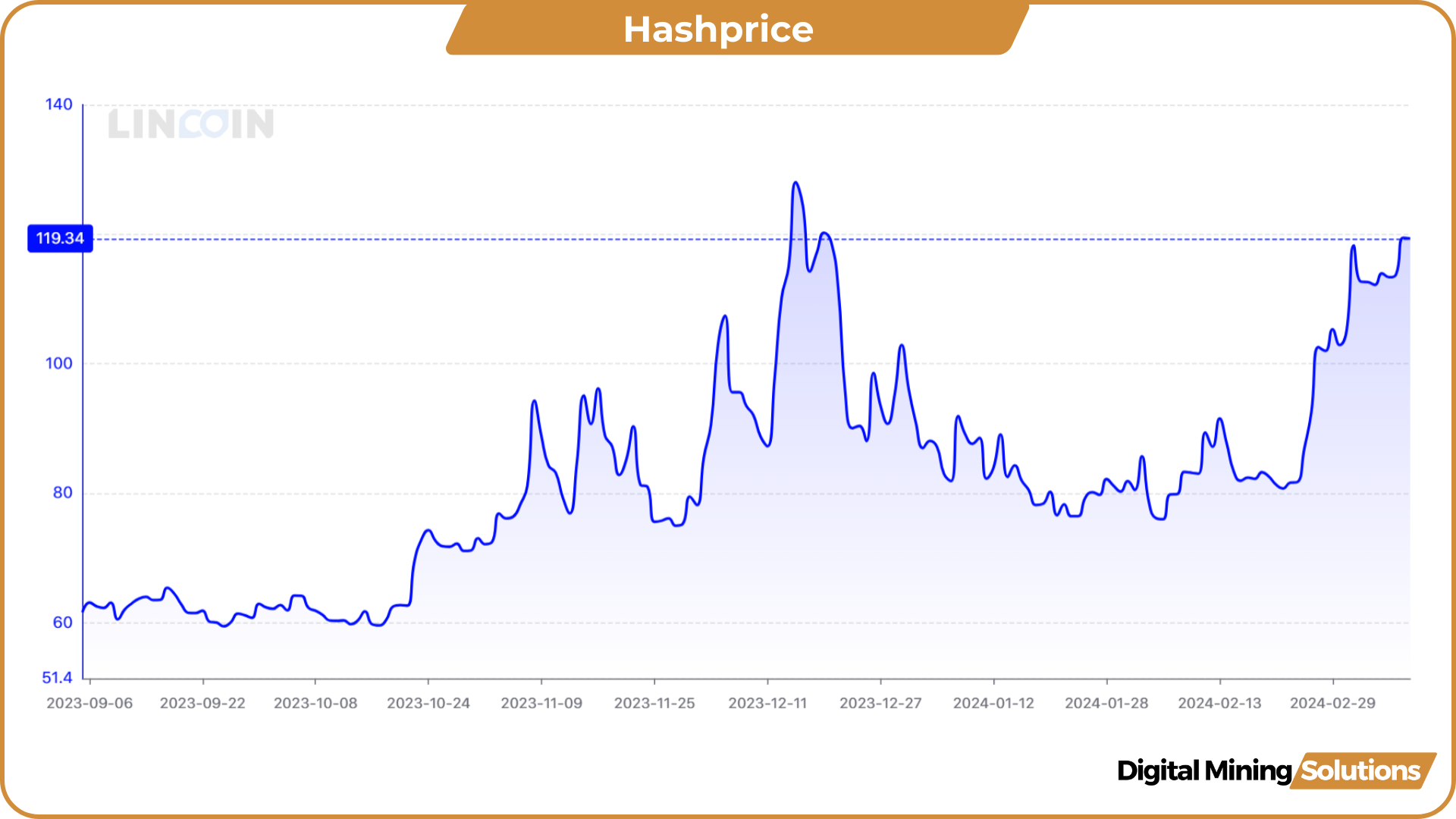

Bitcoin’s price has surged to levels last seen in November 2021, with ETFs emerging as the main driver behind this bullish price action. Greed is starting to dominate market sentiment amidst this rise. Despite low transaction fees, hashprice has emerged as the big winner of the week, being pushed back above $90/PH/Day by the BTC price increase. Many currencies are experiencing all-time highs; the question seems to be not if, but when the Dollar will follow suit. In this week’s mining economics rundown, we will delve into the following topics:

-

-

Bitcoin Price

-

Network Hashrate

-

Difficulty

-

Transaction Fees

-

Hashprice

-

ASIC Prices

-

Fun Fact

-

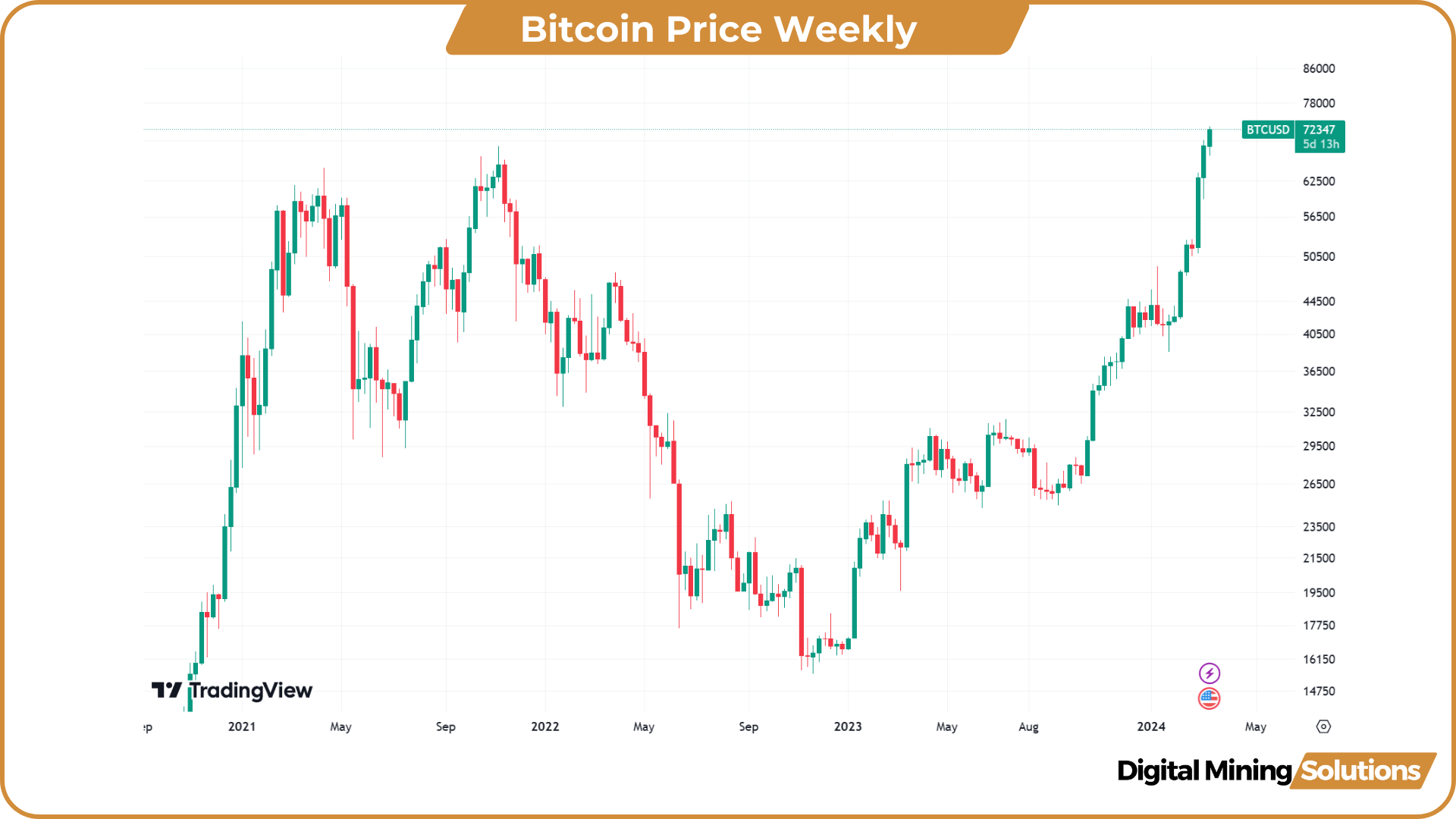

Bitcoin Price

BTC continues to be very bullish. After more than two years, Bitcoin surpassed its previous all-time high of around $69,000, entering price discovery once again. Bitcoin achieved its highest weekly close in its history. After a few attempts, BTC broke the $70K level with conviction. 2024 is starting off very well with a 70% price increase year to date.

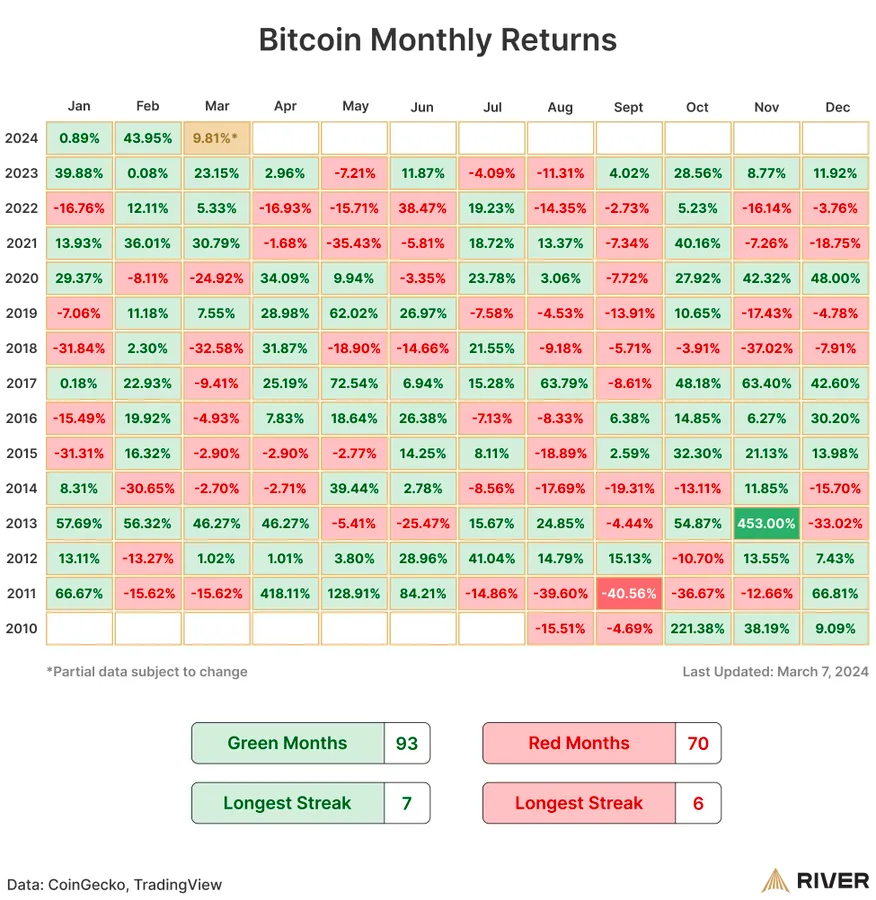

On a monthly basis, Bitcoin has seen a price increase for six consecutive months now. If BTC continues on this path, we might witness the record for the longest streak of consecutive green months being matched.

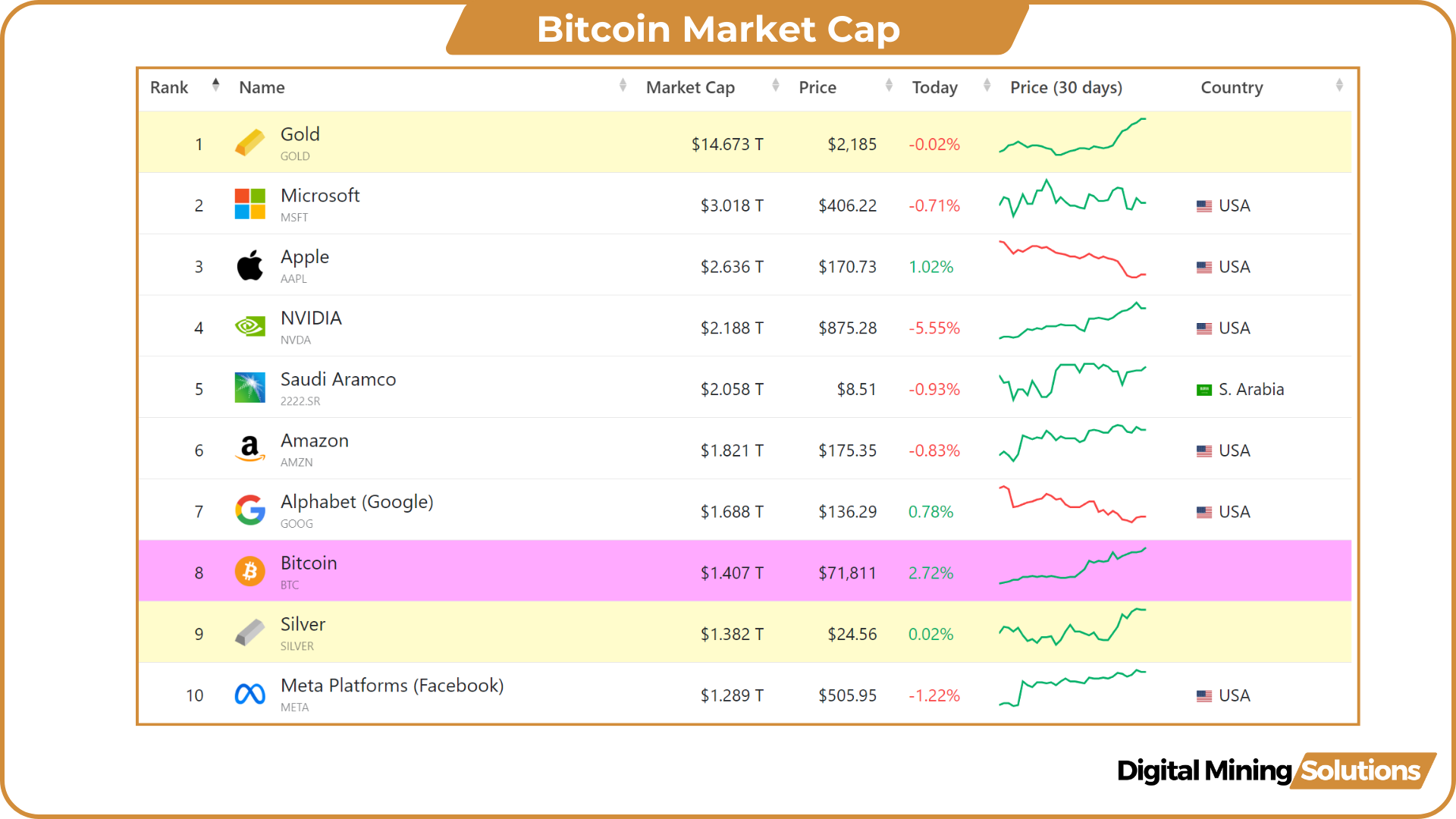

With this week’s surge in price, Bitcoin surpassed silver in market cap. However, with gold at $14.67 trillion, there is still a long way to go before the digital version surpasses the yellow metal.

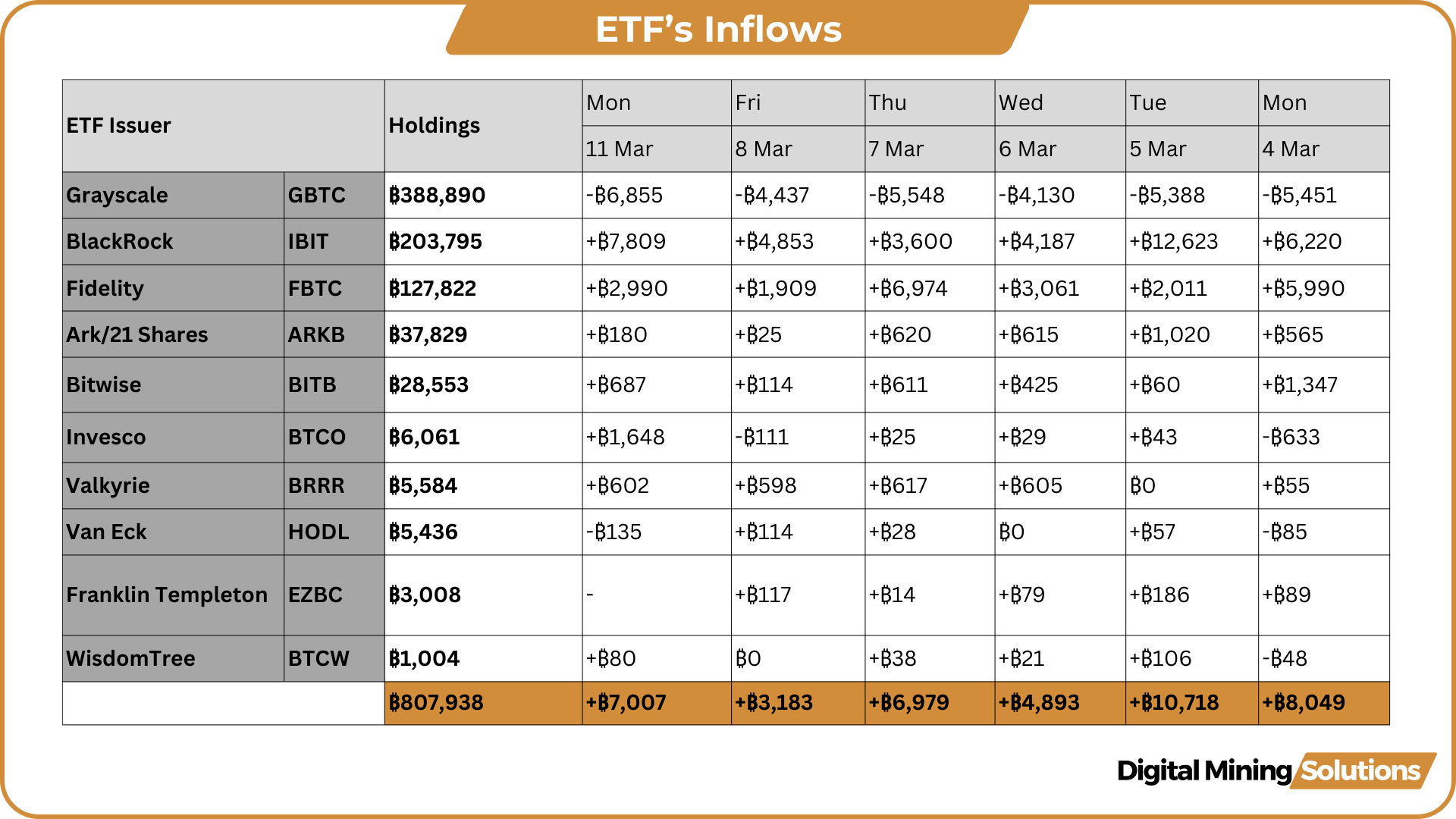

The ETFs have been an obvious driver of the price increase. Last week, the total holdings exceeded 800,000 BTC. Since the launch, the ETF inflow has averaged 3.9K BTC per day. Additionally, last week, BlackRock announced they have plans to buy their own spot bitcoin ETFs as well as other bitcoin ETFs with its Global Allocation Fund, which holds assets close to $18 billion. With the halving around the corner, there will be even more pressure on the price as daily emissions of new coins will drop from 900 to 450 BTC.

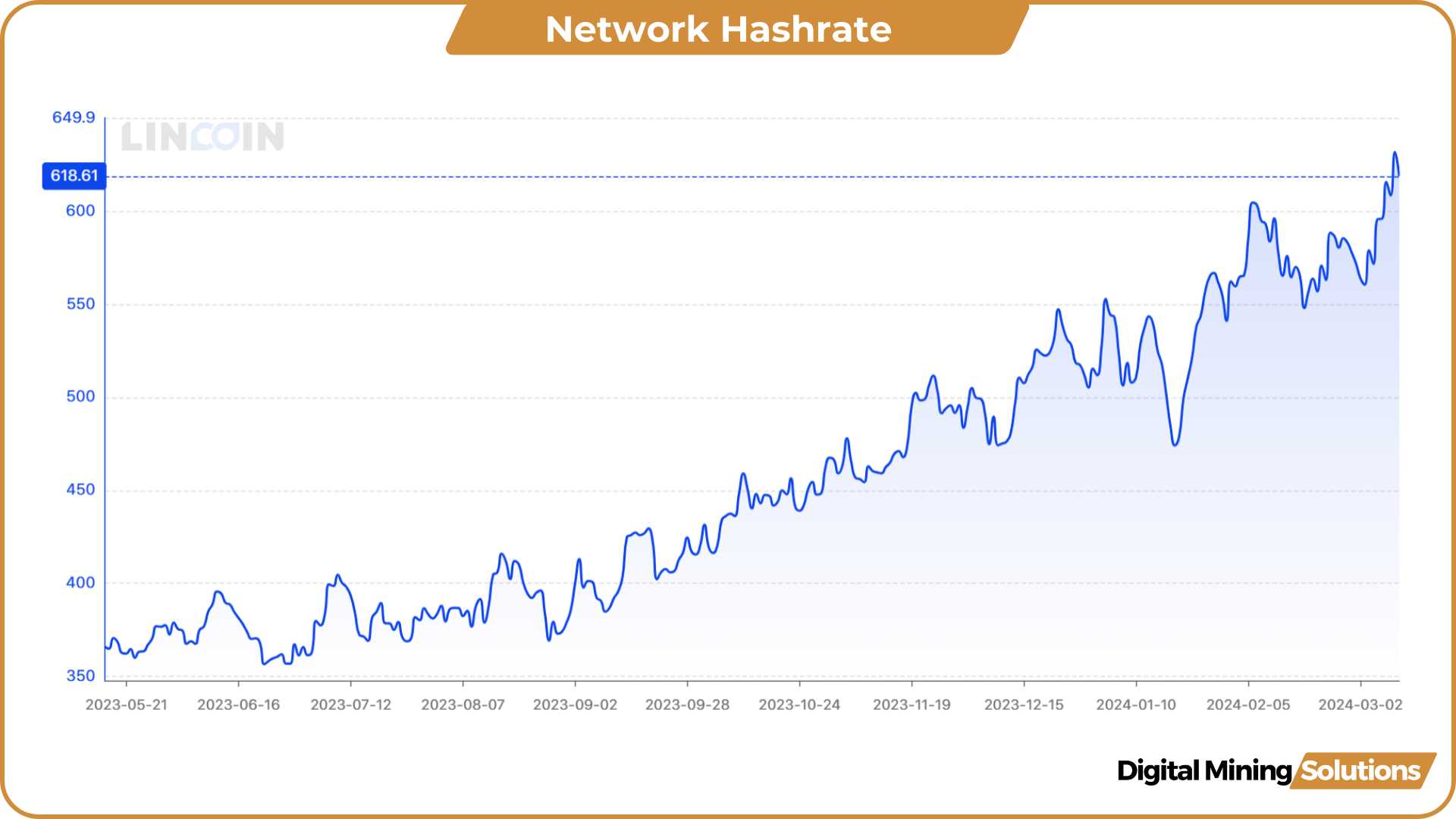

Network Hashrate

After retracing back 9% to 548 EH/s and going sideways for a while, the hashrate surged back above 600 EH/s again. On Monday, March 11th, it marked a new all-time high of 631 EH/s on the 7-day moving average. The rise in network hashrate is likely due to a combination of factors. The most important driver is the latest generation mining equipment that was ordered by public miners in Q4 2024, now coming online. Additionally, improved market conditions are prompting miners to come back online who were not profitable at lower hashprice levels.

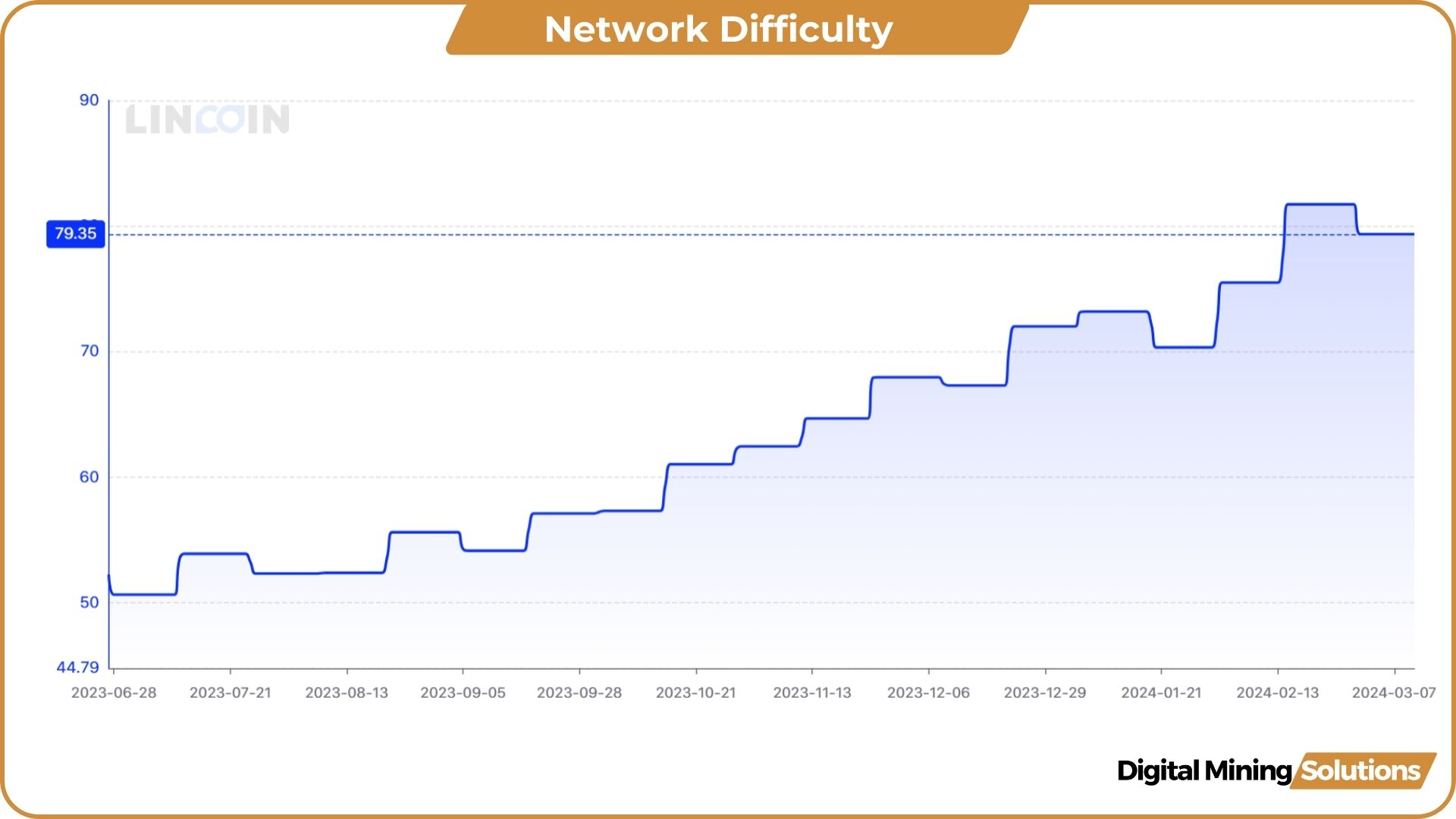

Difficulty

On February 29th, we observed a -2.9% difficulty adjustment. With the current increase in network hashrate, the next difficulty adjustment, projected for March 14th, is estimated to increase by around 5.5%. This would push the network difficulty back to new highs.

Hashprice

Transaction fees as a percentage of the block reward are currently around 3.4%. With transaction fees being at these low levels, the hash price has been mainly driven by the Bitcoin price. After rising above the $100 per petahash per day level two weeks ago, the hash price has sustained above this level. At $119 per petahash per day, the hash price is marking a yearly high and closing in on the highest level we saw in 2023.

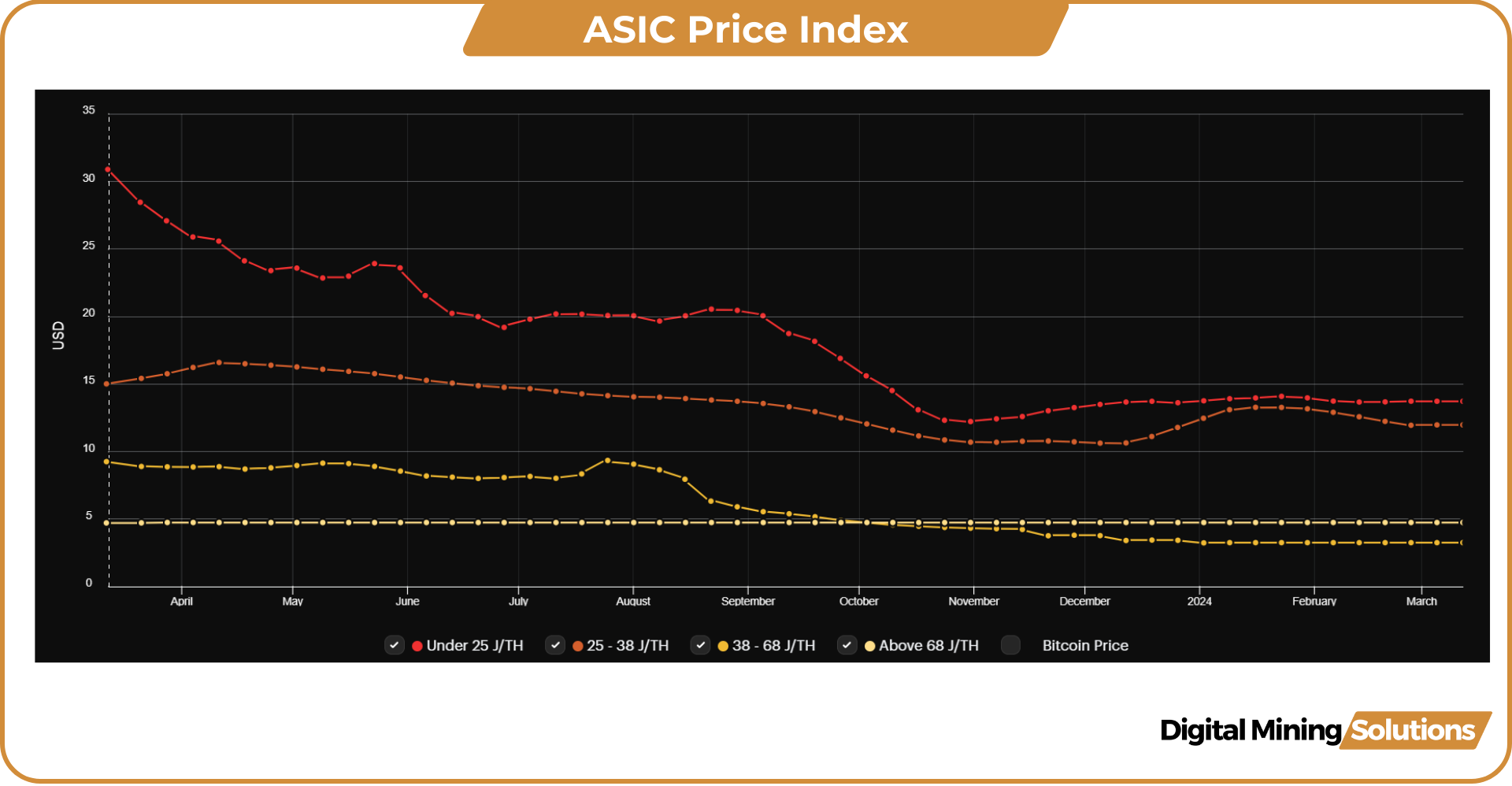

ASIC Prices

Since the beginning of the year, ASIC prices have remained virtually unchanged, suggesting that mining equipment may be bottoming out. In next week’s article, we’ll take a closer look at the state of the ASIC market. Make sure you don’t miss it!

Fun Fact

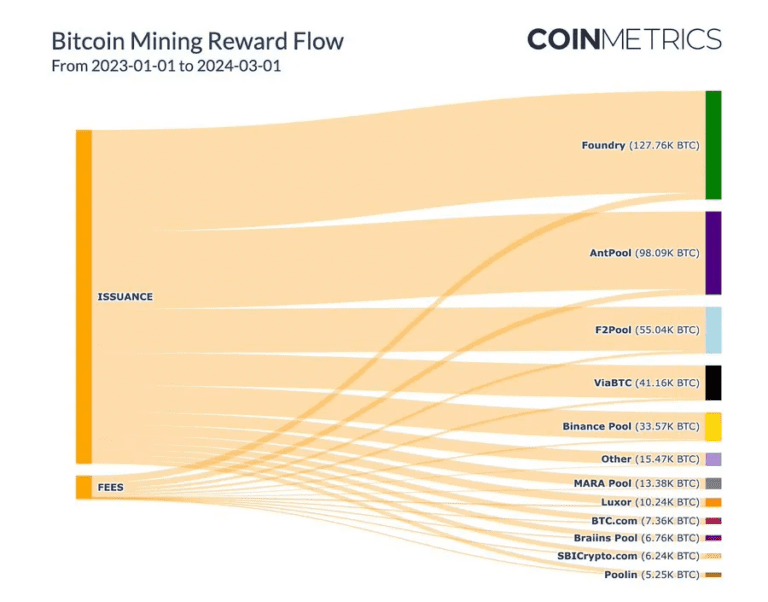

CoinMetrics came out with another great analysis: Following Flows V: Pool Cross-Pollination. In this article the on-chain flows is examined to better assess Bitcoin mining pool decentralization.

Looking at the flow of issuance and transaction fees to mining pools, the dominance of Foundry and AntPool becomes clear once again. In 2023, the top two pools earned the majority of mining rewards, accounting for approximately 53% of the total between them.

Another interesting fact is Marathon Digital’s mining of the largest-ever Bitcoin block. This monumental achievement, accomplished through a collaboration between Marathon Digital’s Slipstream and OrdinalsBot, underscores the growing interest in innovative approaches to data inscription and distribution. The block, measuring an impressive 3,990.36 kilobytes, was mined on March 2nd.