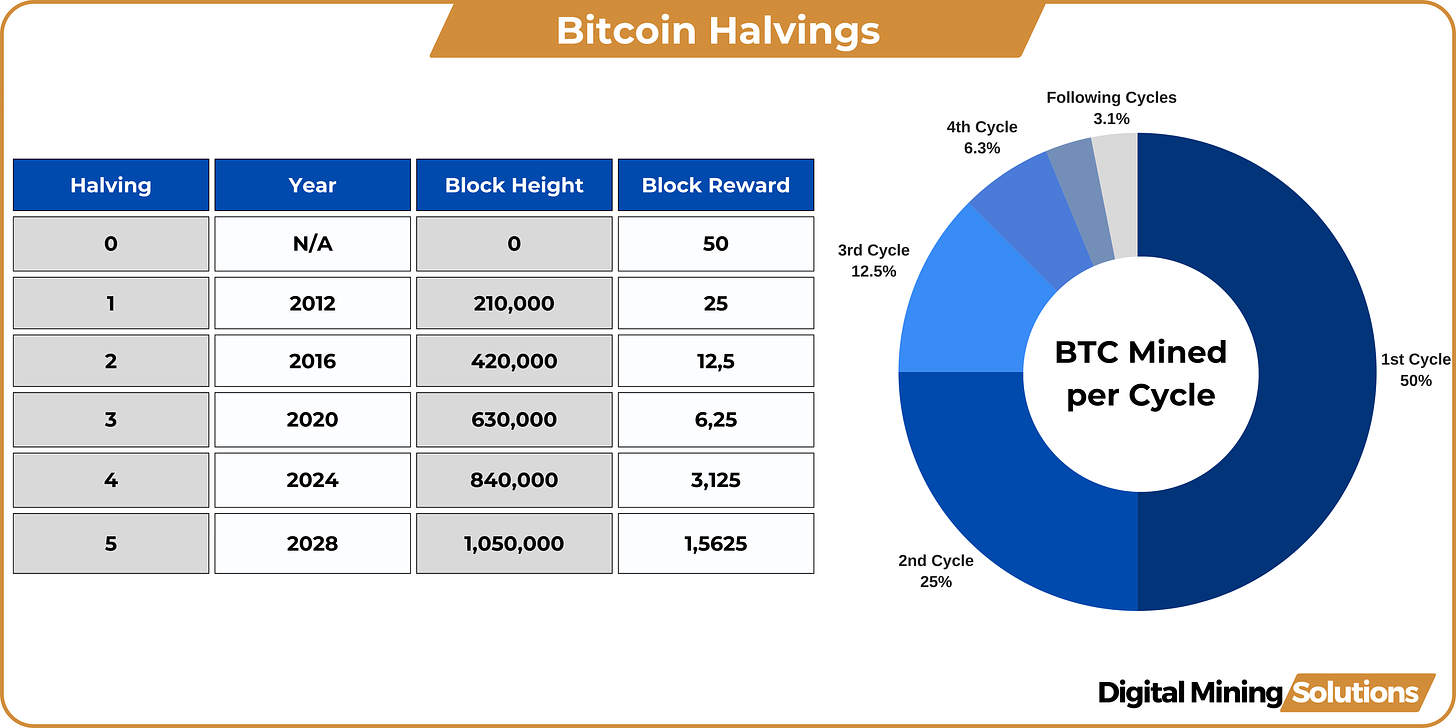

The Bitcoin halving is an event that takes place exactly every 210,000 blocks, which equates to roughly four years. It marks a programmed reduction in the subsidy awarded to miners for validating transactions and generating new blocks on the network.

At the launch of the Bitcoin network in 2009, miners were rewarded with 50 BTC for each block they validated. Subsequently, in 2012, the first Bitcoin halving occurred, reducing the block subsidy to 25 BTC. Another halving took place in 2016, further reducing the block subsidy to 12.5 BTC. The most recent halving, in May 2020, decreased the subsidy to 6.25 BTC.

In total, there will be 32 Bitcoin halving events. After that point, no more Bitcoin will be created, as the maximum supply will have been reached. The last Bitcoin is projected to be mined around the year 2140. At that stage, miner revenue will rely solely on transaction fees.

Next Halving Estimated End of April

The next halving is estimated to occur by the end of April 2024. The exact timing of the halving event depends on the speed of block production, which is influenced by the amount of computing power (hashrate) added to or removed from the network. As more machines join the network, blocks are solved more quickly, which can bring the halving event forward.

The difficulty of mining adjusts every epoch, or every 2,016 blocks (approximately every two weeks), to maintain a consistent block time and limit the movement of the halving dates. Various Bitcoin halving countdown clocks are available to track the expected day and time of the halving. Closer to the halving the estimation of the actual date is becoming increasingly precise.

How does the Halving Impact Bitcoin Price?

The impact of the halving event on Bitcoin’s price is a topic of frequent discussion among Bitcoin enthusiasts. Some argue that the halving is already priced into the market, meaning that investors and traders anticipate the event and adjust their strategies accordingly. On the other hand, others believe that the decrease in the supply of new Bitcoin, coupled with constant or increasing demand, can lead to an increase in price, following the principle of price equilibrium.

Looking back at the last three halvings, we observe that each event served as a catalyst for significant price movements. For instance, during the 2020 halving, Bitcoin was trading around $8,600, after which it experienced a remarkable surge, reaching an all-time high of $68,000. This represented an impressive 691% increase in price following the halving event.

While previous halvings have indeed been followed by surges to new price highs, it’s important to note that this upward movement has typically occurred with a delay. For instance, after the 2020 halving, it took approximately 194 days for Bitcoin to reach its all-time high level of around $19,750, which was attained on December 17, 2017. Interestingly, the time it took to achieve new record price levels shortened with each successive halving event. With current price action BTC is now around the ATH which is something Bitcoin did not experience in previous cycles.

The last two halvings, it took approximately 525 and 547 days (equivalent to 17 to 18 months) before the price of Bitcoin reached the peak of the bull market. Therefore, if the upcoming halving occurs at the end of April, and we extrapolate from past trends, we might anticipate reaching the peak of the next bull market around September or October 2025.

Will Miners Capitulate Again in 2024?

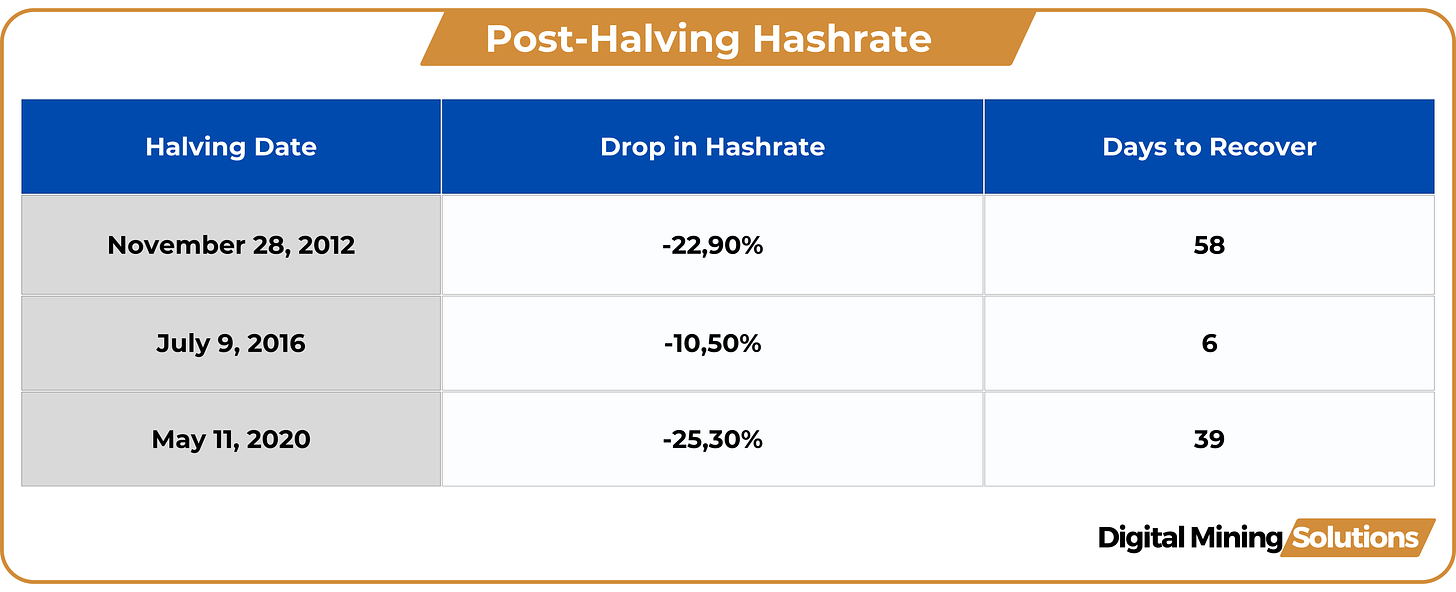

The reduction in the block subsidy, coupled with the lag in Bitcoin price appreciation following halving events, has significant implications for the mining industry. Historically, each halving has led to a decline in hashrate, indicating that miners are forced to take machines offline as they become unprofitable to operate.

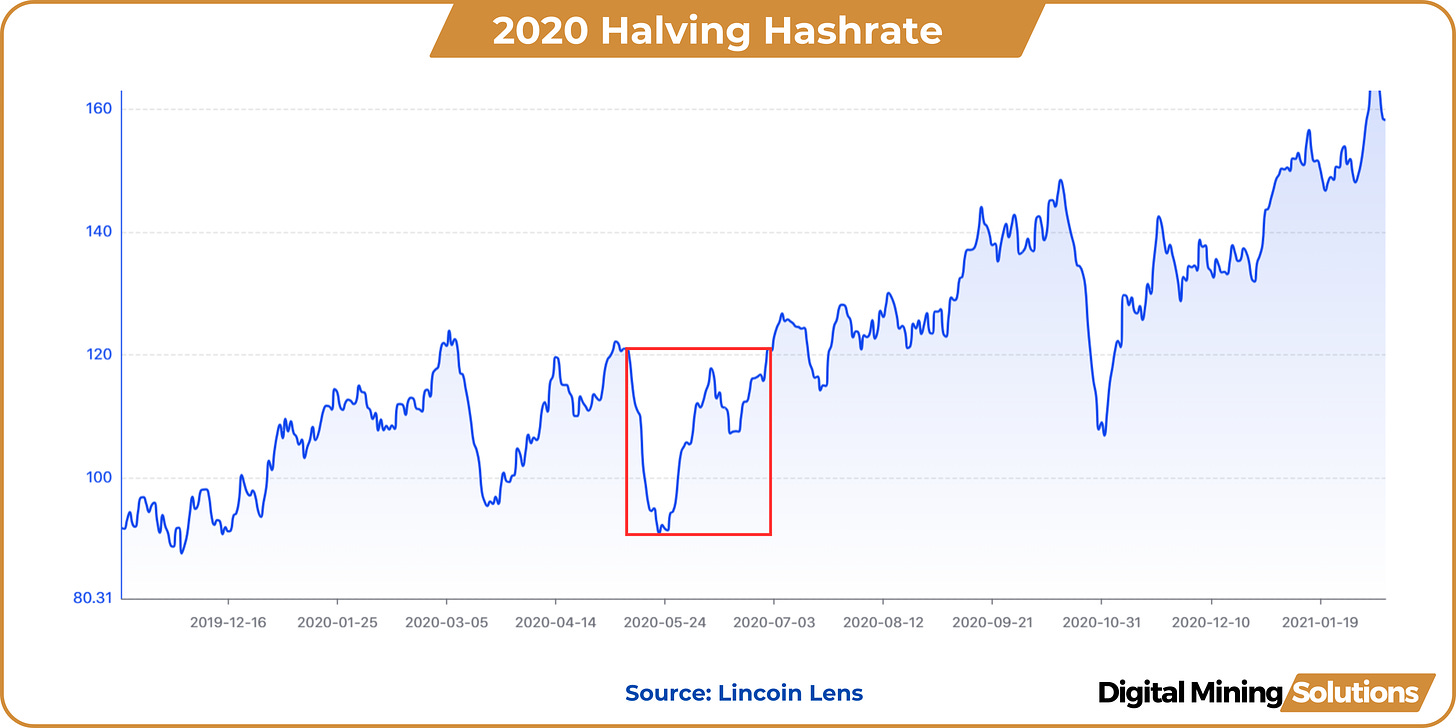

For instance, following the last halving in May 2020, there was a notable drop in hashrate. In just 11 days, the hashrate 7-day moving average, experienced a decrease of approximately 25.30%.

Historical data suggests that hashrate tends to recover to previous levels relatively quickly following halving events. For instance, in 2020, it took approximately 39 days for hashrate to rebound, and in 2016, the recovery occurred even more swiftly.

Considering the upcoming halving, it’s reasonable to anticipate a similar response in hashrate. However, it’s important to note the substantial growth in the size of the network since the last halving. Currently network’s hashrate is approximately 560 EH/s, a significant increase from ~120 EH/s leading up to the 2020 halving.

Given these figures, a 25% drop in hashrate would translate to approximately 140 EH/s coming offline. To put this into perspective, this would be equivalent to approximately 1.4 million Antminer S19J Pro 100TH machines coming offline.

The Impact on Mining Revenue

Hashprice serves as a crucial metric for miners, indicating the expected earnings in USD ($) per Petahash (PH/s) of computing power per day. It’s influenced by Bitcoin price, network difficulty, block subsidy, and transaction fees.

Unsurprisingly, the halving has a significant impact on hashprice, primarily due to the halving of the block subsidy. Following the 2020 halving, hashprice experienced a notable decline, dropping from $160/PH/Day to $73/PH/Day, representing a decrease of 54%. Subsequently, hashprice remained at a lower level for approximately six months. However, it rebounded to pre-halving levels once Bitcoin price surged to new all-time highs towards the end of 2020. Throughout much of the 2021 bull market, hashprice remained elevated, reaching peaks as high as $422/PH/Day.

If historical patterns repeat themselves, miners should brace for a period of narrow profit margins following the 2024 halving. Currently, hashprice stands at approximately $110/PH/Day. In a scenario where transaction fees are minimal and Bitcoin price and hashrate remain unchanged, hashprice could plummet to around $50/PH/Day.

Surviving these challenging months will be pivotal for miners, positioning themselves to capitalize on the opportunity should Bitcoin experience a parabolic surge, as seen in previous halving cycles.

5 Reasons Why This Time It’s Different

While historical data is useful for projections, past performance is not indicative of future results. Here are five reasons why this time might be different in the context of Bitcoin halving:

-

- Increased Demand from ETFs: The emergence of ETFs has significantly increased demand for Bitcoin. On the first of March EFTs were holding 769,643 BTC. In February there were days when ETFs purchased more than 10,000 Bitcoin per day (net – inclusive of $GBTC outflows). While daily production is expected to halve to 450 BTC after the halving, this heightened demand is leading to faster price appreciation. ETFs may also leverage the halving as a selling point, attracting more institutional investors who are still evaluating various offerings.

-

- Refinancing Running Operations: Despite several mining companies facing bankruptcy during the 2020 bear market, many of them kept their rigs operational while undergoing refinancing or acquisitions. A similar scenario post-halving might play out which reduces the impact of bankruptcies on network hashrate.

- Miners Operating at a Loss: Some miners may choose to continue operating at a loss post-halving, anticipating better margins in the future due to expected price appreciation. Factors such as contractual obligations with power provider, tax considerations, and the potential impact on share prices for publicly traded companies may incentivize miners to endure temporary losses.

- Dynamic Mining Strategies: Miners have become more sophisticated, employing techniques such as running machines at low-power mode to enhance efficiency. This adaptability allows miners to maintain profitability even in challenging market conditions, mitigating the need to shut down operations entirely.

- Potential Spikes in Transaction Fees: In 2023 transaction fees spiked a couple of times because of ordinal inscriptions competing for block space. The uniqueness of the first blocks post-halving could further elevate transaction fees as users compete for block space. Miners may be incentivized to add hashrate, even at a potential loss, to increase their chances of mining these unique blocks and capturing the associated transaction fees and unique sats.

These factors collectively suggest that the dynamics surrounding the upcoming halving may diverge from previous cycles.