After reaching a new all-time high, the Bitcoin price declined by 17.6%. While the ETFs did experience a significant net outflow, this is not the sole reason why BTC took a break. Alongside price, hashrate is also consolidating. Transaction fees remain low, causing a high correlation between BTC price and hash price. In this week’s mining economics rundown, we will delve into the following topics:

Bitcoin Price

Network Hashrate

Difficulty

Transaction Fees / Block Reward

Hashprice

ASIC Prices

Fun Fact

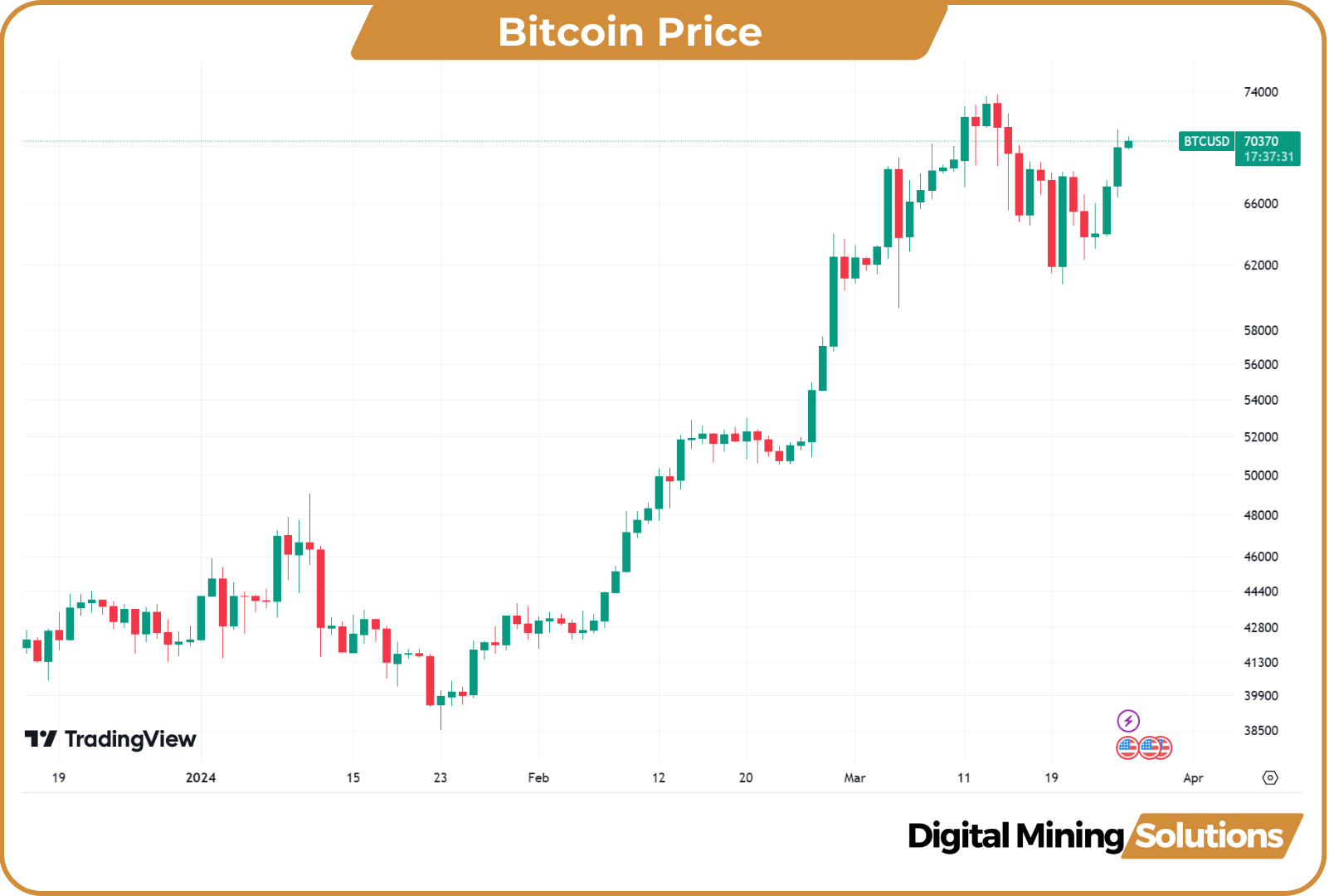

Bitcoin Price

After reaching the all-time high of $73,800 on March 14th, BTC dropped all the way to $60,800. Although this $13K drop in six days seems significant, it amounted to ‘only’ 17.6%. In previous bull markets, there were various 30% pullbacks. Last year, there were multiple declines of 20% or more, and even in January of this year, there was a 21% drop. A 20% drop from recent ATH would put BTC at around $58K, but with the recent recovery back above $70K, the bulls seem to be regaining control.

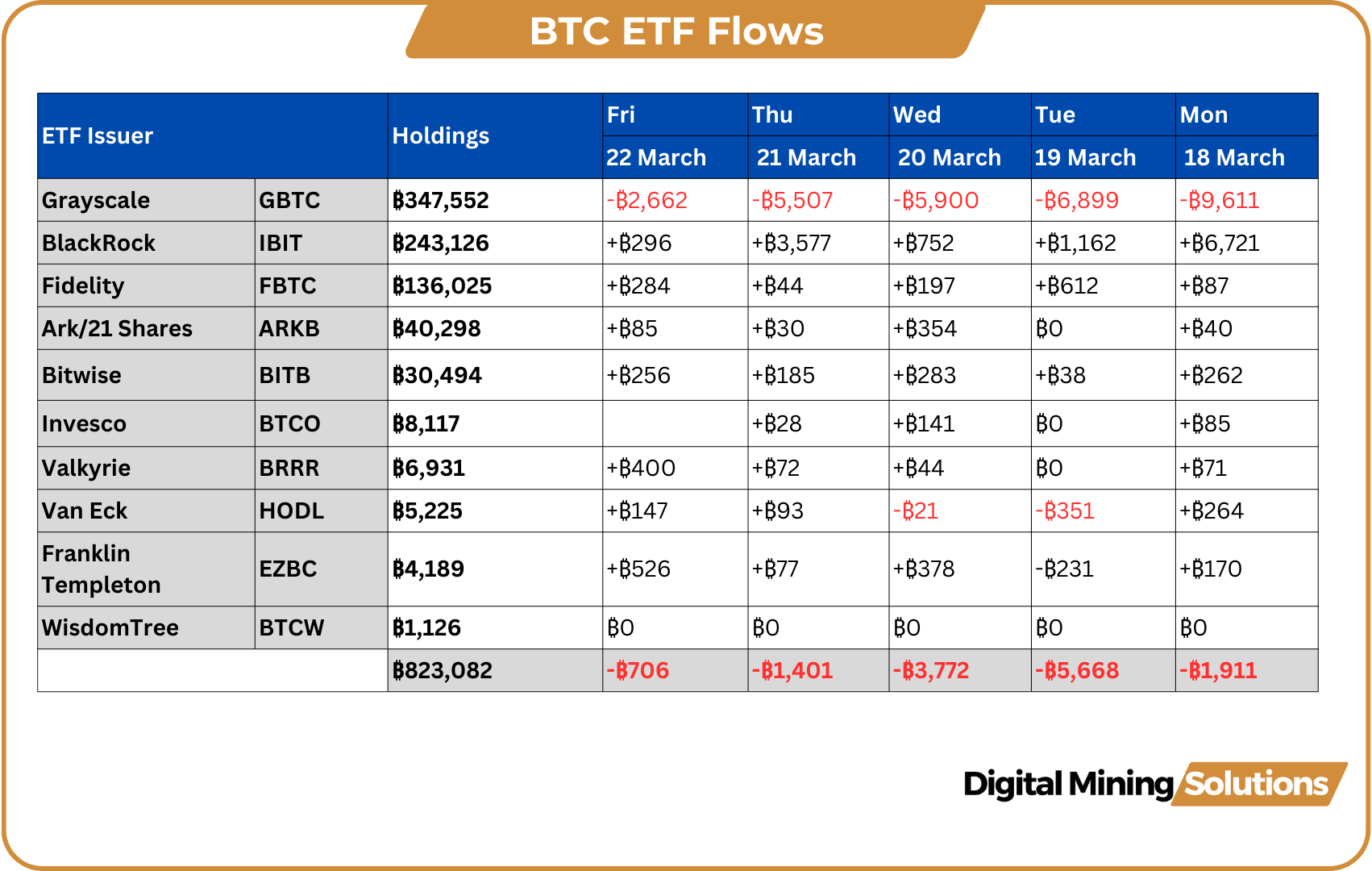

In the past, Bitcoin has shown that new all-time highs trigger profit-taking. Typically, there is some consolidation around these new peaks before an uptrend continues. Last week also marked the first week of net outflows from the ETFs since late January. This outflow also contributed to the decline in Bitcoin’s price. It’s not the first time that outflows from GBTC led to a total reduction in BTC holdings by the ETFs. However, March 19 marked the biggest daily net outflow since the launch of the ETFs.

When in doubt, zoom out. Over a timeframe of merely 10 weeks, the net inflow of the ETFs is well over 800,000 BTC. Since January 1st, 2024, Bitcoin is up 64%, and since January 1st, 2023, it’s up over 300%. In addition, all buyers at the 2021 top are now in the green. No real reason to panic at this moment.

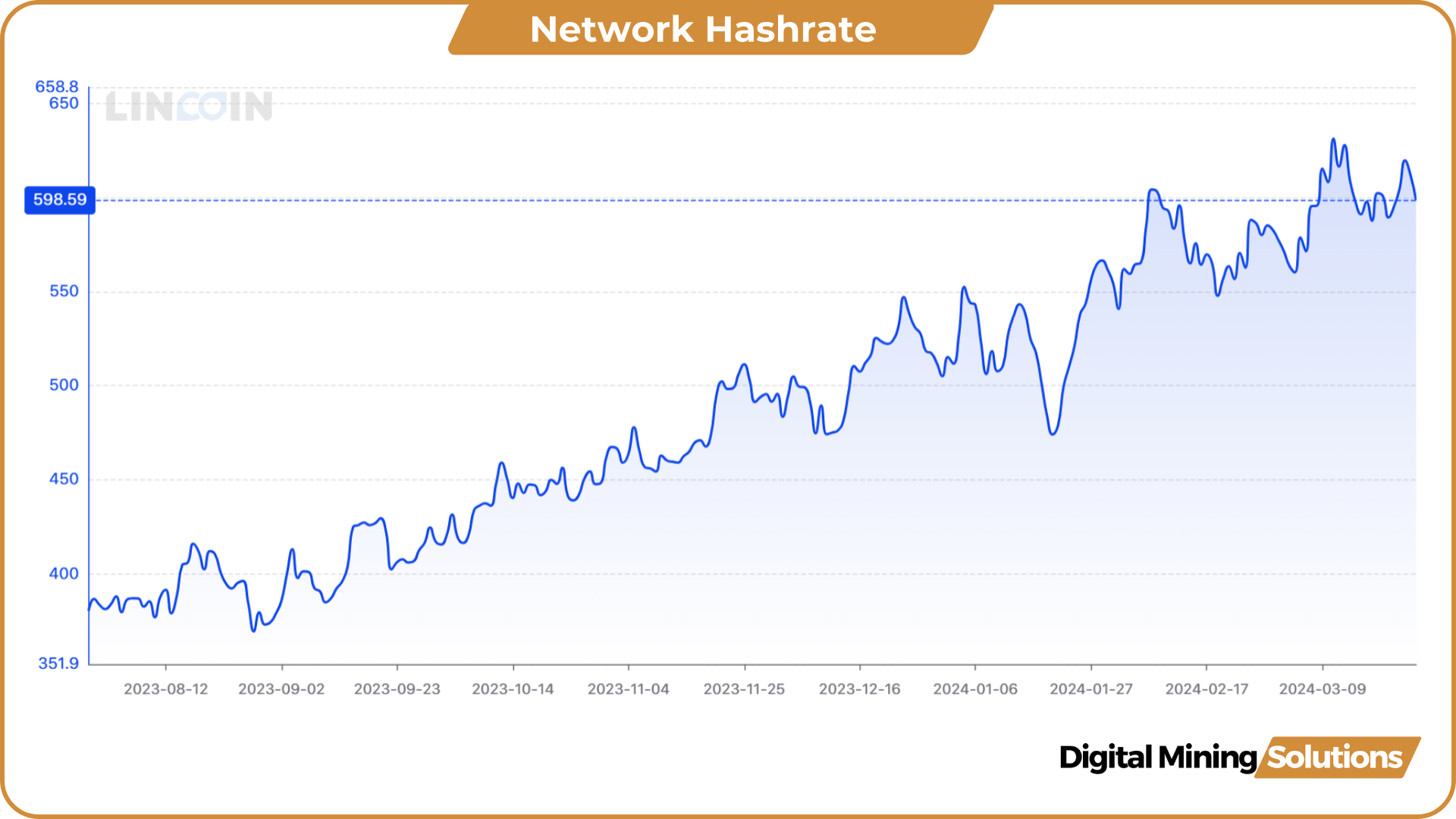

Network Hashrate

On March 11th, the network hashrate reached a new all-time high of 631 EH/s on the 7-day moving average. However, the following week saw hashrate retracting below the 600 EH/s level. Over the weekend, it surpassed that same level again, and hashrate is currently consolidating around the 600 EH/s.

Despite the recent consolidation, the network hashrate has grown over 16% year-to-date (YTD). An important driver of this hashrate growth is the latest generation mining equipment coming online. Additionally, improved market conditions are prompting miners to come back online who were not profitable at lower hash price levels.

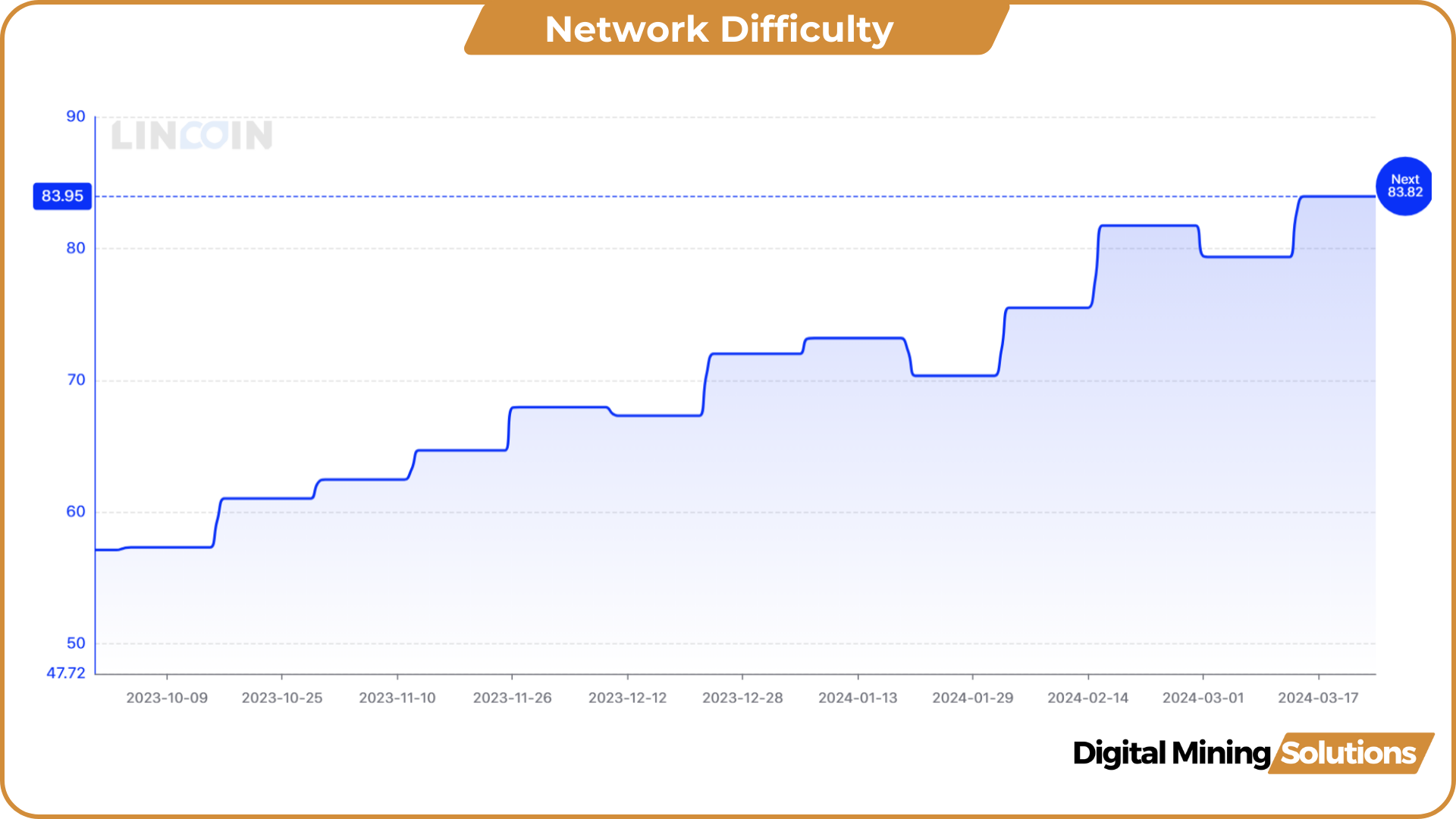

Difficulty

On March 14th, there was a 5.79% difficulty adjustment, leading to a record high network difficulty of 83.95T. The next adjustment, projected for March 28th, is estimated to decrease by around 0.2%.

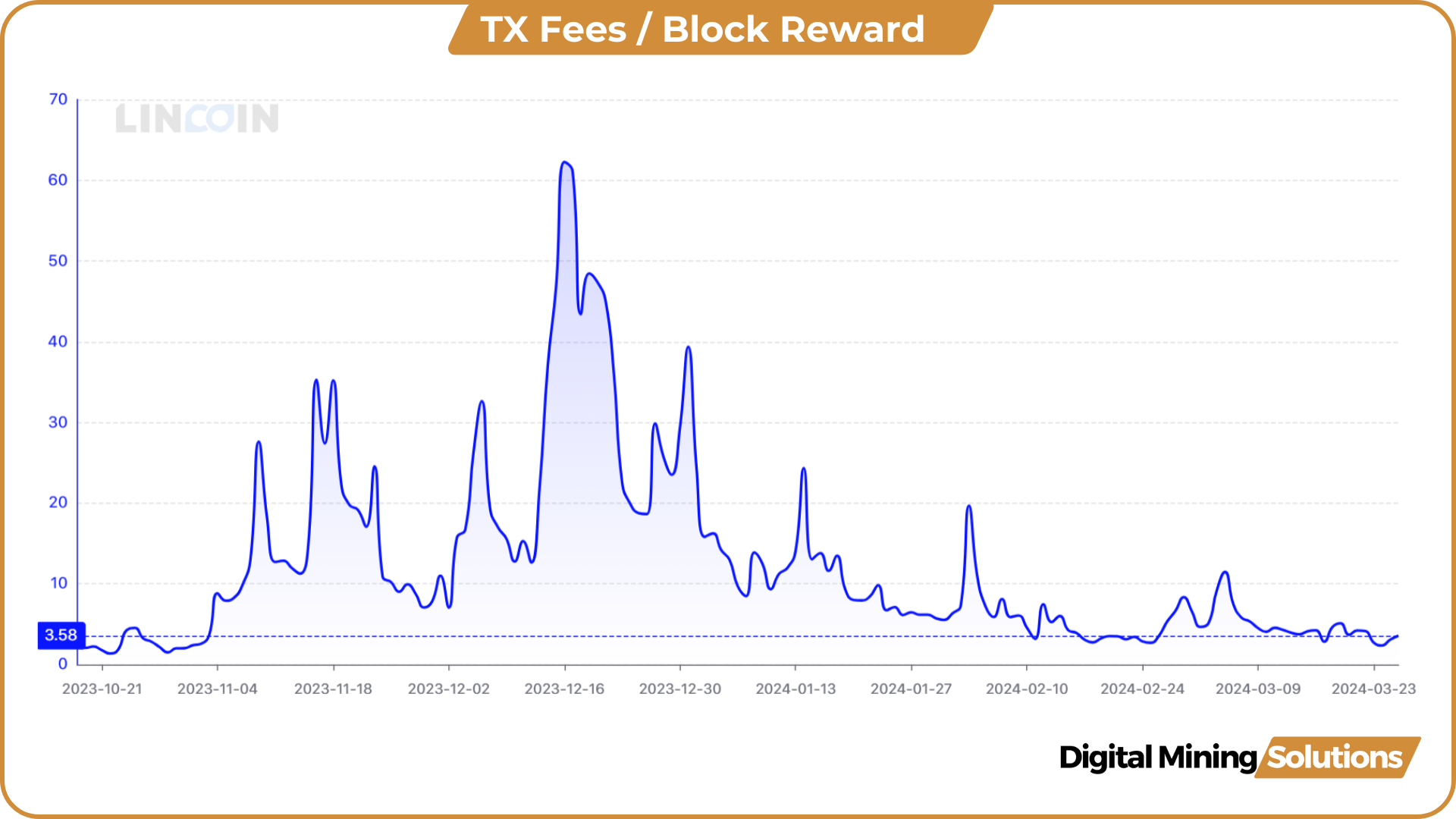

Transaction Fees / Block Reward

The transaction fees as a percentage of the total block rewards have been steadily declining since the high fee period in the last weeks of 2023.

With less than a month to go before the halving event, fees might pick up in the coming weeks. The uniqueness of the blocks around the halving could elevate transaction fees as users compete for block space.

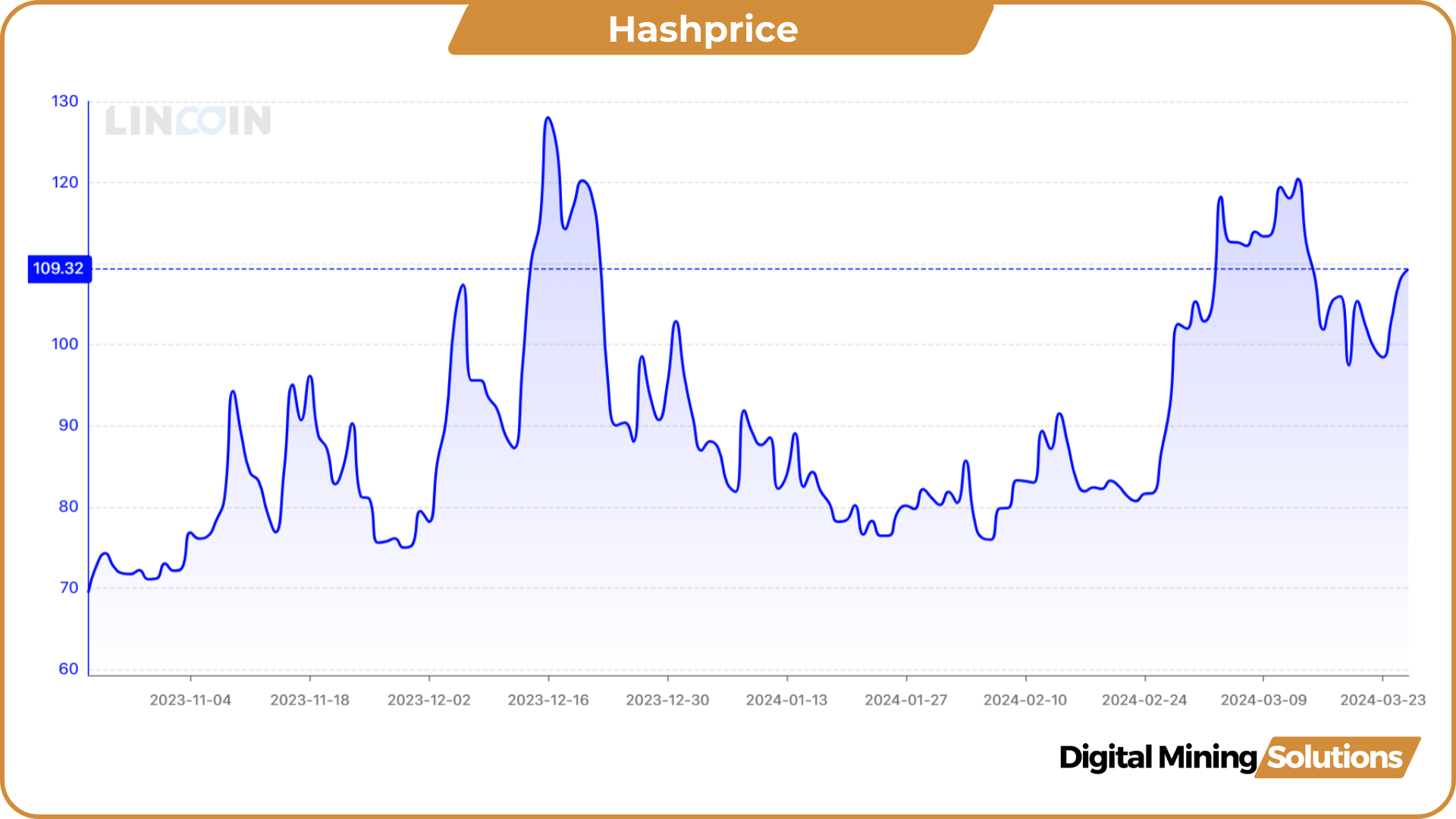

Hashprice

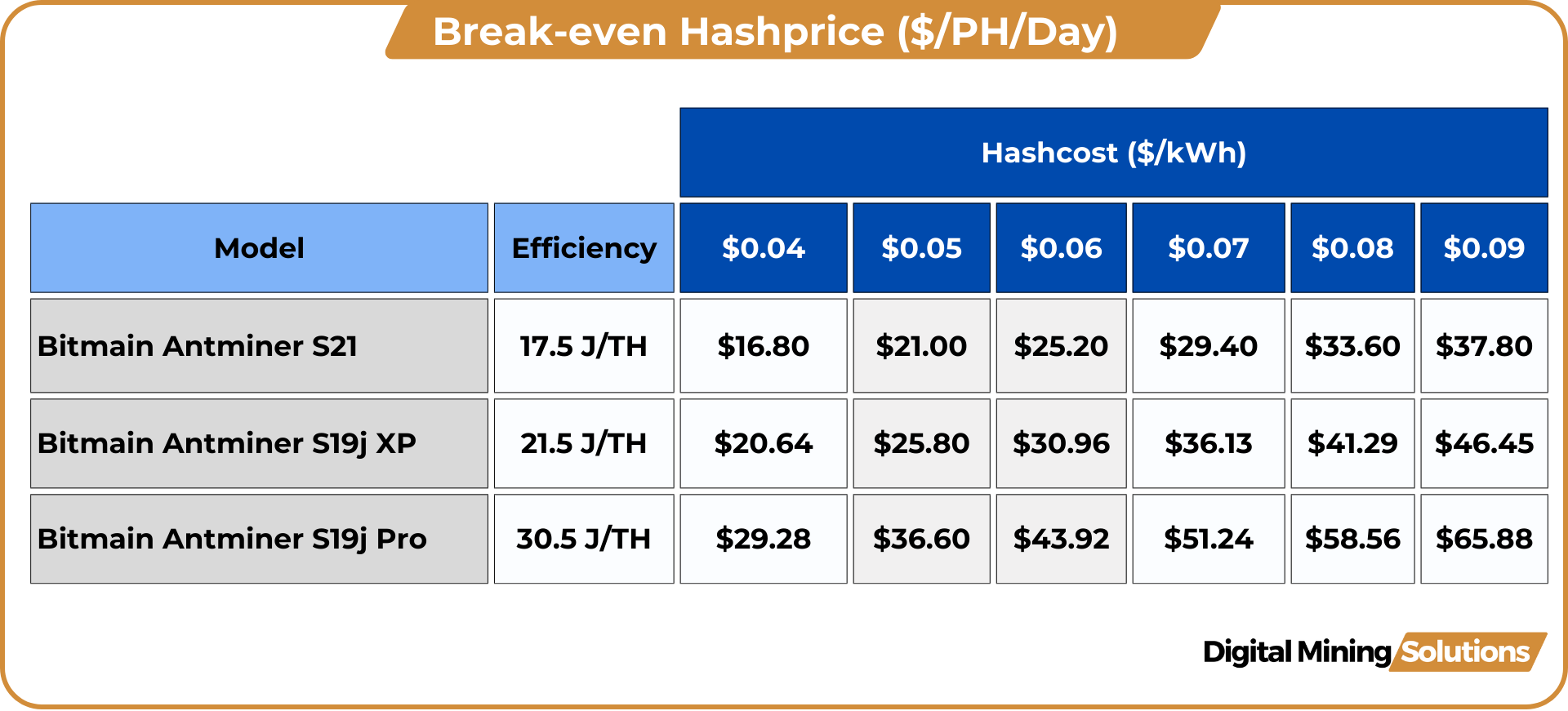

With transaction fees at these low levels, the hashprice has been mainly driven by the Bitcoin price. Not surprisingly, the pullback in BTC was also reflected in hashprice. After reaching a yearly high of $120/PH/Day, hashprice retraced back to the $100/PH/Day level. With the recent recovery in BTC price, hashprice is now at $109/PH/Day.

If the halving were to occur today, the S19J Pro would be operating at a loss when mining at a hash cost of $0.08 kWh or higher. This is significant because this most popular machine on the network comprises an estimated ~27%, according to CoinMetrics. Continued bullish price action and/or another inscription craze are the only factors that can provide a soft landing post-halving for miners with 30+ J/TH fleets mining at $8c or higher.

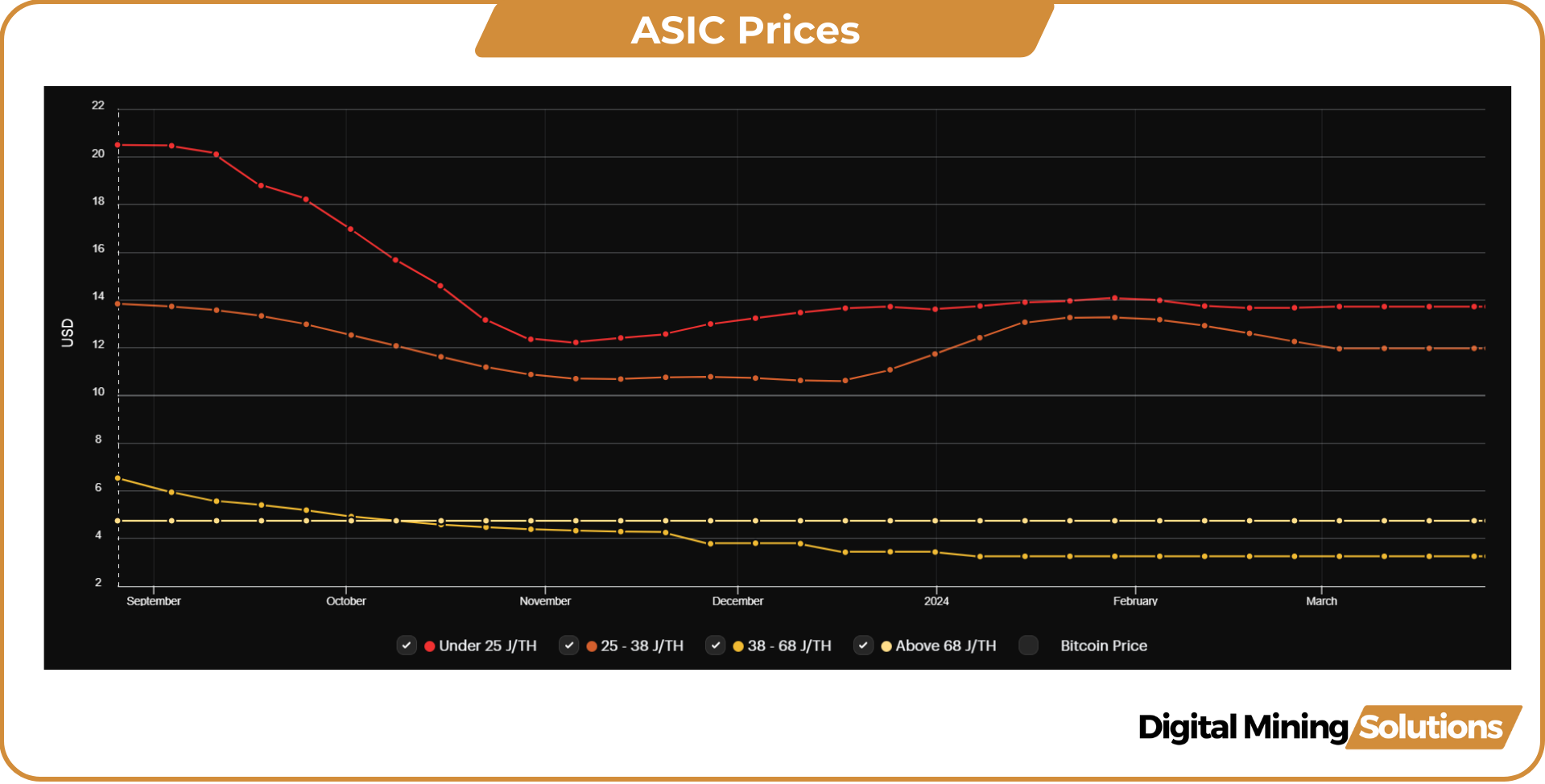

ASIC Prices

The ASIC Price Index is becoming the most uneventful chart to cover. Since the beginning of the year, ASIC prices have remained virtually unchanged, suggesting that mining equipment is bottoming out.

Fun Fact

With the Bitcoin halving looming on the horizon, anticipation builds as we count down the remaining 3650 blocks until the event takes place. This significant milestone, occurring in less than a month, marks a crucial point in Bitcoin’s history, impacting miners, investors, and enthusiasts alike. As the block reward is halved, the ecosystem braces for potential shifts in mining profitability, market dynamics, and overall sentiment.