In the first 12 weeks of 2024, there was a remarkable 25% increase in network hashrate. Yet, amidst this surge, ASIC hardware prices remain suppressed and are seemingly out of sync with Bitcoin’s bullish price trajectory. What lies beneath this apparent contradiction? Delving into the depths of the ASIC market, we’ll have a close look at the subdued premiums on the latest generation machines and what impact the halving event will have on the profitability of mining equipment. In this exploration, we will look into the following aspects of the ASIC mining hardware market:

Continued De-Coupling of BTC and ASIC Prices

More Hashrate Purchasing Power Compared to Previous ATH

Premium on Next-Gen ASICs Stays Small

Improved Margins Makes Network Less Efficient

Break-even Hashcost Pre- vs. Post-Halving

Break-even Hashprice

Post-Halving Outlook

ASIC Miner Prices Stay Suppressed in Q2

Correlation and Premium Will Return

Biggest Headline

Continued De-Coupling of BTC and ASIC Prices

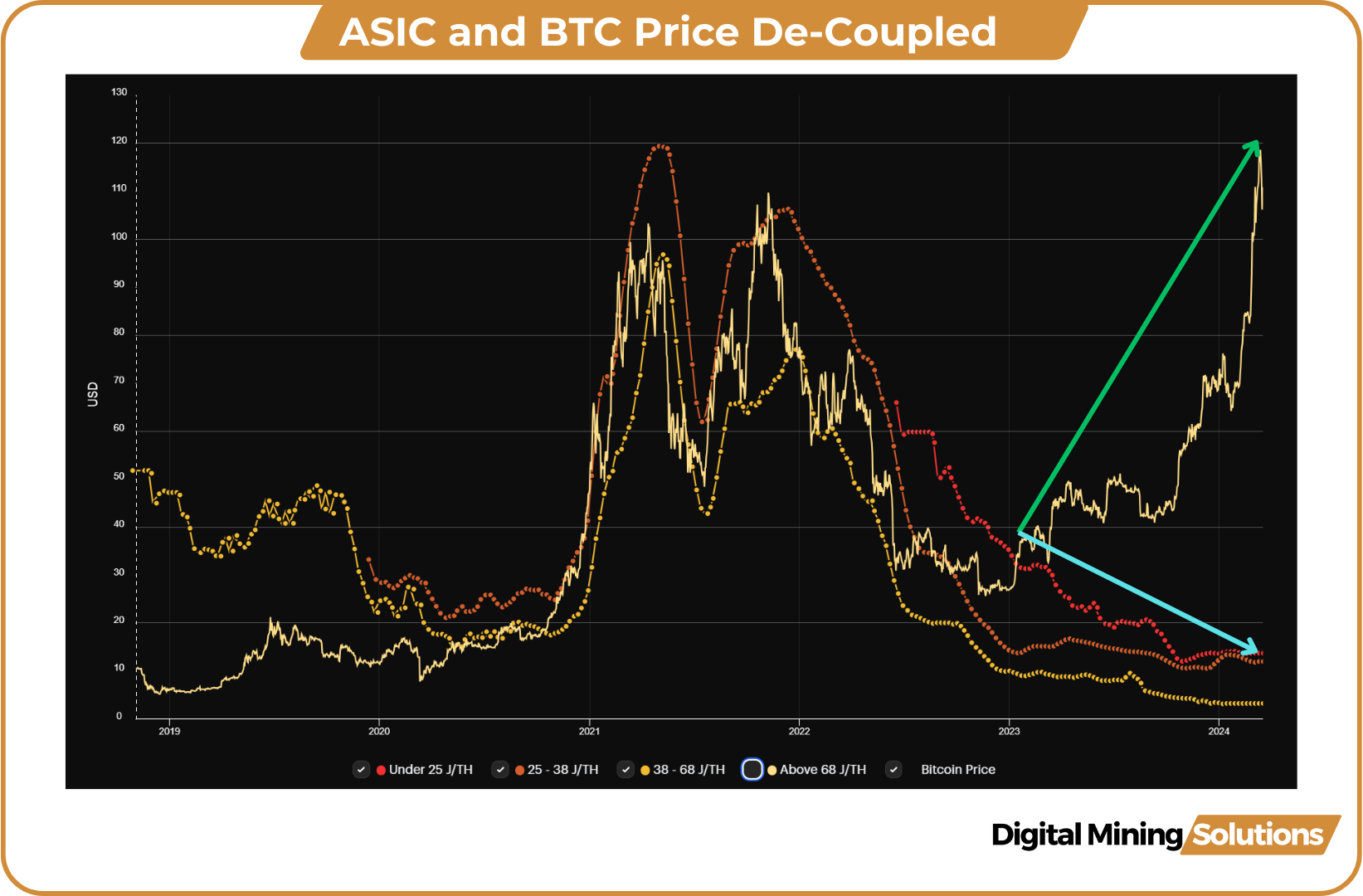

During the period 2020–2022, ASIC prices were highly correlated with BTC. However, starting in 2023, Bitcoin began to rise while ASIC prices continued to decline. The primary factors contributing to the breaking of this correlation with the Bitcoin price were a substantial influx of machine supply into U.S. secondary markets. This increase can be attributed to defaults on equipment loans, asset sales, and corporate bankruptcies.

The trend of decoupled prices continued in the first months of 2024. The approval of ETFs caused an inflow of over 830,000 BTC, which has been one of the major forces driving the surge in Bitcoin price. BTC surged to a record high of $73,600, marking an impressive 75% increase since the beginning of the year. ASIC prices, on the other hand, remained virtually unchanged.

More Hashrate Purchasing Power Compared to Previous ATH

In early March 2024, Bitcoin reached a new all-time high. At that moment, hardware with efficiency ranging from 25 to 38 J/TH was priced at $12/TH. When these record price levels were reached in November 2021, the same generation of hardware was sold for $105/TH. A budget of $100,000 would have allowed you to purchase 9 units of S19J Pro’s 100TH/s in November 2021. With that same amount now, you could acquire 83 of these 100TH machines. This translates to a fleet of 900 TH/s then compared to 8,300 TH/s now.

Premium on Next-Gen ASICs Stays Small

In 2022, the next-generation machines, mostly Antminers S19 XP’s, were selling at a significant premium compared to older models. The primary reason was that the most efficient machines were seen as protection against potential downturns in the market. With uncertainty about the duration and severity of a bear market, miners were willing to pay more to increase their resilience to possible further price declines.

The premium for the next generation, compared to the previous generation ASICs, was $20.92/TH at the beginning of 2023. This price difference narrowed to $1.38/TH by the end of 2023. In January, this premium was reduced to $0.70/TH and currently stands at $1.75/TH. The reason for this reduced premium is mainly because machines with efficiency below 25 J/TH, such as the Antminer S19XP’s, are now widely available. Additionally, manufacturers began delivering ASIC miners with efficiency below 20 J/TH in Q1 of this year.

Improved Margins Makes Network Less Efficient

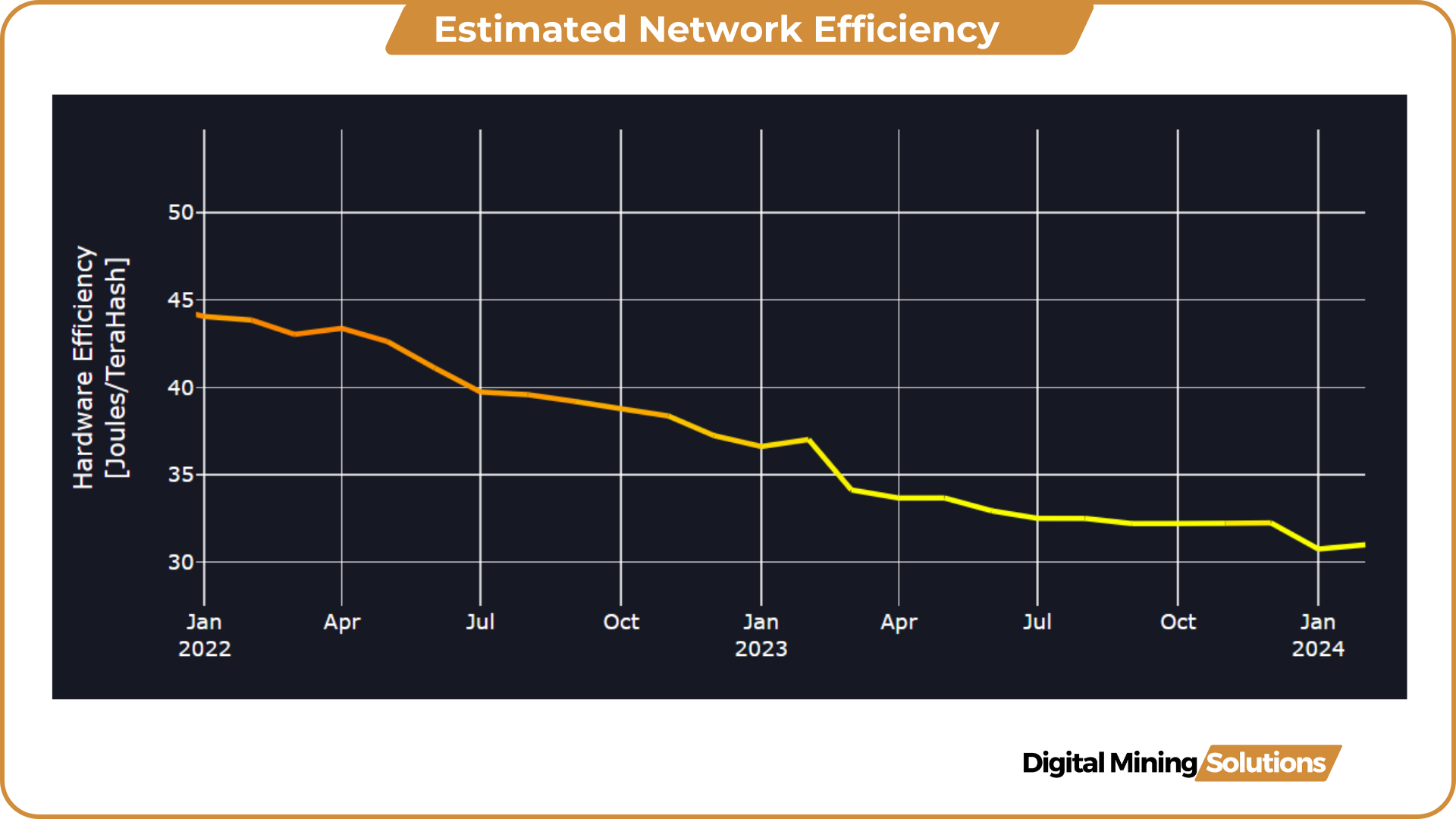

The surge in Bitcoin price has resulted in an increase in hashprice. Despite a 16.6% difficulty increase year-to-date, the hashprice rose from $81/PH/Day at the beginning of the year to a yearly high of $120/PH/Day.

These improved margins have led to less efficient miners staying online or even being switched on again. This is reflected in the average efficiency of the network. Despite the continued deployment of the latest-generation machines (sub 20 J/TH) by the major (public) miners, the average network efficiency saw a slight uptick from 30.75 J/TH to 30.9 J/TH in the first month of the year.

Break-even Hashcost Pre- vs. Post-Halving

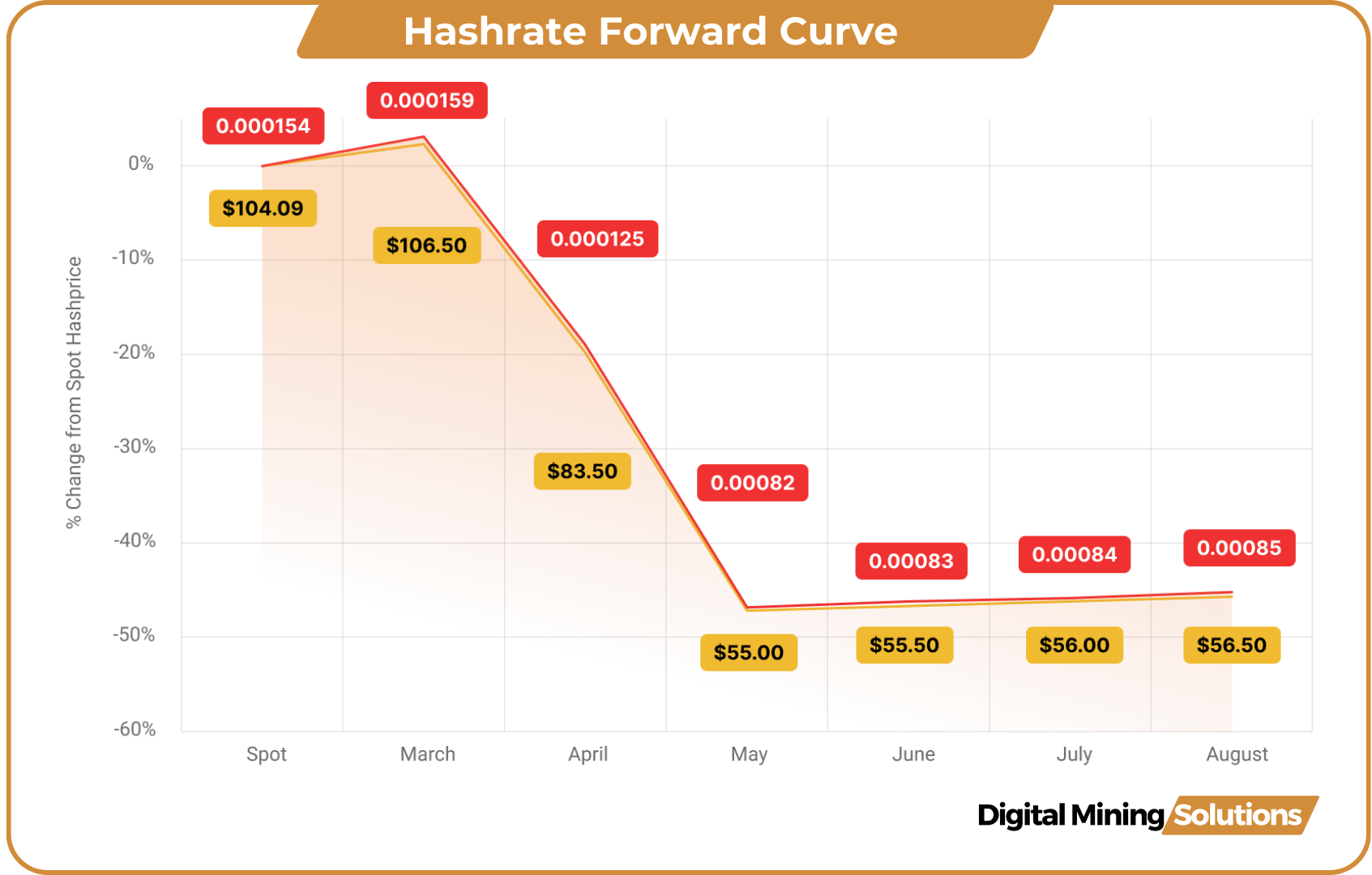

Currently, the hashprice is sitting at $104/PH/Day. Considering the Luxor Hashrate Forward Curve as an indicator, we can observe that the market anticipates a hashprice of $55/PH/Day post-halving.

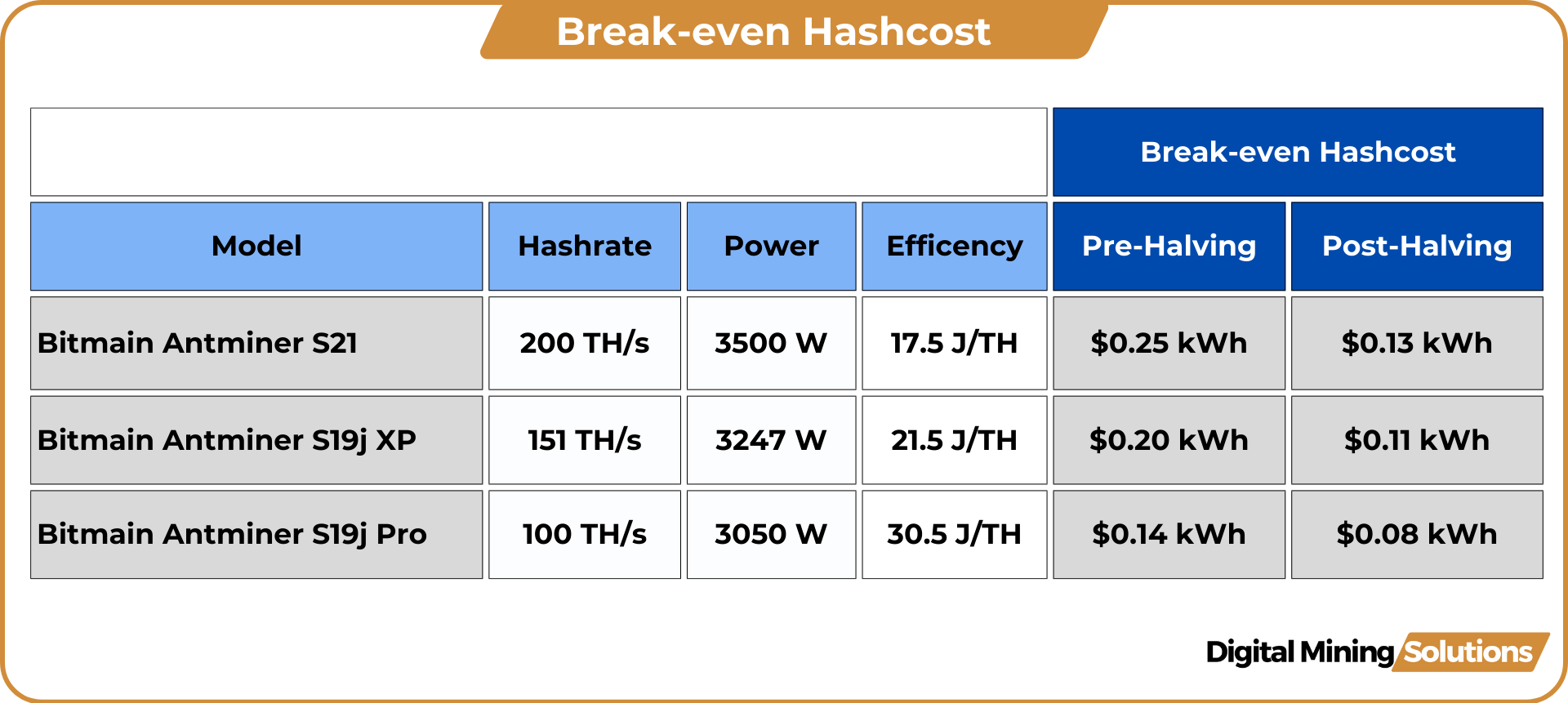

Given the current hashprice of $104/PH/Day and the post-halving hash price of $55/PH/Day, we can calculate the break-even hash cost as shown in the table below.

- Hashcosts are the overall costs of a mining operation (electricity, SG&A, lease, depreciation etc.) per day. If you are using hosting services, this is typically referred to as hosting service fee.

At the hashprice of $55/PH/Day, machines with an efficiency similar to the average network efficiency (30.5 J/TH) remain profitable post-halving as long as the hashcost stays below $0.08 per kilowatt-hour (kWh).

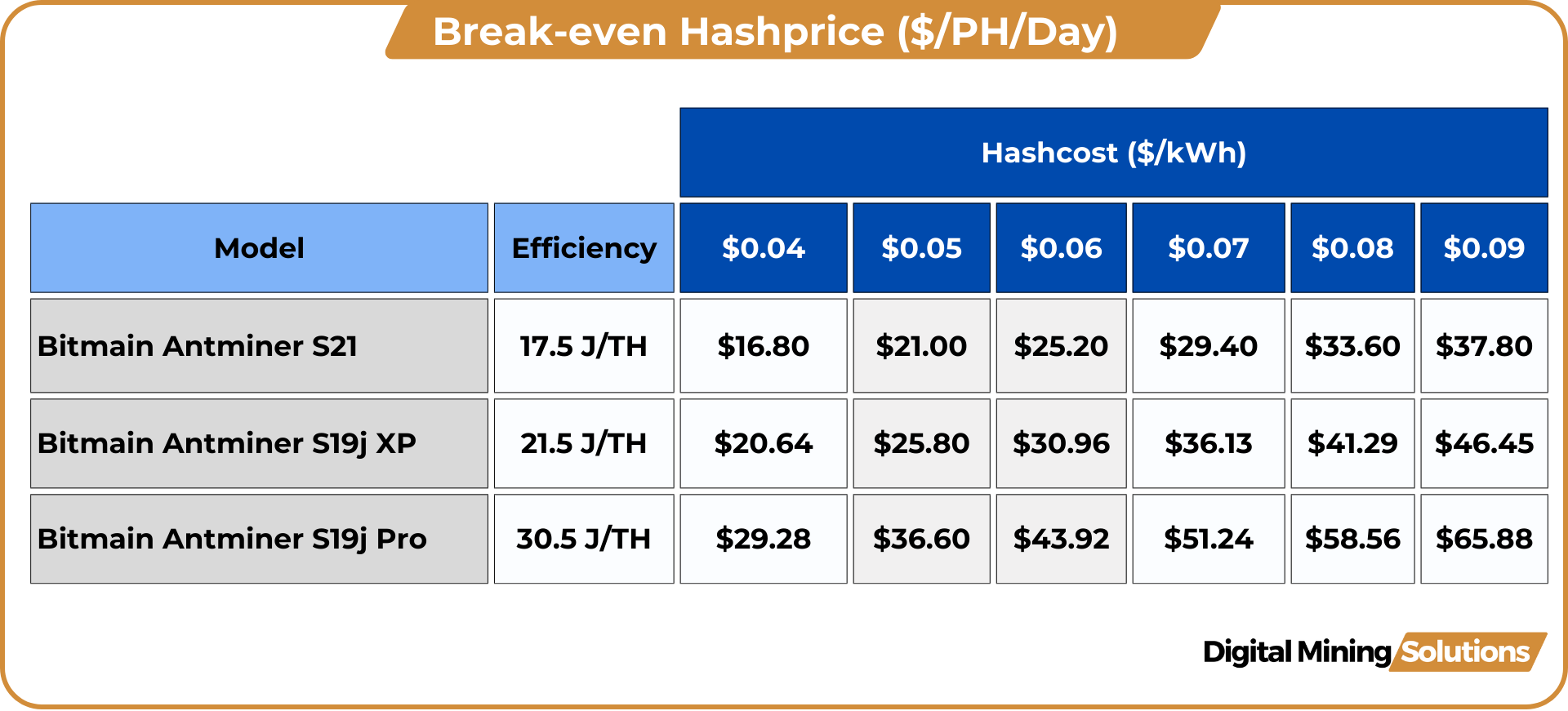

Break-even Hashprice

When calculating the break-even hashprice for the same three models, it can be concluded that all equipment will be running at a profit up to a hashcost of $0.09 kWh, as long as the hash price stays above $65/PH/Day.

Post-Halving Outlook

ASIC Miner Prices Stay Suppressed in Q2

A significant number of machines came online in the first months of this year, leading to a 25% growth in network hashrate, rising from 505 EH/s on January 1st to a record high of 631 EH/s in March 2024. Despite this massive deployment, there is still a surplus of mining equipment available on the market.

At present, miners appear to be in a “wait and see” mode as we approach the halving event. A survey conducted by ASIC Jungle among its customers confirms this sentiment, with 65% of respondents indicating they are postponing the purchase of new miners until after the halving.

More than 75% of the surveyed customers indicated they are only interested in new-generation ASIC miners. However, if Bitcoin continues on its bullish path, the hashprice is likely to remain above the break-even level for the 30.5 J/TH machines ($65/PH/Day). These margins might be sufficient to delay the urgency for miners to upgrade their fleet.

It will take time for the market to absorb the surplus of machines, as building out infrastructure is a time-consuming process. Coupled with low demand leading into the halving and favourable margins, it is likely that ASIC hardware prices will remain suppressed in the coming quarter.

Correlation and Premium Will Return

Once Bitcoin enters the later stages of the bull market and true mania sets in, the correlation between BTC and mining equipment is likely to return. Fleet upgrades, new entrants, and increased availability of funding will drive up demand, leading to higher prices.

It is probable that the most efficient machines will experience price increases first, as miners seek to future-proof their operations and availability is limited compared to previous generations. This will result in an increase in the premium for the latest machines.

As miner supply becomes constrained, price increases will trickle down the efficiency ladder. S19s and S19J Pros may experience price hikes similar to those seen by S9s in the previous bull market. If this occurs, it would present a good opportunity to sell these generation machines.

Biggest Headline